In the context of leveraged trading (be it futures or margin trading), margin refers to the amount needed to enter into a leveraged position. There are three main approaches to margining that are adopted by exchanges. These are Isolated Margin, Cross Margin and Portfolio Margin. Portfolio Margin is the most advanced and is not offered by most crypto exchanges. In this article, we are going to concentrate on Cross Margin and Isolated Margin.

Understanding the mechanics of Cross Margin and Isolated Margin can help traders to use their trading capital more efficiently and avoiding preventable liquidations of open positions. We are also going to cover how a trader can use Auto Margin Top-Up feature on Delta Exchange to use it create Cross Margin like benefits.

Cross Margin

In Cross Margin the entire available balance is shared across all the open positions in the account. The account is considered to be sufficiently margined as long as the combined maintenance margin requirements of the open positions are lower than the available balance. This design has the following ramifications:

- The trader’s entire available balance is at risk. In case of adverse market moves, the trader could lose his entire balance.

- Any realised profit/ loss is available to be used as margin for a loss-making open position.

- In some cases, unrealised profits are allowed to offset unrealised losses. This is quite advantageous to traders because this reduces the probability of the positions going into liquidation.

- Most crypto exchanges do not allow the offsetting of unrealised losses with unrealised profits. Even then, not all open positions may have unrealised losses simultaneously. And, thus, a given amount of available balance may be able to support more positions in Cross Margin compared to when each position has a dedicated margin for it.

- Cross Margin takes a holistic portfolio approach and reduces the overall liquidation probability. As a consequence of this, in Cross Margin, a trader has lesser control over a particular position. In situations where a trader needs to monitor and control a specific position, Isolated Margin works better.

Isolated Margin

In Isolated Margin, each position has a dedicated margin allocated to it. When a position is opened in Isolated Margin, the trader is required to allocate margin equal to or greater than the Initial Margin to this position. This allocated margin is referred to as Position Margin. Any unrealised profit/ loss in this position has no impact on any other open positions. Further, if unrealised losses deplete the position margin, it will be liquidated even if the trader has additional balance in his account.

Isolated Margin is especially useful in case of speculative trades placed at high leverage. Although Isolated Margin positions have higher liquidation risk, the loss is limited to the Position Margin put up and not the entire available balance.

How to use Auto Margin Top-Up to create a cross margin feature

At present, Delta Exchange only offers Isolated Margin. However, a trader can combine Isolated Margin with Auto Margin Top-up to create Cross Margin like behavior. If Auto Margin Top-Up is enabled for a position, whenever it is about to go into liquidation, additional margin is added to the position from the Available Balance. A trader can selectively enable Auto Margin Top-up for some positions and run the rest on Isolated Margin. This gives additional flexibility to traders in managing their positions.

Click here to know more about Auto Margin Top-Up on Delta Exchange.

The video tutorial below shows how a trader can enable the Auto Top-Up Margin feature for an existing position:

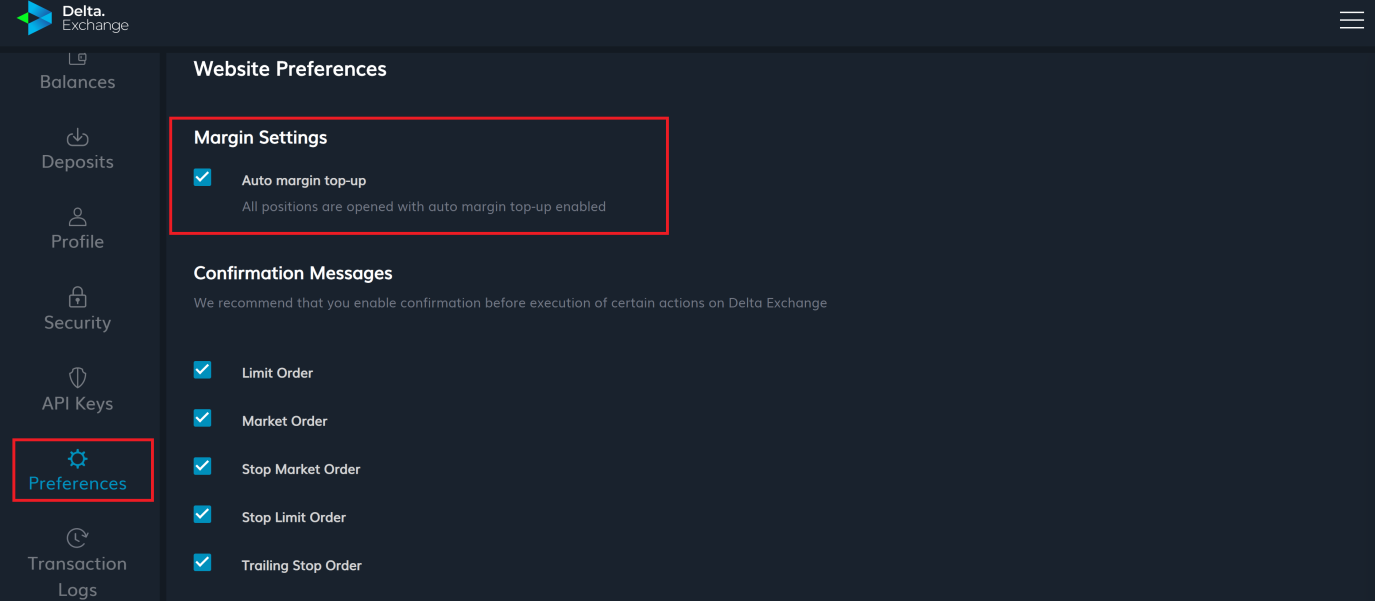

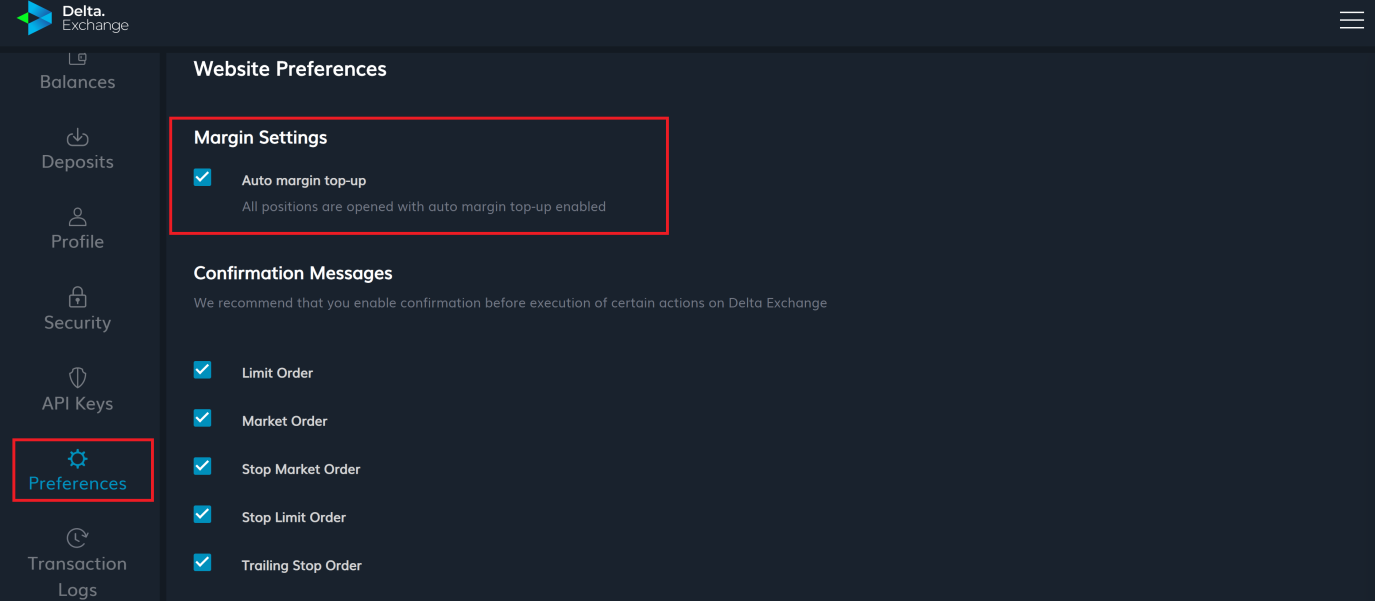

One can also enable the Auto Top-Up Margin feature for all new positions taken on Delta Exchange. This can be done through the following steps:

My Account > Preferences > Margin Settings > Auto Margin Top-Up

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter