Educational

February 13, 2019

The Most Comprehensive Guide to Bitcoin Futures Trading

Jitender TokasChief Business Officer

If you are looking to start trading bitcoin futures, then this is the only article you need to read to get up to speed . Using a Q&A format, I cover the all the key concepts for cryptocurrency futures. The aim of this article is to serve as a solid foundation for your further explorations into learning about and actually trading bitcoin futures.

1. What are derivatives?

Derivatives are a class of financial instruments wherein the value of the instrument is linked to a separate asset or group of assets. This asset or group of assets is known as the ‘underlying’.

A derivative is essentially a contract whose payout is driven by the price of the underlying. How exactly the price of the underlying changes the contract payout is defined in the contract. While there are some standard derivatives contract types e.g. futures, options, swaps, there is no reason why one can’t be creative in defining a contract.

Typically, a derivative contract is entered into by two parties and has a well-defined maturity. As the price of the underlying moves, the actual or expected payout for each party changes. It is worth noting that in derivative contract, payout to be received by one party will have to be provided by the other one. In other words, the profit of a party in a contract is exactly equal to the loss of the other party. This feature makes derivative contracts a zero-sum game.

2. What is a futures contract?

A futures is a derivative contract in which two parties agree to buy/ sell the underlying at a pre-defined price on a date in the future. The buyer is long the contract and the seller is short. The pre-defined price is the price of the futures contract and the pre-defined date is the date of maturity of the contract.

Now, let’s analyse the impact of changes in price of the underlying on the payout of the two counterparties. Buyer benefits when underlying price goes up because the contract lets her buy the underlying at a lower price. By the same logic, seller benefits from decline in price of the underlying.

So, here’s the simple rule you need to follow when trading futures contract: go long when you think price will go up. And, go short when you think price will go down.

3. What is a bitcoin futures contract?

A futures contract in which the underlying is bitcoin is known as a bitcoin futures contract. This can be extended to other cryptocurrencies as well. Futures contracts which have XRP as the underlying are called ripple futures contracts. And, futures which have cryptocurrency as underlying are called cryptocurrency futures contracts.

4. Do I need to have bitcoins to trade bitcoin futures?

Not necessarily. Recall that the underlying of a bitcoin futures contract is bitcoin. The payout terms and conditions of futures a contract are independent of the underlying. Let’s use the contracts listed on Delta Exchange to understand this better. We have two types of futures contracts on bitcoin:

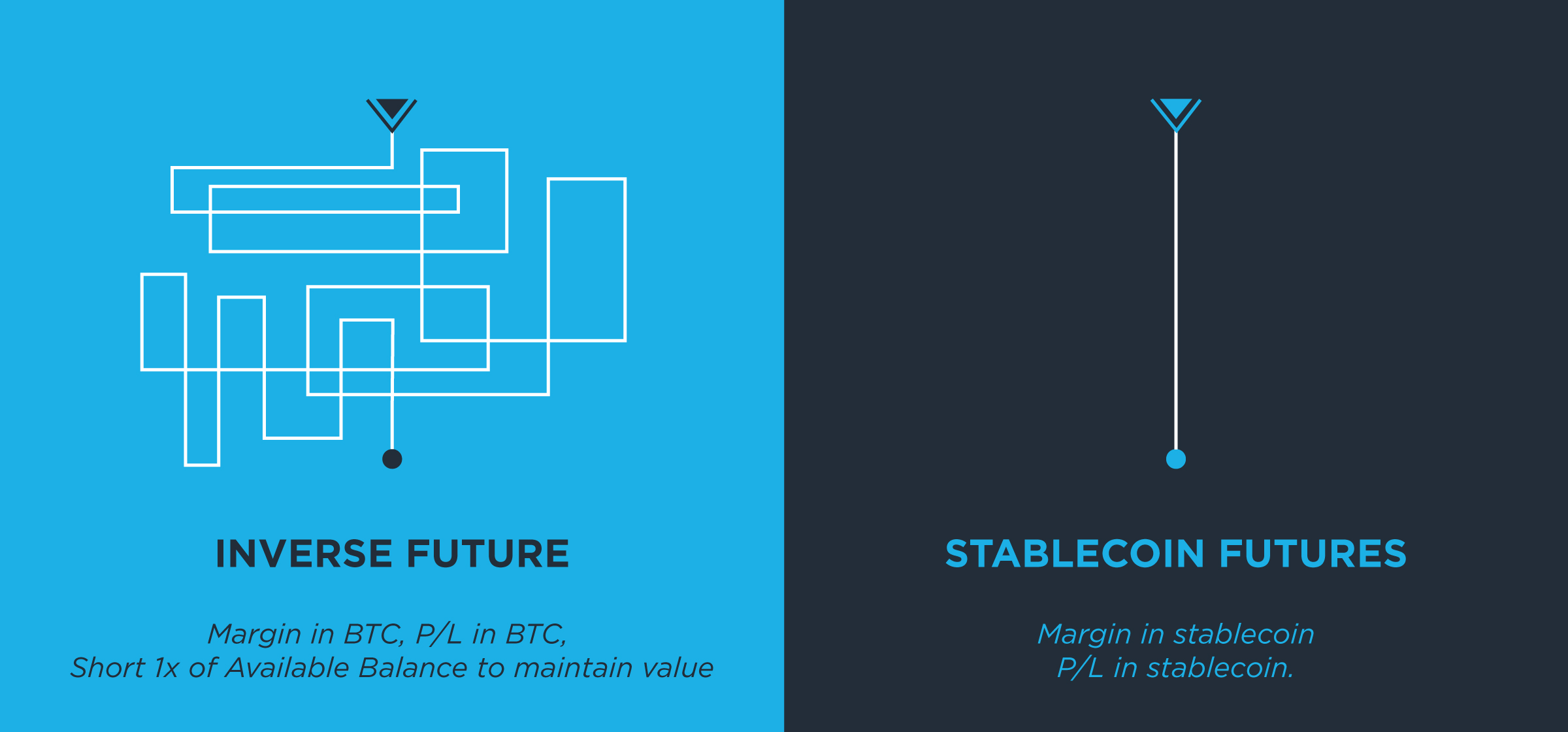

- Bitcoin settled: This futures contract tracks the price of bitcoin in US Dollars. The profit/ loss of this contract is denominated in BTC and hence you need bitcoins to trade this contract.

- USDC settled: This futures contract tracks the price of bitcoin in US Dollars. The profit/ loss of this contract is denominated in USDC and hence you need USDC to trade this contract.

This is the upshot: a bitcoin futures contract can have its profit/ loss denominated in potentially any fiat or crypto currency. So you can absolutely trade bitcoin futures without even having bitcoins!

5. Can you give an example of a bitcoin futures trade?

Let’s say current bitcoin price is $3500. Trader BTCBull thinks bitcoin price will go up and will be over $3600 in a month’s time. So, he is happy to get into a contract that will enable him to buy bitcoin at $3550 one month hence. So BTCBull goes long the bitcoin futures at $3550, and BTCBear takes the other side of the trade, i.e. goes short.

Profit/loss of BTCBull = Current_BTCFutures_Price – $3550

Profit/loss of BTCBear = $3550 – Current_BTCFutures_Price

It is important to note that the traders don’t need to hold their positions in the bitcoin futures till contract maturity. At any time, the trader can close his position at any time in the market and crystallise his profit/ loss.

It is worth noting that the price of the bitcoin futures contracts typically tracks the current price of bitcoin. Moreover, it converges to the bitcoin price at the time of contract maturity. So, if both BTCBull and BTCBear hold their positions till the contract maturity and the bitcoin price at that time is $3700, then:

Profit/loss of BTCBull = $3700 – $3550 = $150

Profit/loss of BTCBear = $3550 – $3700 = -$150

Note that price of bitcoin went up from $3500 to $3700. But price of bitcoin futures contract went up from $3550 to $3700. Price went up and that’s why the trader that was long (i.e. BTCBull) made money.

6. How is trading bitcoin futures different from trading bitcoin?

When you buy bitcoin, you gain when bitcoin price goes up. Similarly, you lose when bitcoin price goes down. What would you do when you expect bitcoin price to go down? Sell the bitcoins you already have and then do nothing. If your bitcoin forecast turns out to be true, you’d avoid losses, but still won’t be able to benefit from correctly predicting price of bitcoin.

Enter bitcoin futures contract. If you think bitcoin price is set to decline, you could go short bitcoin futures. You’d gain when bitcoin price falls. Obviously, if you go long, you’d gain when bitcoin price goes up. Thus, unlike trading bitcoin, trading bitcoin futures enables you to profitably navigate both bull and bear market.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter