Delta News

June 4, 2021

Options Weekly – Trading Bitcoin and Ethereum Options – June 2021

Options Weekly is a brief overview of the Crypto Options market. This is not financial advice.

Date: 4th June 2021

Bitcoin Options:

After a rally to $39K, spot BTC trades back around the $37K level. Skew of Calls over Puts has been expanding and now sits just below zero. Volatility has been mean-reverting with IV still trading higher than realized. Options market price in a 32% probability of $42K and 22% of $32K by the end of the month.

Last week saw a 37% chance of $42K and 25% chance of $35K by the same expiration.

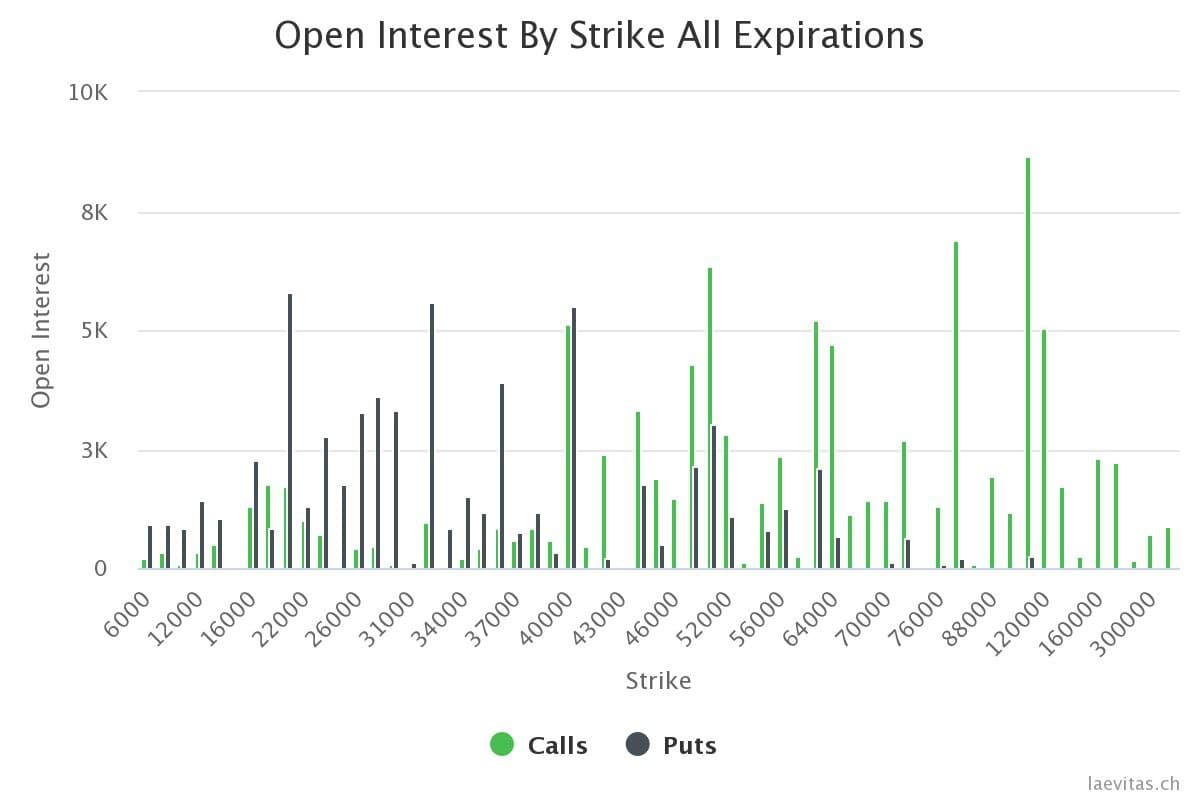

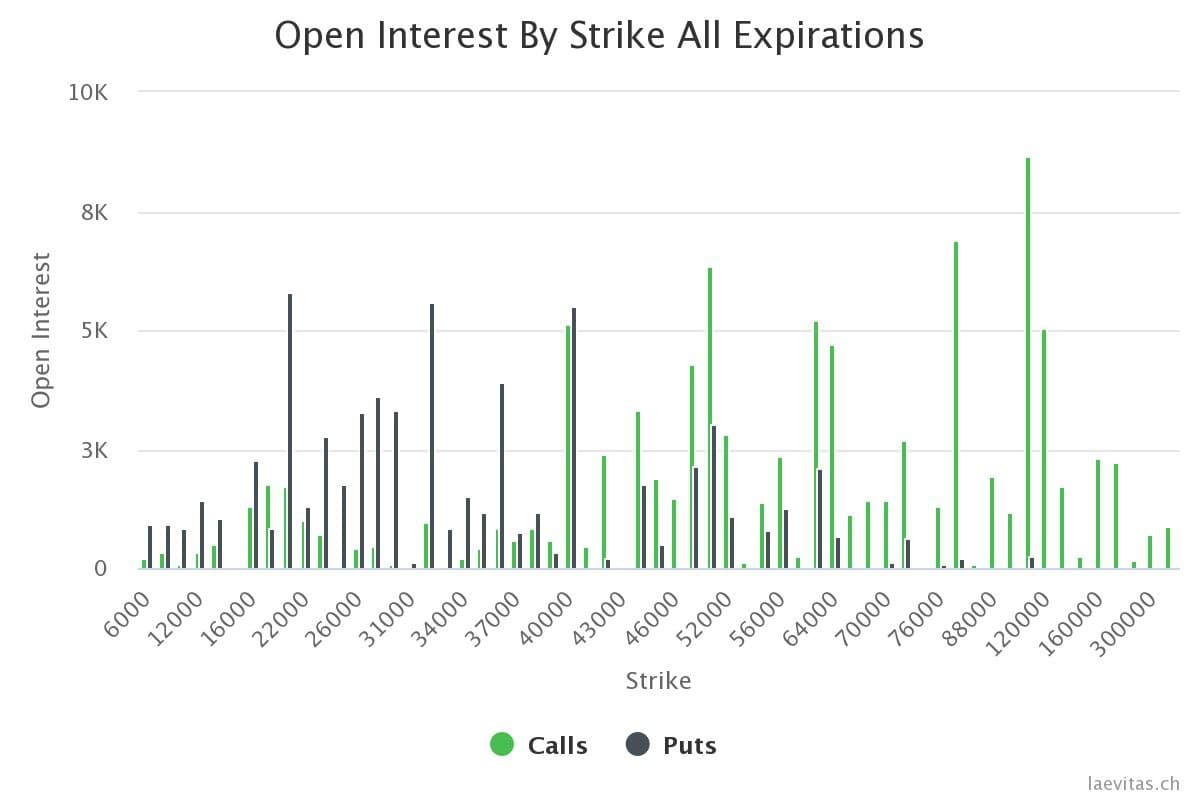

Over the last few days traders took advantage of high IV to sell $25K-$35K puts and $40K calls. While put selling continues we now see a rekindled interest in upside exposure as far OTM calls expiring August-September are bought in the $60K and $80K strikes. Open Interest for puts is highest in $20K, $32K and $40K strikes; for calls in $50K, $80K and $100K strikes.

Looking at gamma exposure, $40K remains the crucial level for both puts and calls. After last month’s selloff we now see first signs of cautious optimism while fear has clearly not vanished. With significant pressure from put selling call skew is approaching positive territory for the first time in three weeks.

At the same time bets on a new rally by Q4 of this year become lucrative at these levels. Until we see the same upside demand and call skew expansion at spot levels of $42K and higher, we expect rallies to be faded by larger players and more downside to come.

Trade Bitcoin Options on Delta.

Ethereum Options:

With ETH back at the $2.6K level, volatility has not subsided. Call skew has been expanding and even turned positive for short dated expiries. IV is higher than realized volatility. Delta option quotes price in a 45% chance of $2.9K and 27% chance of $2.3K by the end of the month. Last week saw a 45% chance of $2.9K and 32% chance of $2.3K by the same expiration.

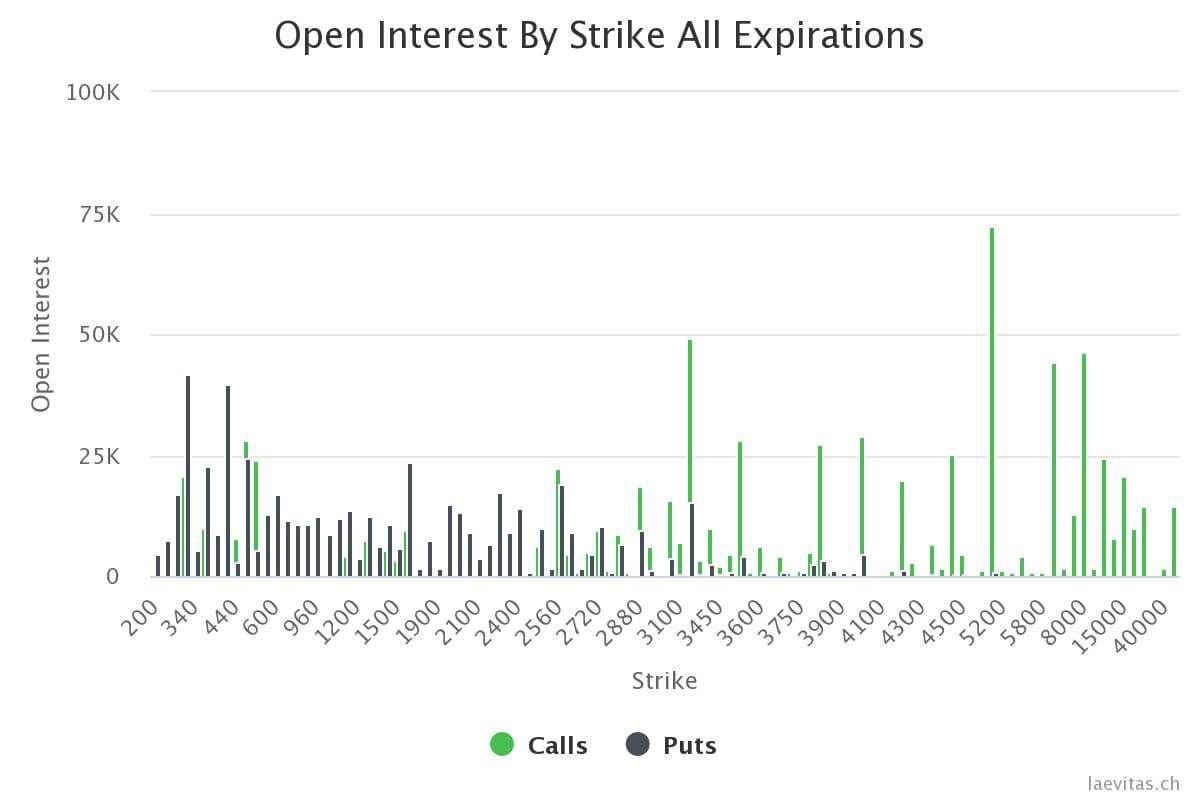

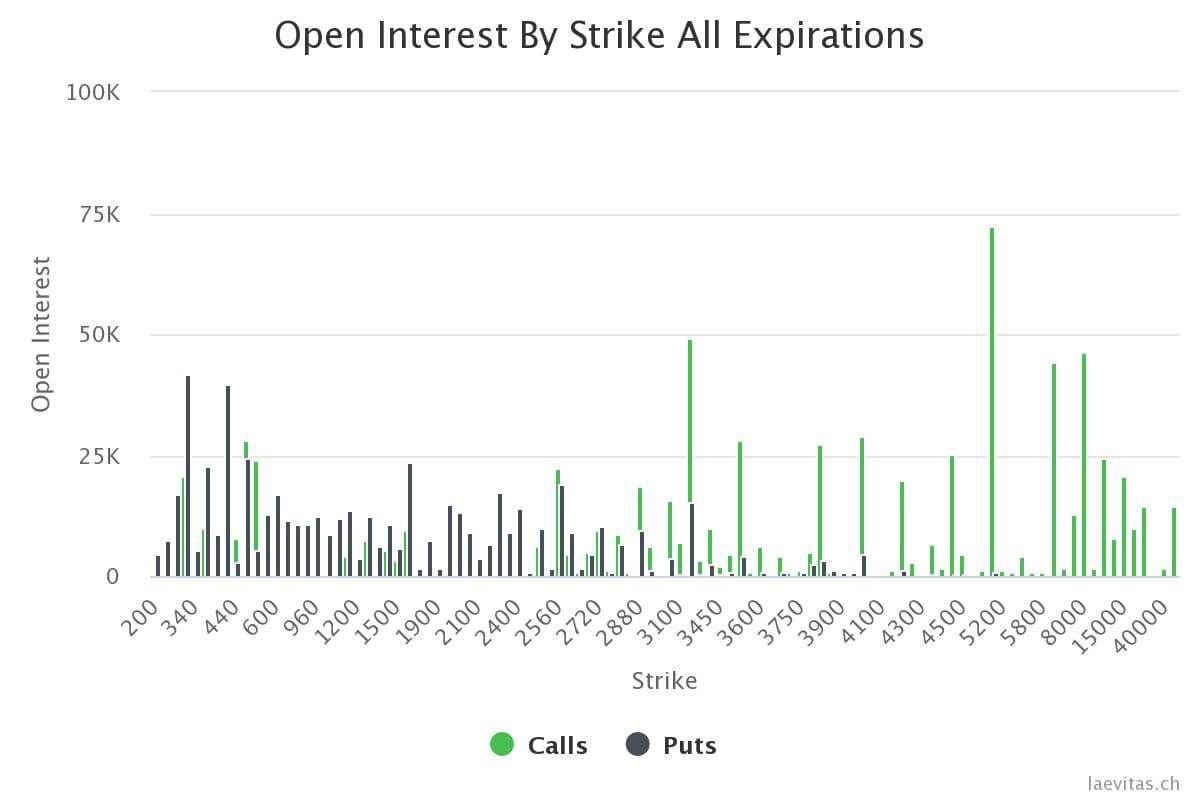

While $1.8K puts are in demand, downside exposure in the $2.7K strike is sold. The $3K call sees strong buying and writing. OI is highest for $3.2K and $5K on the upside, $400 and $320 on the downside. Gamma exposure at $3.2K for calls and $2.8K for puts needs mentioning.

With short term call skew positive again we see some signs of cautious optimism. However traders are buying far OTM ‘disaster’ puts and selling downside exposure predominantly ATM. As opposed to BTC options, volatility seems too high to play the upside with naked call exposure as OTM strikes see equal amounts of buying and selling. Downside risk has not disappeared and it will take more upside to change the market’s defensive stance.

Trade Ethereum Options on Delta.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter