Delta News

March 5, 2019

Perpetual Swaps Versus Futures

Pankaj BalaniCEO, Delta Exchange

Is Funding Rate on Perpetual Swaps eating into your profits?

Perpetual Swap is the most common instrument used for trading Bitcoin with leverage. This unique instrument trades very close to spot and involves exchange of an interest-rate term every few hours between buyers and sellers. This rate term is defined such that those who are trading against the trend are rewarded and those who are trading with the trend pay. The design of the contract is good but the frequent exchanges of the rate term can make it very expensive to trade.

In order to understand the impact of rate-exchange on P/L, we looked at the returns of Perpetual Swaps between October’17 and January’19 and compared them to those of traditional futures. Almost always, swaps underperformed futures.

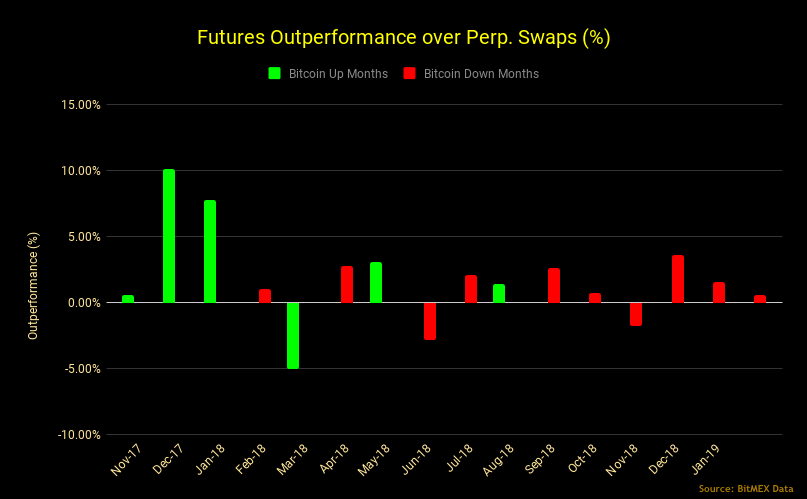

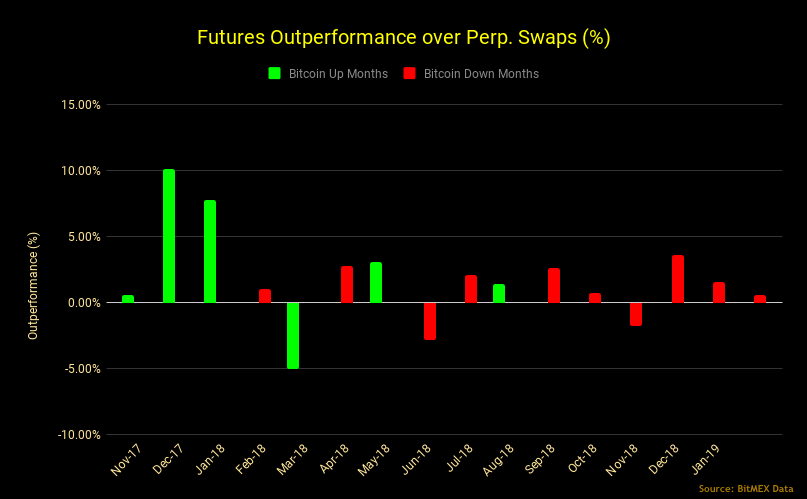

Below we’ve plotted the outperformance of Futures over Perpetual Swaps month-on-month. Months for which Bitcoin finished higher are marked in GREEN. RED bars indicate months for which Bitcoin finished lower month-on-month. On the y-axis is the outperformance of futures contracts over perpetual swaps. In 13 out of 16 cases Perpetual Swaps have underperformed futures.

A part of this underperformance comes from the interest rate term which one has to pay to hold the position in the direction of the trend. We thus conclude that the interest rate term makes Perpetual Swaps a much more expensive product to trade than futures.

Note that for this analysis we taken the case when a trader would have been trading in the direction of the market. The motivation here is to understand which instrument is better for a trader if their market call is correct. Hence, in UP months we compare Long Perpetual Swap with Long Futures. For DOWN months, we compare Short Futures position against a Short position in Perpetual Swaps.

Does market direction change this?

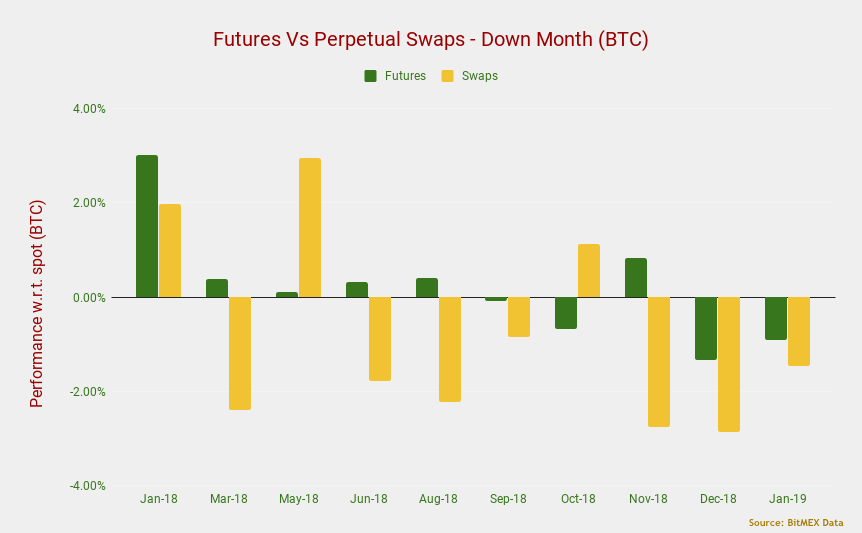

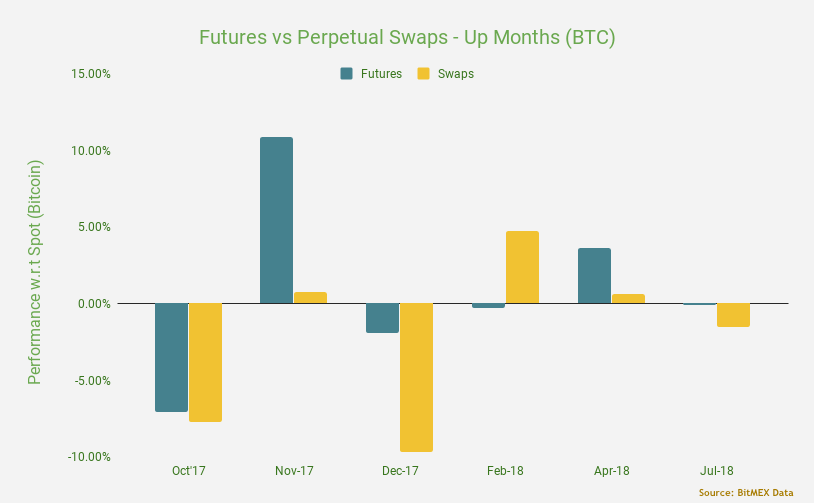

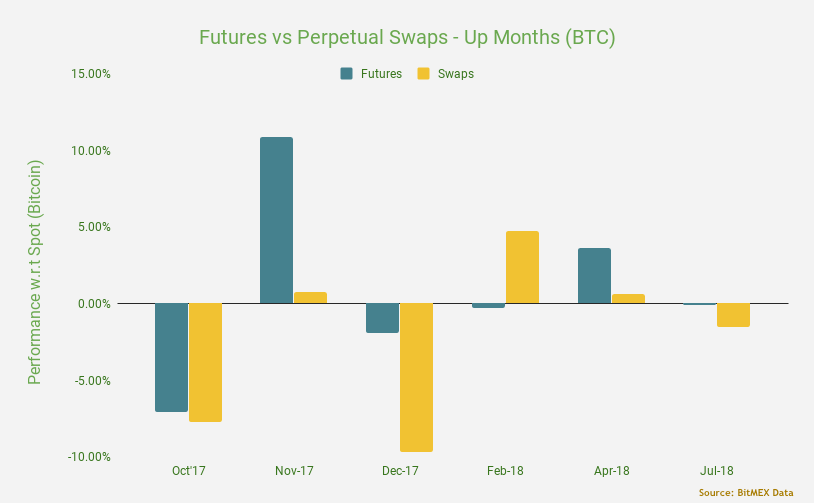

We have called the months in which Bitcoin ended higher as ‘Up months’ and those in which Bitcoin ended negative as ‘DOWN’ months. Continuing from the above analysis we look at UP months and DOWN months separately to see which instrument performs better and does the highlighted outperformance prevail in all market conditions.

Data Suggests that in UP months, it would have been better to hold a Long Position via a Future than via a Perpetual Swap. 5 out of 6 times Futures have outperformed Perpetual Swaps. Do note that in Oct’17 both Future and Perpetual Swap underperform Bitcoin. Futures however perform better than perpetual swaps for Oct’17. Only in Feb’18 it would have been better to hold a levered long via Perpetual Swaps.

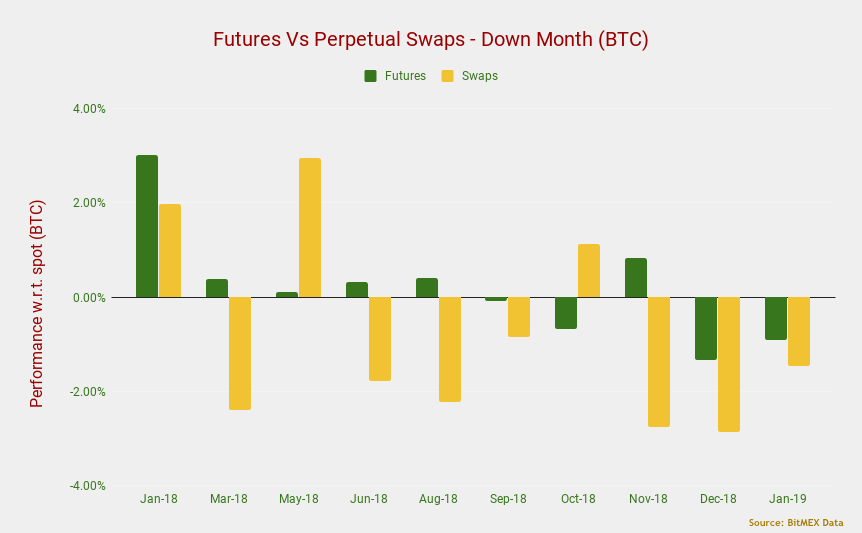

DOWN months are those where Bitcoin returns are negative on a monthly basis. For DOWN months as well, it would have been better to short Bitcoin via Futures than via Perpetual Swaps.

A higher underperformance in Swaps makes them less suitable for hedging. This assertion however assumes that roll-costs, that one will incur should one hold the hedge for long time-period, is marginal.

Hence if you have been hedging you Bitcoin balance by shorting 1x Perpetual Swap, chances are that you have paid roughly 2% per month as hedging cost.

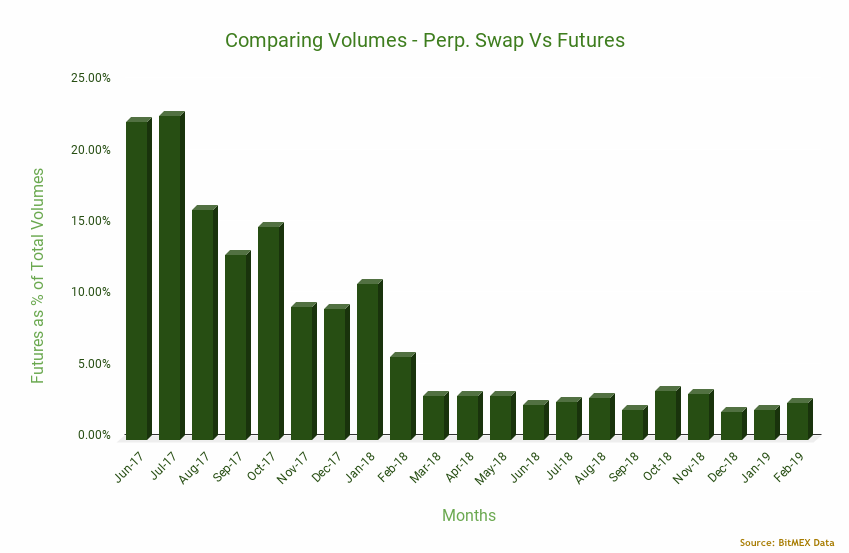

Volumes show that Traders love Perpetual Swaps

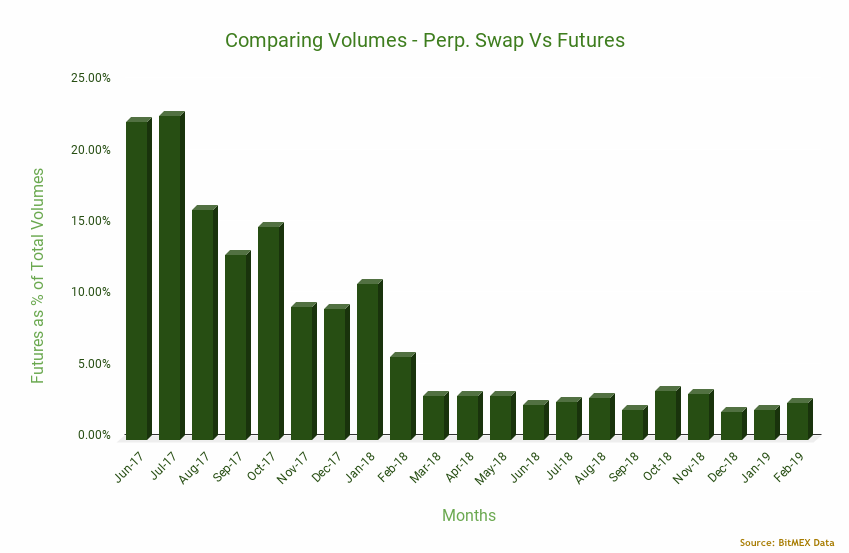

Despite being expensive Perpetual Swaps command higher share of the volumes. In-fact the share of volume in Futures has declined drastically over last year.

We ascribe this excess liquidity in Perpetual Swaps to ease of trading these contracts. Since perpetual swaps trade very close to spot price they are more relatable. Traders seem to be willing to pay the extra cost for simplicity.

This behaviour might change as more sophisticated investors enter the market. We expect the volume-share of futures to rise as more institutional money enters crypto markets.

Is market sophistication increasing already?

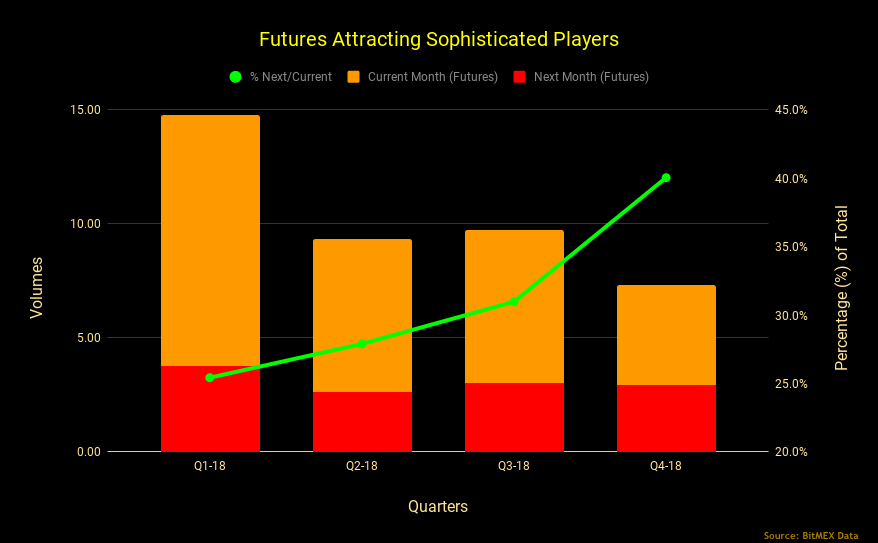

In one of the tweets last week we had pointed out that spread between Bitcoin near maturity and far maturity futures presents juicy trading opportunities. The spread tends to widen in the times of extreme volatility and converge as market cools off.

Such opportunities exist because longer maturity futures are not that liquid and hence don’t reflect correct basis in times of extreme volatility.

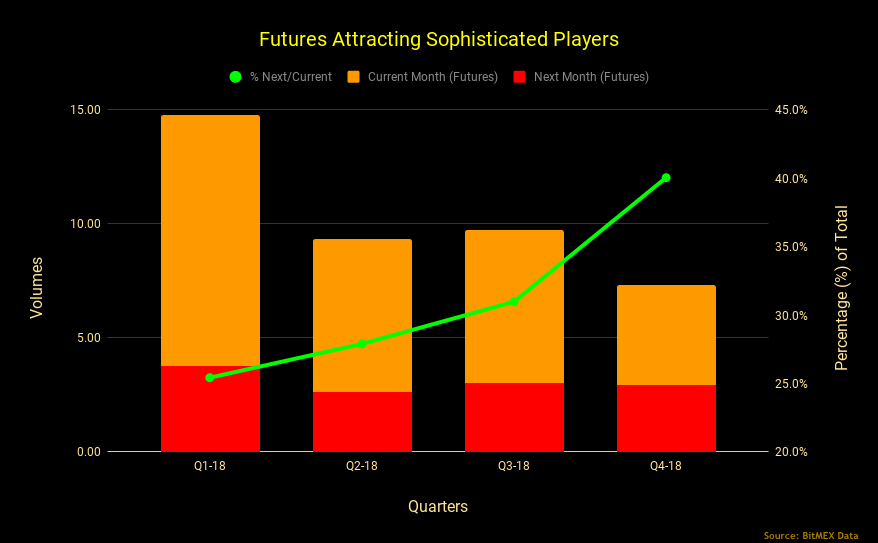

There are indications that this is changing. We looked at how the volumes in longer maturity futures compare with those in shorter maturity futures.

Share of volumes in longer maturity futures have continuously increased over last 4 quarters from 20% to 40%.

Conclusion

Overall we conclude that frequent funding exchanges make Perpetual Swaps much more expensive to trader as compared to futures contracts. This makes Swap a less desirable instrument as compared to futures for leveraged longs and for hedging. However, perpetual swaps beat futures hands down when it comes to ease of understanding & trading. Most of the volumes are concentrated in perpetual swaps but this should change as market sophistication increases.

Disclaimer: Delta Exchange currently only offers Futures contracts for leveraged trading. We are however, in the process of launching Perpetual Swaps and they should be available for trading in next few weeks.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter