Educational

January 18, 2023

Morning Star Pattern: Trading Crypto Using Morning Star Candlestick

Shubham GoyalProduct Specialist

In this particularly harsh crypto winter, if you’re looking for signals for the winds (so to speak) to change – Morning Star Pattern is what you’re on the lookout for.

The Morning Star pattern is a bullish reversal pattern that can be found in candle charts, particularly in the stock and cryptocurrency markets. It is a signal that a downtrend may be coming to an end and that it may be a good time to buy.

This pattern is a strong indication that the bears have exhausted themselves and that the bulls are ready to take control of the market. In this article, we will take an in-depth look at the Morning Star pattern and explain how to identify and trade it in the crypto market.

Identifying The Morning Star Pattern in crypto

Identifying the Morning Star pattern in the crypto market is relatively straightforward.

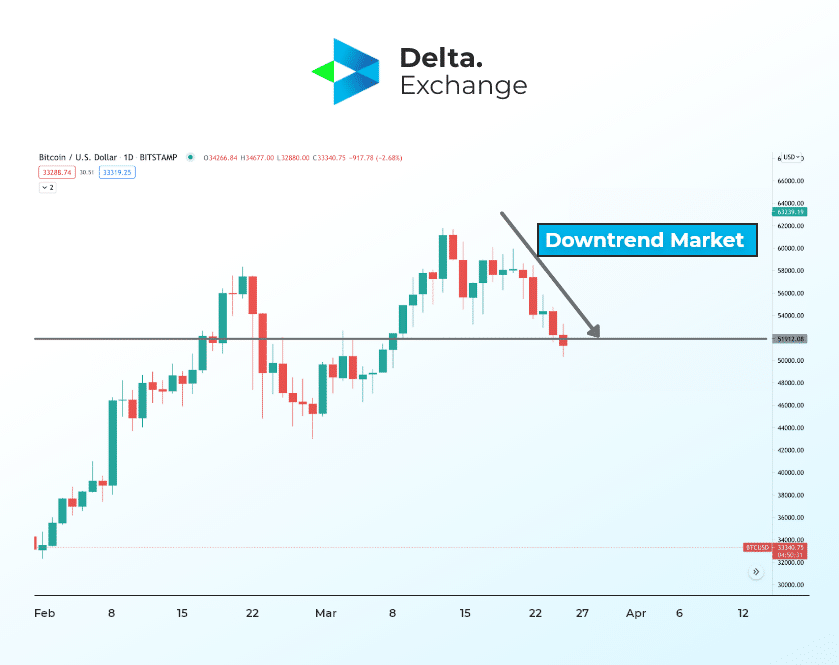

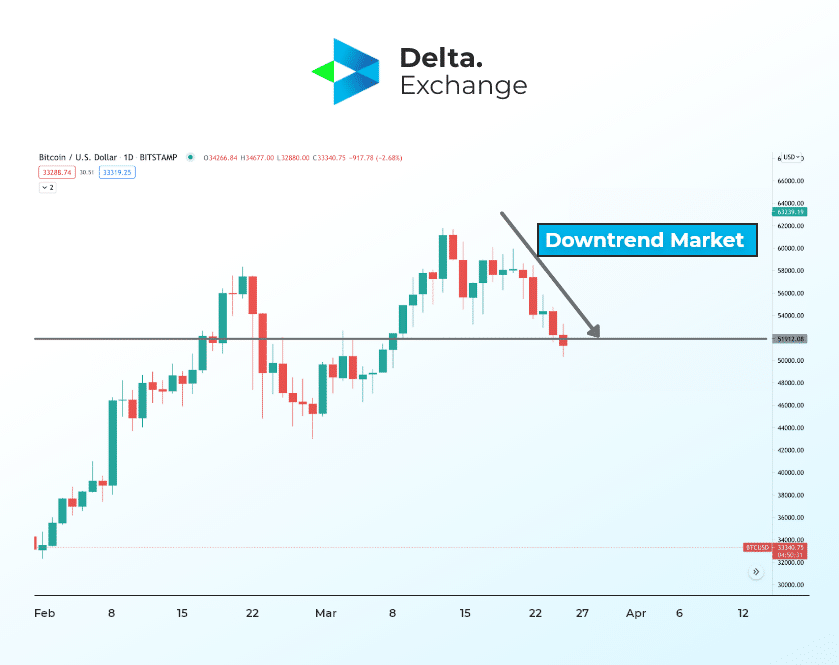

1. The first step is to locate a downtrend in the market. The downtrend is identified by a series of lower lows and lower highs, as shown in the BTCUSD daily price chart below.

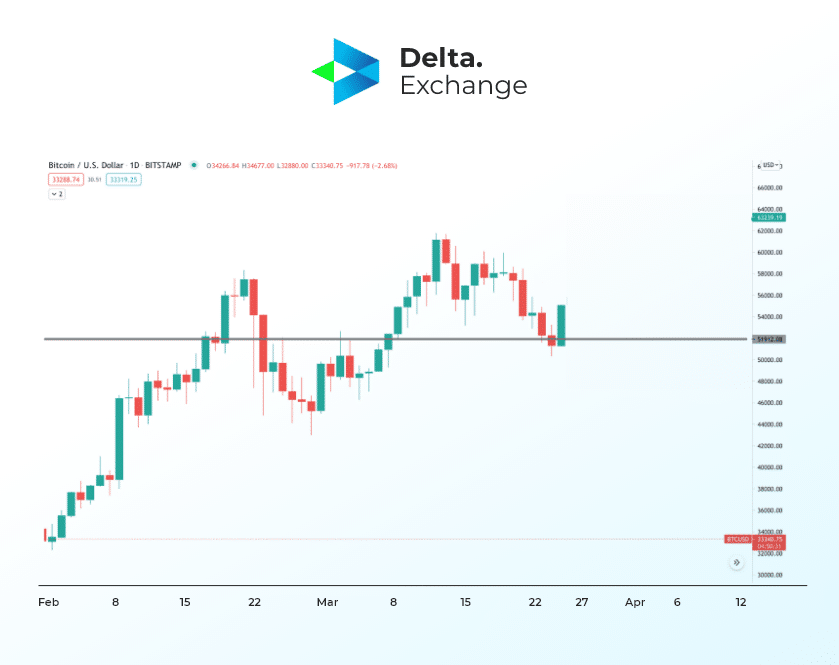

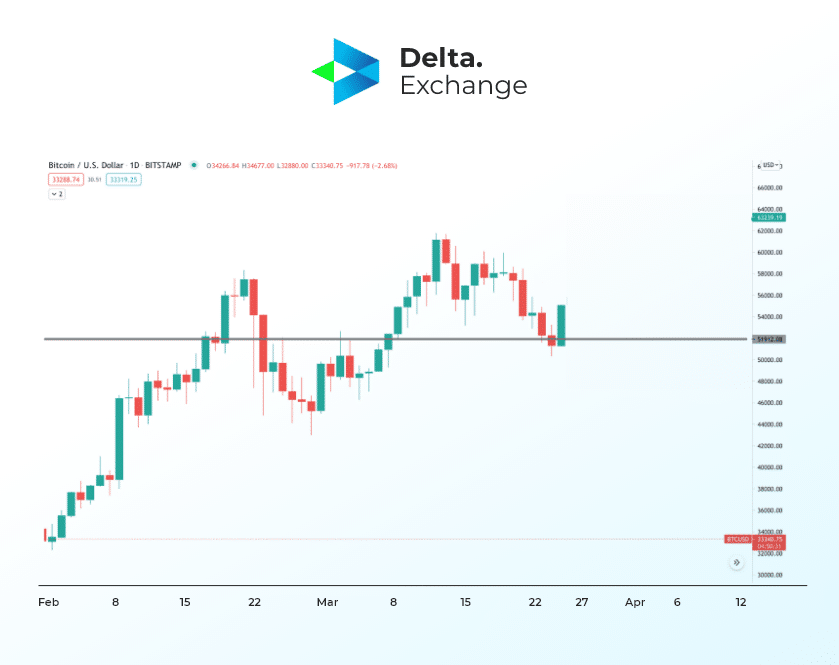

2. The next step is to look for the formation of the three candles that make up the Morning Star pattern.

3. The first candle is a bearish candle, also known as the “long black candle”. This candle should be relatively large and should have a relatively small or non-existent upper shadow.

4. The second candle is a small candle, also known as the “doji”. This candle should have a small real body and long upper and lower shadows.

5. The third candle is a bullish candle, also known as the “long white candle”. This candle should be relatively large and should have a relatively small or non-existent lower shadow.

It’s important to note that the second candle (doji) should be located within the range of the first candle. The third candle should close above the midpoint of the first candle.

As a continuation to the chart above, now we see a bullish candle that closed over the high of the candle twice removed from it. Comparing the last three candle formations, this chart now satisfies the conditions for the morning star pattern.

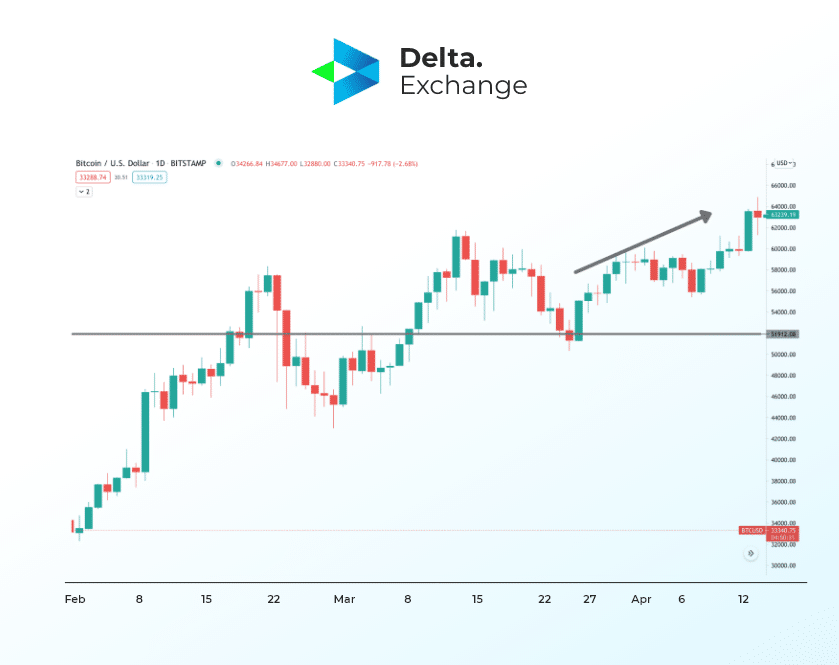

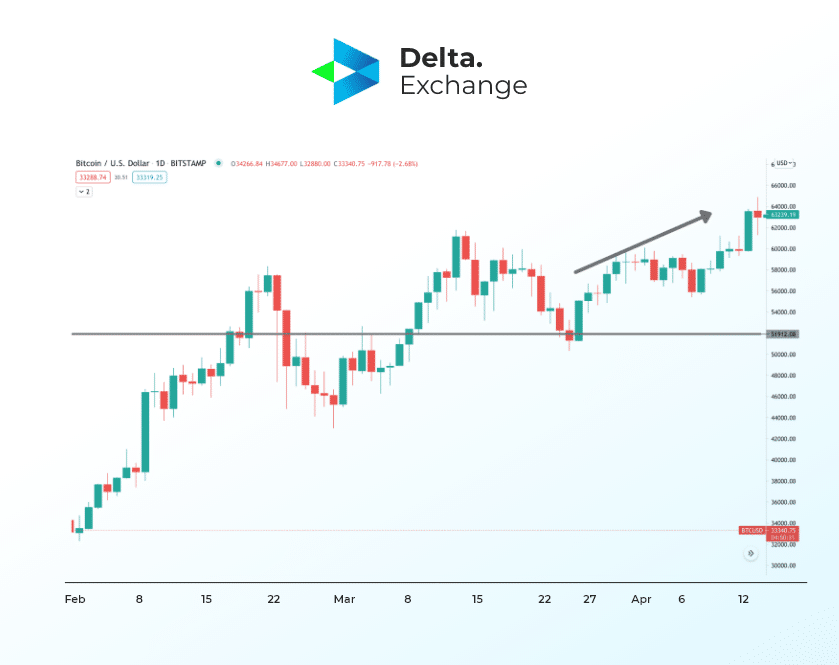

Finally, this image shows the pattern was indeed correctly identified, and it is a sign that the bears are losing control and that the bulls are gaining control. This can be a good opportunity to buy and make profit.

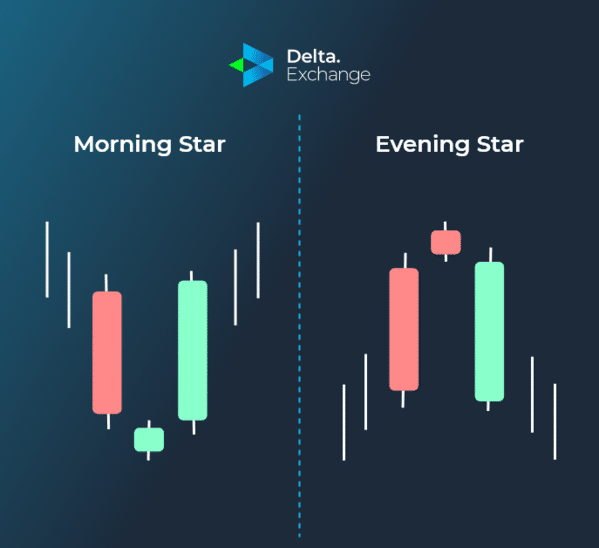

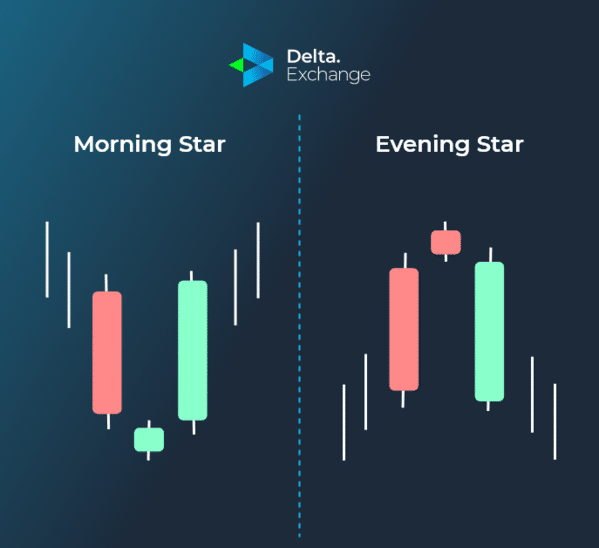

Difference Between the Morning Star and Evening Star Pattern

The Morning Star and Evening Star patterns are both reversal patterns that can be found in candle charts, but they have opposite implications. The Morning Star pattern is a bullish reversal pattern that indicates that a downtrend may be coming to an end, and it may be a good time to buy. On the other hand, the Evening Star pattern is a bearish reversal pattern that indicates that an uptrend may be coming to an end and it may be a good time to sell.

The Evening Star pattern is also composed of three candles, but with opposite implications. The first is a bullish candle (the “long white candle”), the second is a small candle (the “doji”), and the last is a bearish candle (the “long black candle”). This pattern is a signal that the bulls have exhausted themselves and the bears are ready to take control of the market.

Steps To Trade Crypto Using the Morning Star Pattern

Trading crypto using the Morning Star pattern can be a profitable strategy, but it’s important to have a well-defined plan in place. Here are some general steps to follow when trading crypto using the Morning Star pattern:

- Locate the pattern: Look for a downtrend in the market and identify the three candles that make up the Morning Star pattern. The first candle should be bearish, the second should be a small candle (doji), and the third should be bullish.

- Confirm the pattern: Use other technical indicators such as moving averages, Relative Strength Index (RSI), and volume to confirm the validity of the pattern. The more confirmations, the more reliable the pattern.

- Identify the entry point: Look for the point at which the third candle (bullish) closes above the midpoint of the first candle. This is the ideal entry point to buy.

- Set a stop loss: To minimize potential losses, it’s important to set a stop loss at a level below the low of the first candle. This will limit your losses in case the pattern does not work out.

- Take profit: Identify potential profit-taking levels using technical analysis such as resistance levels or Fibonacci retracements.

- Monitor the position: Keep an eye on the position and monitor the market for any changes. If the market starts to move against the position, consider closing the position to minimize potential losses.

Just How Reliable is the Morning Star Pattern while Trading Crypto?

The Morning Star pattern is considered a relatively reliable reversal pattern in the stock and crypto markets, but it’s not a guaranteed indicator of a reversal. The pattern is a signal that the bears have exhausted themselves and the bulls are ready to take control of the market. However, it’s important to use the pattern in combination with other technical analysis tools and indicators to make a more informed decision.

Limitations of the Morning Star Pattern

The Morning Star pattern is a relatively reliable reversal pattern, but it does have some limitations. Here are a few things to keep in mind when using the pattern:

- False signals: The pattern can generate false signals, especially in choppy or sideways markets. It’s important to use the pattern in combination with other technical analysis tools and indicators to confirm the validity of the pattern.

- Limited to downtrends: The pattern is only useful for identifying potential reversals in downtrends. It’s not useful for identifying potential reversals in uptrends.

- Not a guaranteed indicator of a reversal: It’s not a guaranteed indicator of a reversal and it’s important to use the pattern in combination with other technical analysis tools and indicators to make a more informed decision.

Trading the Morning Star Pattern

In conclusion, the Morning Star pattern can be a valuable tool for traders in the crypto market, but it’s important to use it in combination with other technical analysis tools and indicators and to consider the context and location of the pattern. Hope this blog post gives you an understanding of how you can use the morning star pattern to place your trades!

Interested in crypto derivatives trading in India? Head over to Delta Exchange today to find out how!

Frequently Asked Questions

Q. How do I confirm the validity of the Morning Star pattern?

A. To confirm the validity of the Morning Star pattern, use other technical indicators such as moving averages, Relative Strength Index (RSI), and volume. The more confirmations, the more reliable the pattern.

Q. How often should I monitor my positions when trading crypto using the Morning Star pattern?

A. It’s important to keep an eye on your positions and monitor the market for any changes. If the market starts to move against your position, consider closing the position to minimize potential losses. The frequency of monitoring positions may vary depending on the volatility of the market, the size of the trade, and the traders risk appetite.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter