Educational

June 29, 2022

How To Trade The Bearish Flag Pattern In Crypto

Shubham GoyalProduct Specialist

Pattern trading requires spotting trends and formulating trading strategies based on the pattern. There are specific chart patterns that represent a particular trend in the crypto market. Spotting trends or patterns may be challenging for beginner, especially in a volatile market like cryptocurrencies.However, these trends can tell the traders what bulls and bears are up to during a given period of time.

What is a Bear Flag Pattern?

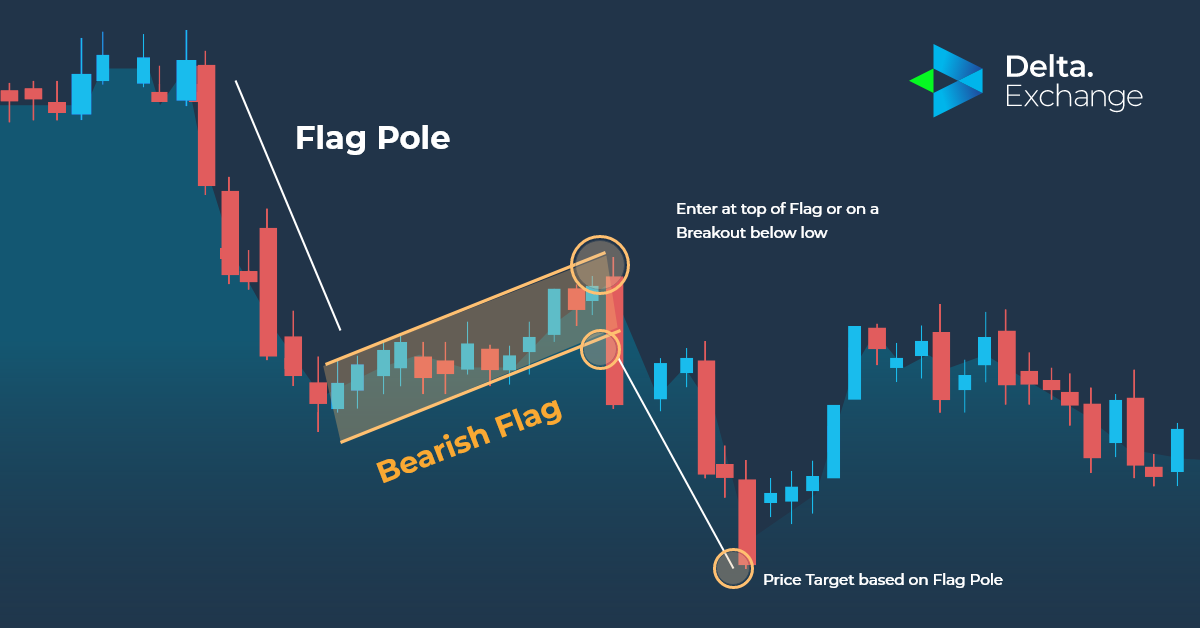

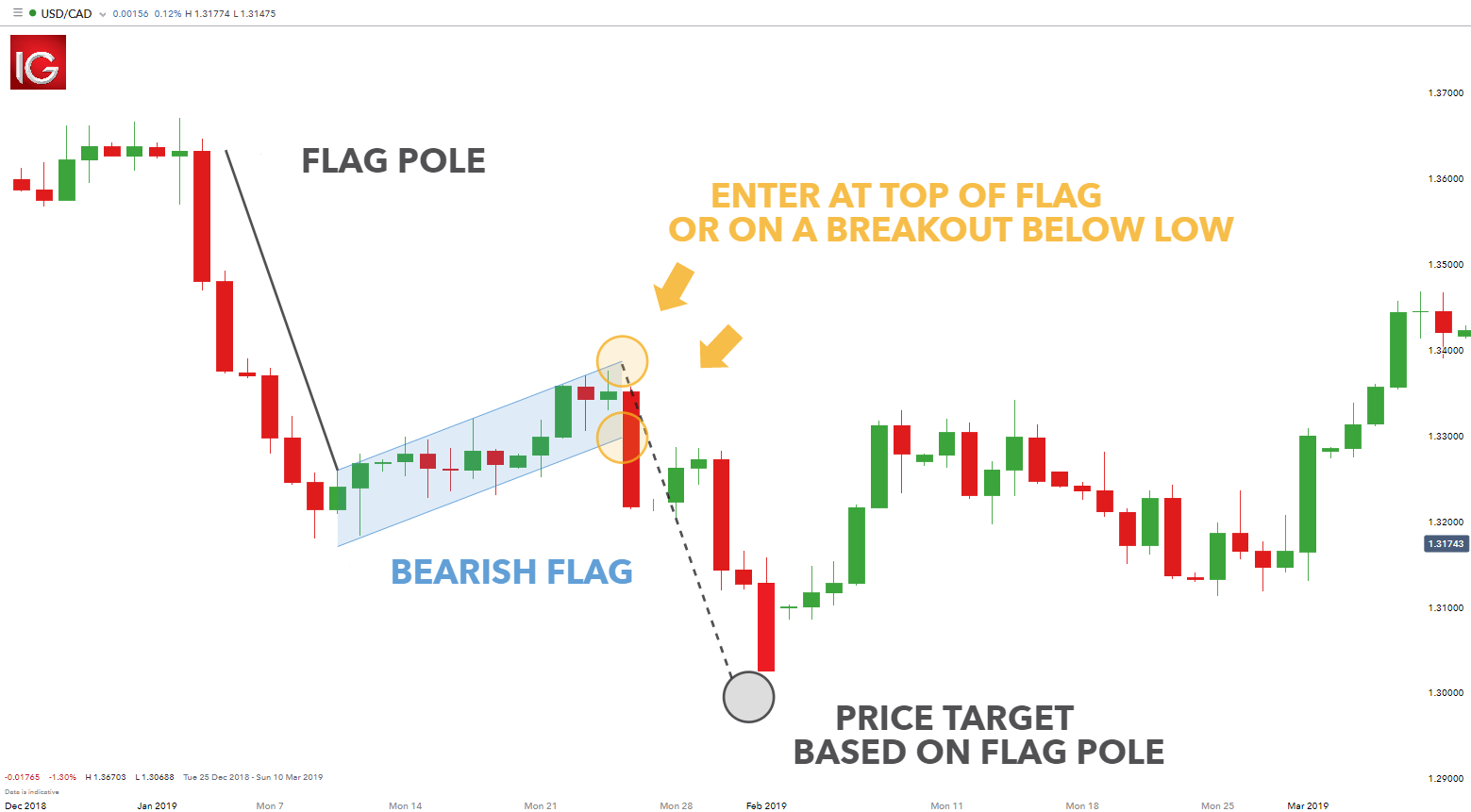

The bear flag is one such candlestick chart formation that occurs when the price of a cryptocurrency pushes below in a steep downward move (resembling a flag pole) to go into a temporary reversal/pullback (resembling a flag). The pattern anticipates the continuation of a bearish downtrend, notwithstanding the pullback. The figure shows how a bearish flag pattern appears on a chart.

It signals the extension of a downtrend after the temporary reversal. The flag part in the bear flag formation represents the actual retracement. On the whole, the bear flag pattern is a continuation pattern that helps the bears push the price lower.

How to Identify the Bear Flag Pattern

Source: Barok.com

A bear flag pattern has two main elements – the pole and the flag. The bear flag, however, looks like an upside-down flag.

The pattern formation begins with a price downtrend driven by a strong bearish momentum that continues until a new support level is reached. The downward movement here is very steep. We can call this the pole in the pattern formation.

Once the support level is reached, the price enters an upward consolidation channel for some time. This is the flag section in the pattern.

After the pullback, the price should break below the support level to continue the bearish downtrend. If the upward price movement continues, we do not get the bearish flag pattern.

Besides the price patterns, other factors to look for while identifying a bear flag chart pattern are the volume indicator and the breakout. The trading volume needs to rise during the pole phase and decline and stabilize during the consolidation or the flag phase in the chart pattern.

How to Trade Crypto Using the Bear Flag Pattern

Source: Daily FX

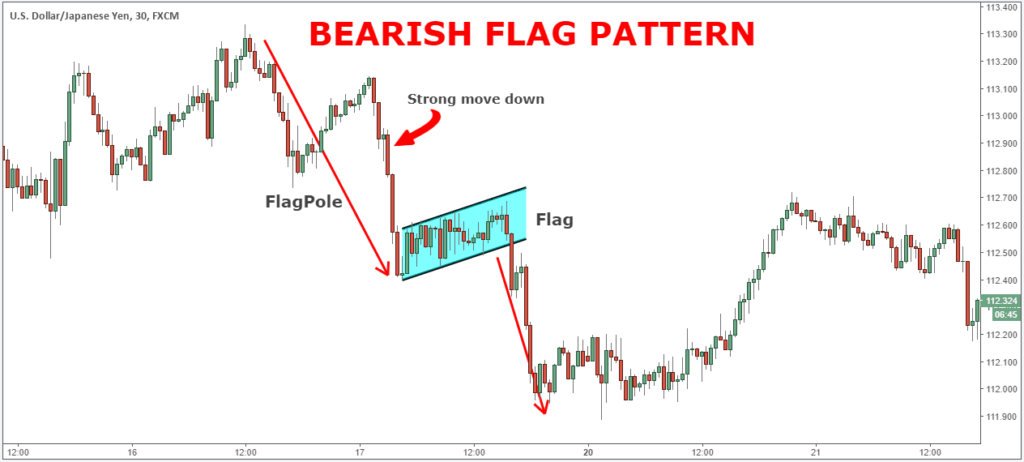

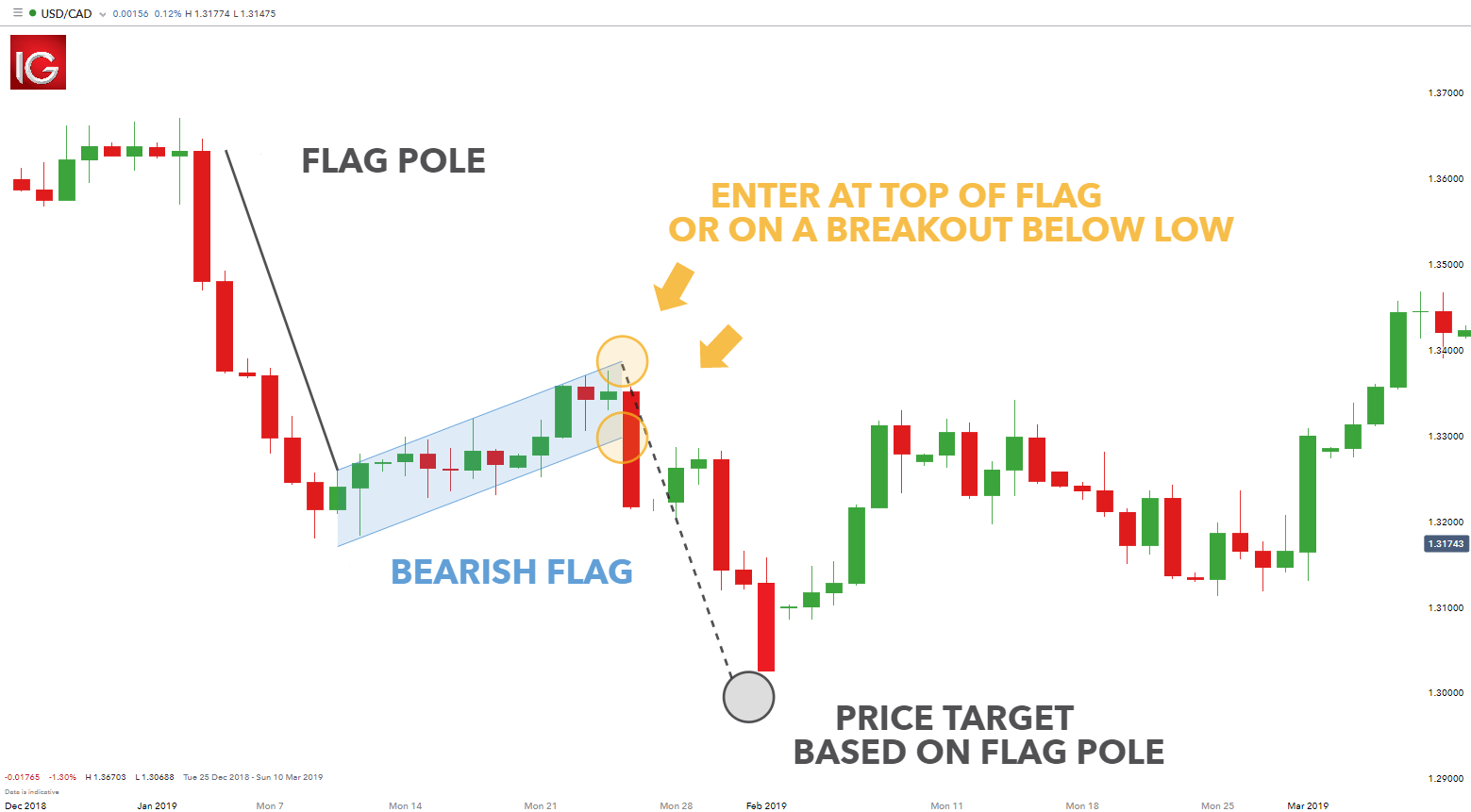

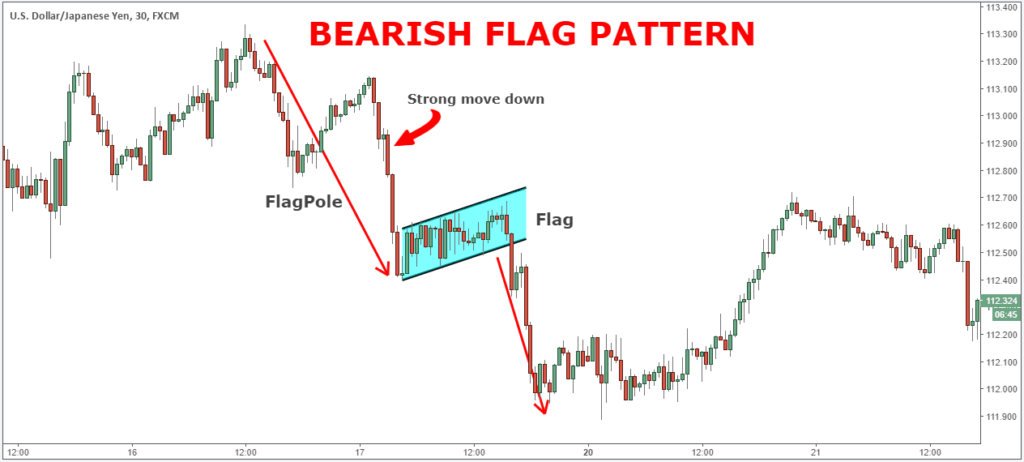

The flag phase in a bear flag chart pattern indicates an oversold range. Thus, after a steep downward price movement, the market takes a rest, or the price continues in upward reversal for a while before it continues to move in tune with the current bearish phase.

The traders can start placing their bets as soon as the temporary correction phase is over. Once the price breaks below the flag’s support line, traders can go short or place sell orders. However, it is prudent to wait for the confirmation of the downtrend to avoid following a false move. The traders can also seek an entry at the top of the flag.

Source: Think Markets

While trading bear flag, traders must consider the volumes, as discussed earlier. The volumes witness a drop and remain stable once the flag phase starts. An ideal pullback should be less than 38% of the flag’s pole. However, a 50% retracement is considered acceptable in a bear flag pattern.

Stop Loss: Traders must place the stop-loss order above the flag’s resistancevline to avoid potential losses in case the price starts moving in the opposite direction.

Take profit: For determining the price target, most traders consider the length of the flag pole. The distance of the flag pole can be used to determine how much the price may decline. Some traders consider the height of the flag channel as a more compact profit target.

Benefits of the Bear Flag Pattern

A bear flag is a common phenomenon in stocks and conventional markets. Cryptos trade just like traditional stocks and forex, and most of the continuation patterns work well for predicting crypto price movements. Some of the benefits of the bear flag pattern include:

- The bear flag pattern is a success in all kinds of markets. The pattern can be identified on all timeframes while trading cryptocurrencies.

- Both day traders and swing traders prefer using this pattern to strategize their trade moves.

- The pattern provides clear-cut visualization to the traders about where to open the short position, what profit to expect, and where ot place the stop loss.

- Traders get a favorable risk-to-reward ratio while trading the bear flag.

Risks Associated with the Bear Flag Pattern

Since cryptocurrencies tend to be volatile and unpredictable, the bear flag pattern can be hard to spot on a crypto price chart. As a standalone, the pattern seems straightforward, but in actuality, traders face difficulty handling it.

The pattern can be misleading if the retracement or the flag is larger than 50% of the pole. In that case, don’t rely on the pattern. Sometimes the pattern may remain incomplete, or the price may rebound after a drop below the flag’s support, triggering the stop-loss.

To avoid such a situation, traders must consider the associated volumes and other technical indicators like the moving averages and relative strength index (RSI). Measuring the volume and RSI will help you gauge the strength of the pattern and the momentum after it. Using volume as a guide also helps traders make entry and exit decisions with surety.

Reliability of the Bear Flag Pattern

The bear flag is one of the most reliable technical indicators in crypto trading. But no signal or indicator can be full-proof given the uncertain nature of the markets. Users should use risk management techniques to avoid losses, like placing a stop loss. Also, traders should stick to the 1% rule, which disallows traders to spend more than 1% on a single trade.

Conclusion

The bear flag pattern is one of the many patterns crypto traders use to analyze the market trend. The traders may be tempted to trade using technical chart patterns in shorter time frames but it is advisable to use a longer time frame, such as the 4-hour time frame, to implement flag-related strategies.

It is best ot practice these patterns on a demo account, such as one provided by Delta Exchange India, or use small amounts to start trading in crypto, in case the trader is a novice. The correct implementation of charts and patterns in technical analysis requires practice, observation, and experience on the trader’s part, all of which require time and patience. So be careful. And invest your funds carefully.

FAQs

1. What is a bear flag?

Ans. A bear flag pattern is a continuation pattern that resembles an upturned flag with a pole. It shows a continued bearish downtrend broken midway by a pullback – the upward channel representing the flag.

2. How should traders trade the bearish flag pattern?

Ans. Traders should first wait for the confirmation of the price breakout below the flag’s support line. Once confirmed, the traders can go short or place sell orders.

3. What market trend does the bear flag chart pattern represent?

Ans. The bear flag pattern represents an oversold condition in the market during the bearish downtrend.

4. When do we consider a bear flag complete?

Ans. A bear flag pattern is considered complete when the price breaks below the support level of the flag or upward consolidation channel temporarily formed during the steep market downtrend.

5. Should the bear flag pattern be used in confluence with other indicators?

Ans. To ensure greater reliability, the bearish flag pattern can be used with other indicators like the Relative Strength index.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter