Educational

February 8, 2023

What is Stochastic Oscillating Index?

Shubham GoyalProduct Specialist

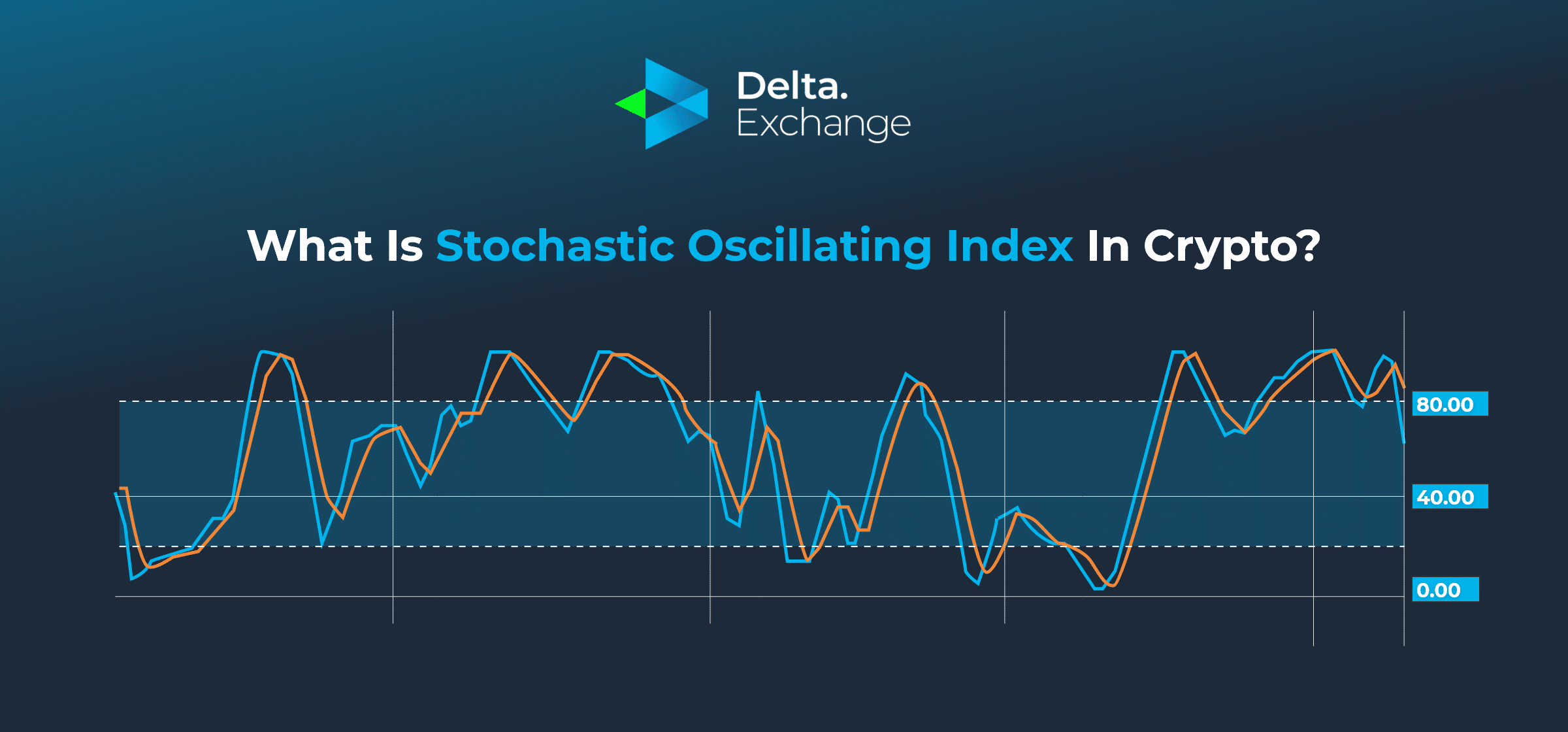

The Stochastic Oscillator is a technical indicator used to generate overbought and oversold signals, and can also be used to identify bullish and bearish divergences. In this detailed article, let us go in detail about this powerful indicator, and see how you can use this to successfully make profits in crypto futures, even during harsh crypto winters.

Typically, in practical scenarios – the Stochastic Oscillating Index, is used in tandem with the RSI (Relative Strength Index) indicator to get useful signals. Let’s understand stochastic crypto trading!

How does the Stochastic RSI indicator work?

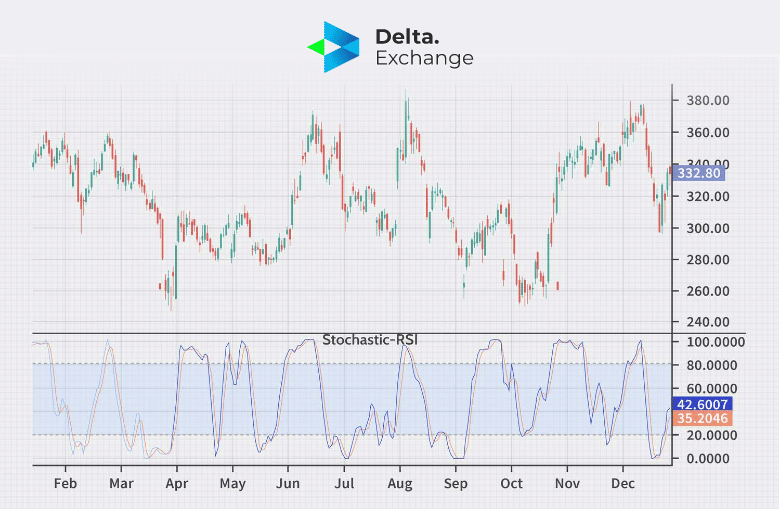

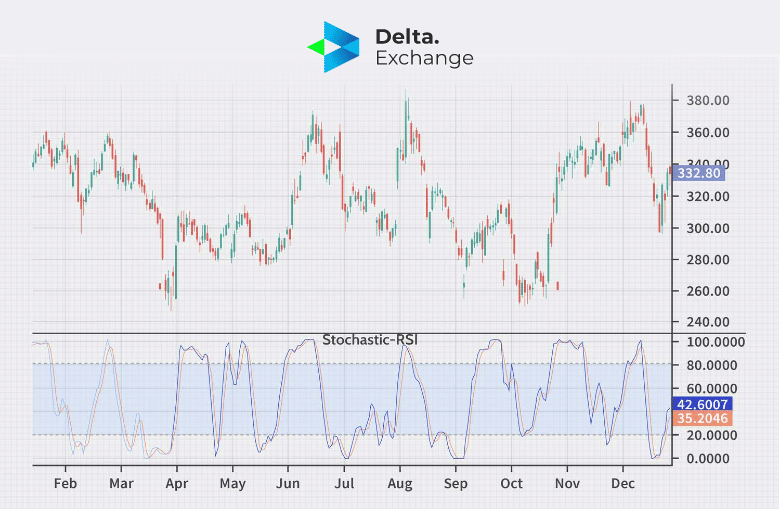

The Stochastic RSI is a momentum oscillator that measures the level of the RSI relative to its range over a given period of time. The RSI is a commonly used indicator that compares the magnitude of recent gains to recent losses in order to determine overbought and oversold conditions in the market.

The Stochastic RSI takes this a step further by applying the stochastic formula (discussed below) to the RSI values, rather than to the price data. This gives us an indicator that oscillates between 0 and 100 and is designed to identify overbought and oversold conditions in the RSI.

When the Stochastic RSI is above 80, it is considered overbought and indicates that the RSI is at a relatively high level compared to its recent range. This can be seen as a bearish signal, suggesting that the market may be due for a pullback or correction.

On the other hand, when the Stochastic RSI falls below 20, it is considered oversold, indicating that the RSI is at a relatively low level compared to its recent range. This can be seen as a bullish signal, suggesting that the market may be due for a rally or rebound.

Formula for Stochastic Oscillating Index and Stochastic RSI

The formula for the Stochastic Oscillator is:

%K = (Current Close – Lowest Low) / (Highest High – Lowest Low) * 100

%D = 3-day SMA of %K

Where:

- Current Close is the closing price of the crypto for the current period

- Lowest Low is the lowest closing price for the crypto over a given period (usually 14 periods)

- Highest High is the highest closing price for the crypto currency over a given period (usually 14 periods)

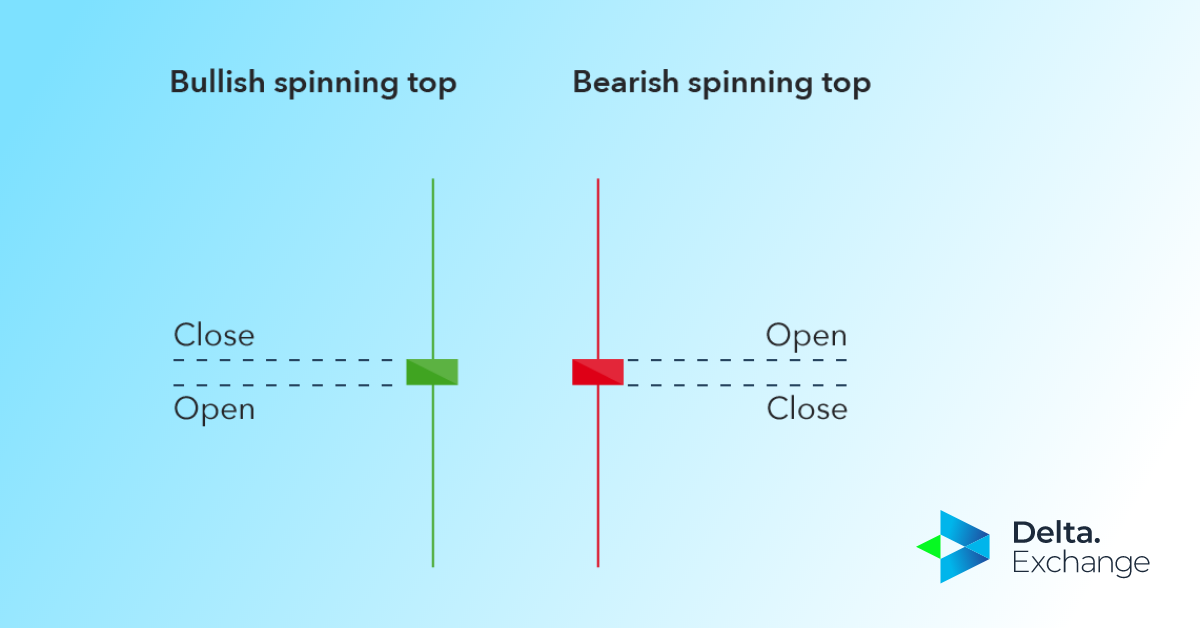

- %K is the fast line of the Stochastic Oscillator

- %D is the slow line of the Stochastic Oscillator and is usually a 3-day Simple Moving Average of %K

The formula for the Stochastic RSI is:

%K = (RSI – Lowest Low RSI) / (Highest High RSI – Lowest Low RSI) * 100

Where:

- RSI is the relative strength index of a crypto

- Lowest Low RSI is the lowest value of the RSI over a given period (usually 14 periods)

- Highest High RSI is the highest value of the RSI over a given period (usually 14 periods)

- %K is the stochastic RSI

Advanced traders sometimes alter the period chosen, and the type of moving average to suit their requirement better.

Stochastic RSI vs Stochastic Oscillator

The main difference between the Stochastic Oscillator and the Stochastic RSI is the type of data that each indicator uses to generate its signals.

The Stochastic Oscillator is a momentum indicator that compares the closing price of a cryptocurrency to its price range over a given period of time. It is calculated by taking the difference between the current close and the lowest low over the given period, divided by the difference between the highest high and the lowest low over the same period. The result is then multiplied by 100 to give a value between 0 and 100.

On the other hand, the Stochastic RSI is also a momentum indicator but it compares the level of the RSI to its range over a given period of time. The RSI is a commonly used indicator that compares the magnitude of recent gains to recent losses in order to determine overbought and oversold conditions in the market. The Stochastic RSI is calculated by applying the stochastic formula to the RSI values, rather than to the price data.

Another main difference is that the Stochastic RSI is usually displayed as a single line on a chart, while the Stochastic Oscillator is usually displayed as two lines, the %K line and the %D line, which are used to generate overbought and oversold signals.

Both indicators can be used to identify overbought and oversold conditions in the market and generate signals for potential trade opportunities in stochastic crypto trading. However, they use different types of data to generate these signals, and the Stochastic RSI is considered as a more advanced version of the Stochastic Oscillator.

Using Stochastic RSI to trade in Crypto Futures

The Stochastic RSI can be used to trade in crypto futures in several ways:

- Overbought and oversold signals: As the Stochastic RSI oscillates between 0 and 100, when it is above 80, it is considered overbought, forming a potential sell signal. When the Stochastic RSI falls below 20, it is considered oversold, giving a potential buy signal.

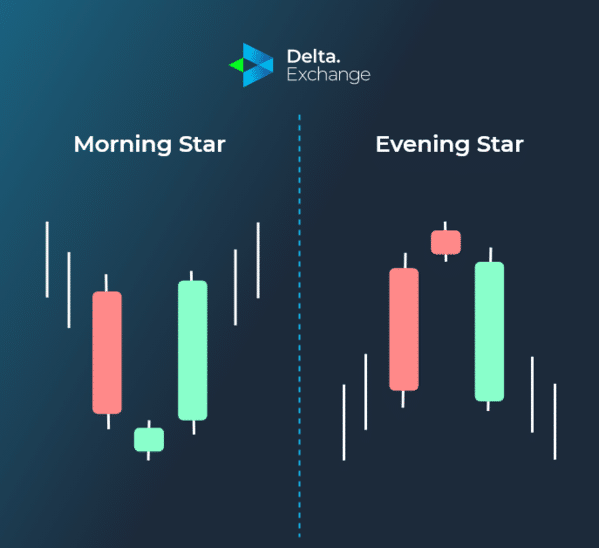

- Bullish and bearish divergences: When the Stochastic RSI forms a higher low while the price of the cryptocurrency forms a lower low, it can be a bullish divergence signal, indicating that momentum is building for a potential price reversal. Similarly, when the Stochastic RSI forms a lower high while the price of the crypto forms a higher high, it can be a bearish divergence signal, indicating that momentum is declining for a potential price reversal.

Advantages and Disadvantages of Stochastic RSI

Advantages of Stochastic Crypto Trading

- The Stochastic RSI can be used to identify overbought and oversold conditions in the market.

- It can also be used to identify bullish and bearish divergences, which can be used to confirm potential price reversals.

- It can be used in combination with other technical indicators to increase the accuracy of signals and confirm trades.

- The Stochastic RSI is a versatile indicator that can be used in different markets and time frames.

Limitations of Stochastic Crypto Trading:

- The Stochastic RSI is a momentum oscillator, which means that it may not be suitable for all markets.

- It can generate false signals in choppy or non-trending markets.

- It can be affected by volatility in the market, and the period used to calculate the indicator may not always be appropriate for all markets.

Final Words

The Stochastic RSI can be used in combination with other technical indicators to increase the accuracy of trade signals, but it’s important to keep in mind that stochastic crypto trading involves a momentum oscillator and may not be suitable for all markets.

If you’re interested in learning more about crypto trading, the Delta blog is a great resource. Over here, you will have access to the most up-to-date information and strategies for successful trading.

Frequently Asked Questions

Q: What is the optimal period to use for the Stochastic RSI?

A: The period used for the Stochastic RSI can vary depending on the market and the trader’s preferences. Common periods used are 14 periods, but it can be adjusted to suit the trader’s needs. It’s important to note that different periods may work better in different markets and time frames.

Q: Can I use the Stochastic crypto trading in the short-term?

A: Yes, the Stochastic RSI can be used for short-term trading. The indicator can be used to generate signals for potential trades in various time frames, including short-term trades.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter