Research

February 2, 2024

Selling ETH Straddles: A 500% Return in Just 6 Months

What if you sold an ETH straddle daily for six months (June 2023 to Jan 2024)?

- How would your capital have grown?

- What levels of risk would you have been exposed to?

Description of Trading Strategy

- Underlying Asset: ETHEREUM (ETH)

- Strategy Type: Daily ATM Straddle Selling (A straddle simultaneously sells a call and a put option of the same underlying asset, expiration date, and strike price)

- Trade Execution: Trades are executed at market price and held till expiration.

- ATM Strike is calculated as the closest to the money strike from the available option contracts at the time of execution.

- Position Sizing: All graphs and statistics are produced considering a trade size of 1 ETH.

- Fees: The strategy considers the total fees paid and calculates the Net Profitability accordingly.

- Duration of Analysis: June 2023 to Jan 2024

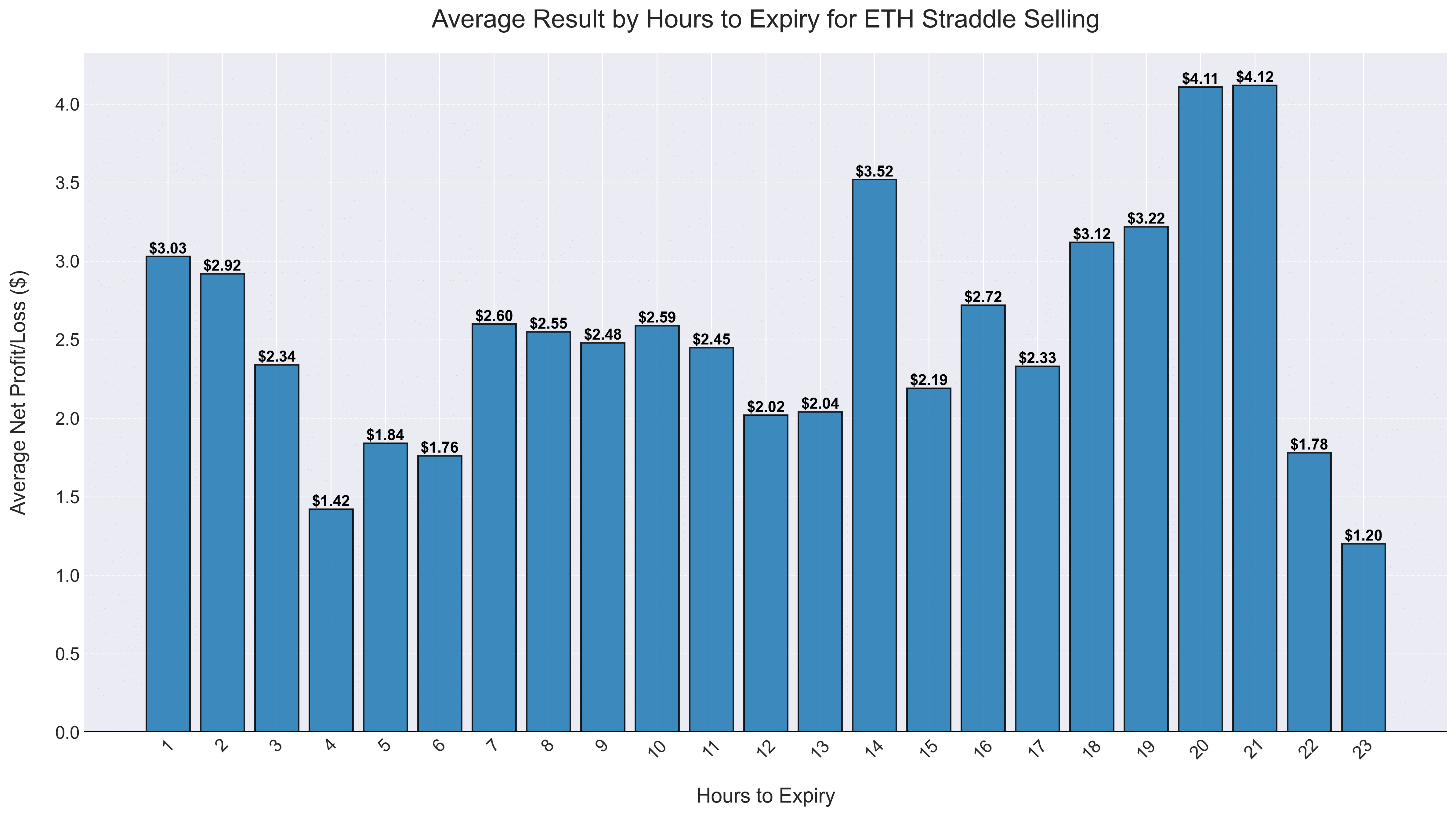

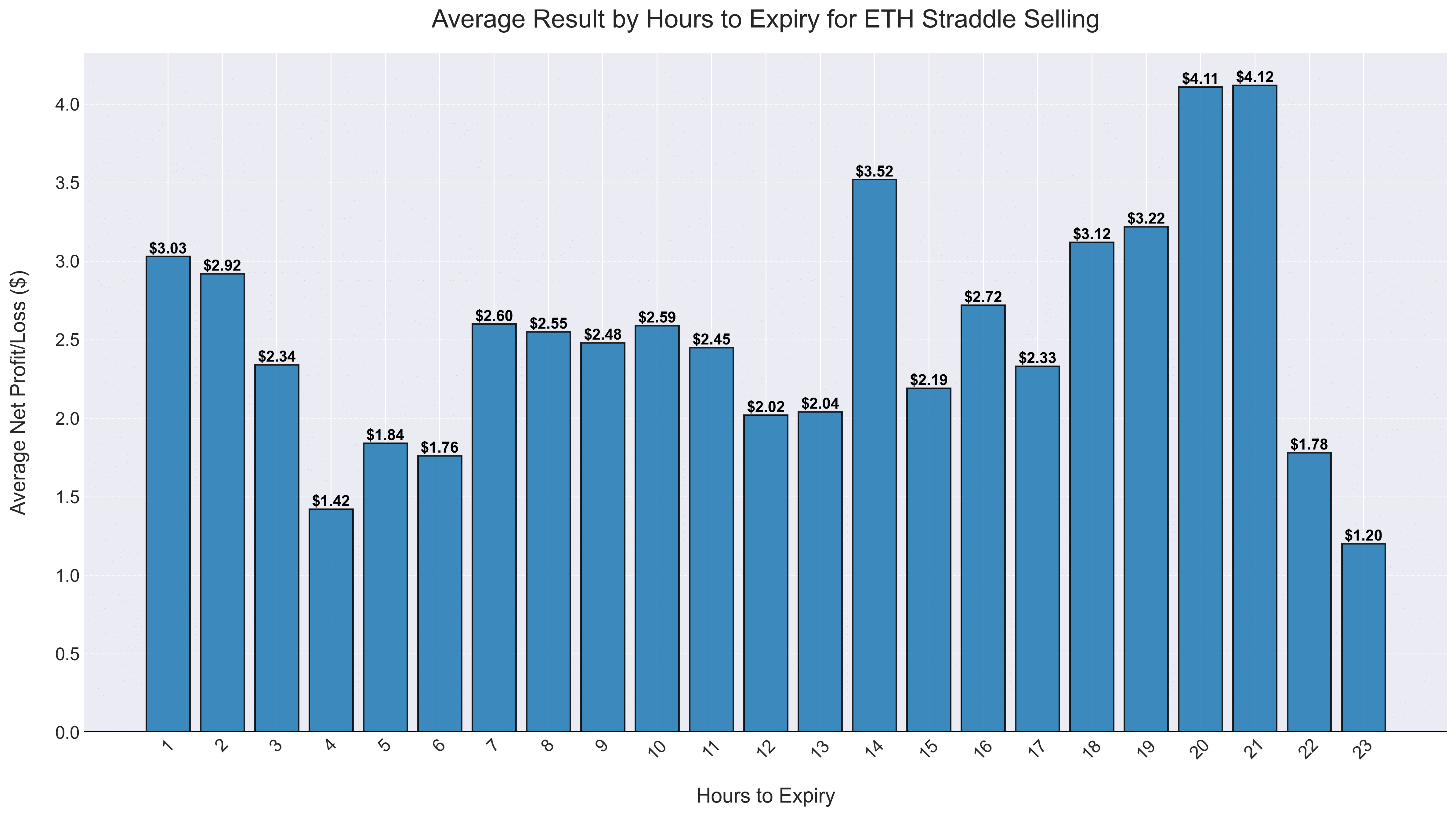

Time-of-Day Analysis

Analysing trades initiated at various hours before expiry, we identified patterns that suggest optimal and suboptimal times for selling ETH straddles. The following graph shows the average daily PnL generated by selling straddles at different hours.

Notably, selling straddles 21 hours prior to expiry, i.e. 20:30 IST, is the most profitable time to sell ETH Straddles. Let’s dive deeper.

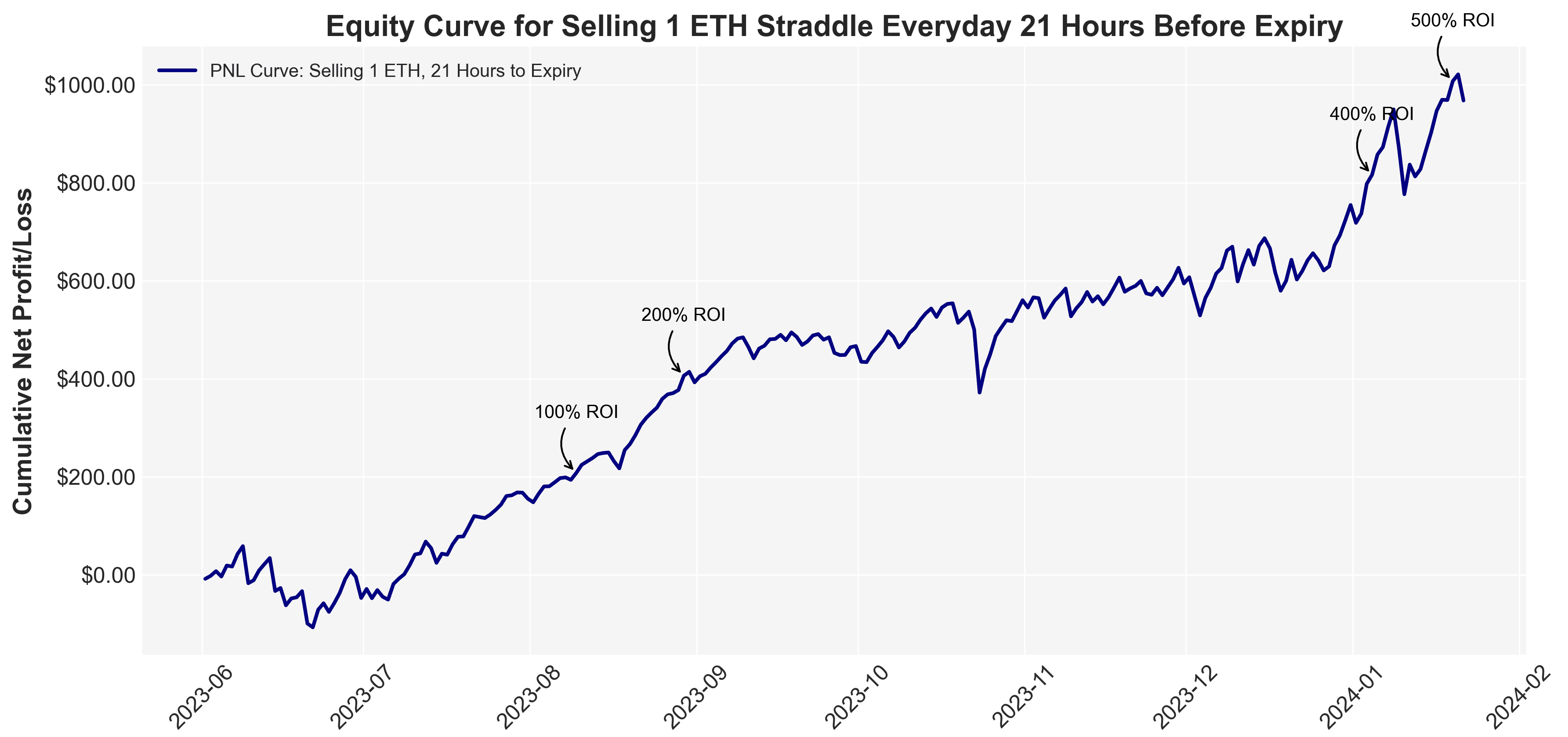

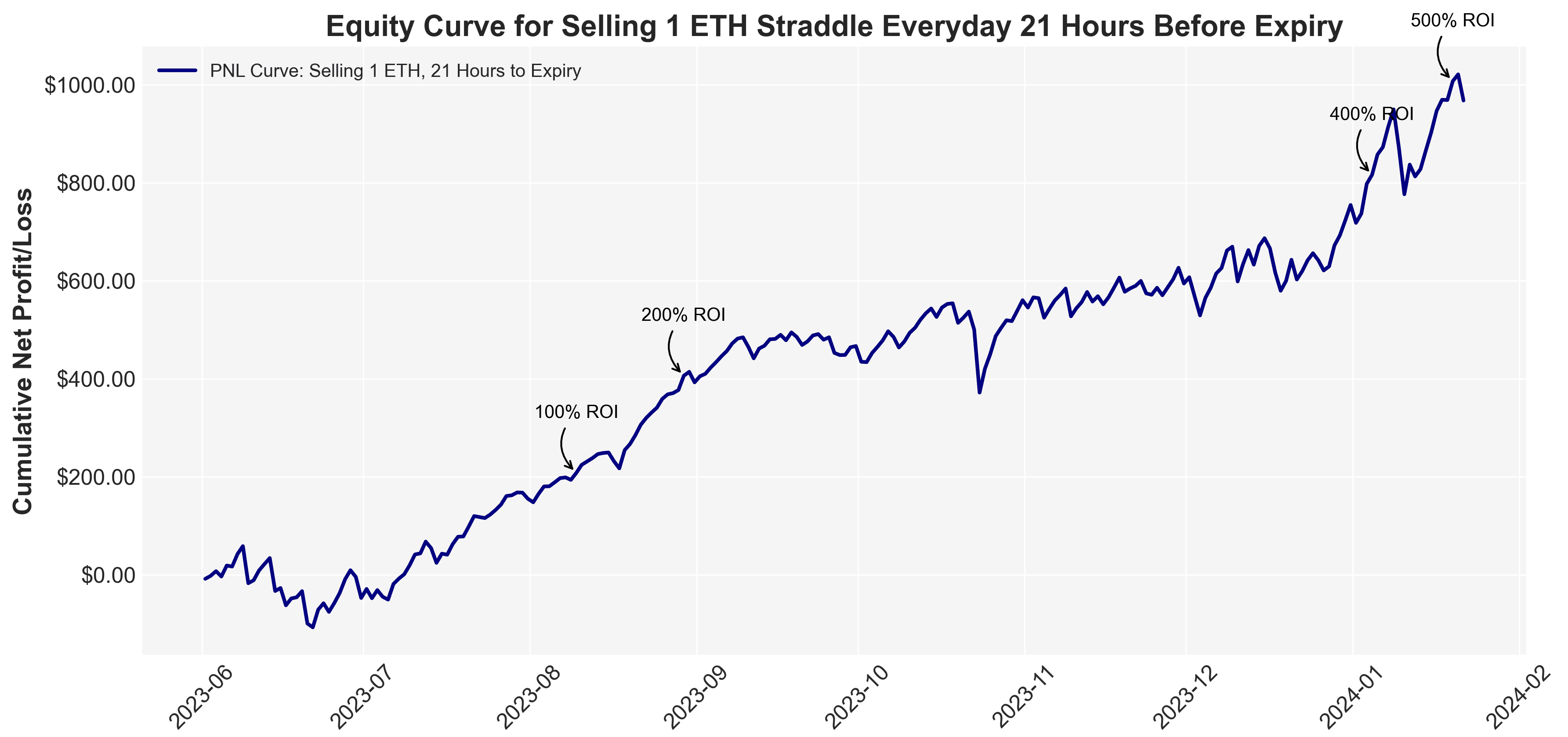

Equity Curve for 21 Hours to Expiry Straddles

- Total PnL: The strategy achieved a total profit of $1,493.87.

- Net PnL: The net profit is approximately $967.89 after accounting for fees.

- Win Rate: The win rate, or the percentage of profitable trades, is 70.21%.

- Average Win: On average, a winning trade yielded approximately $16.99.

- Average Loss: Conversely, the average losing trade resulted in a loss of approximately $26.22.

- Max Drawdown: The largest drawdown experienced during the backtest was approximately $182.26.

- Profit Factor: The profit factor is the ratio of total profits from winning trades to total losses from losing trades, which is approximately 1.53. This suggests that the total profits from winning trades are about 1.53 times the losses from losing trades.

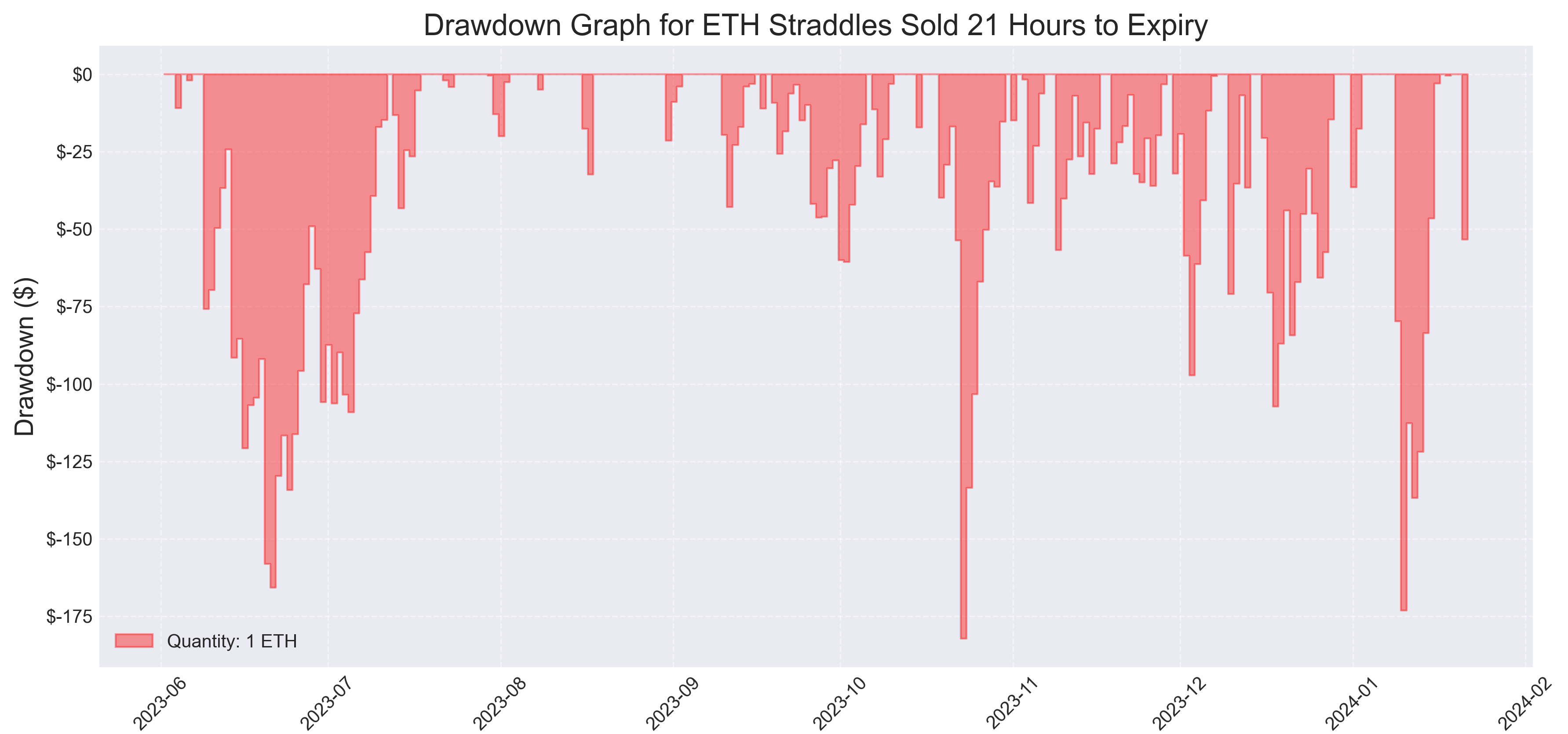

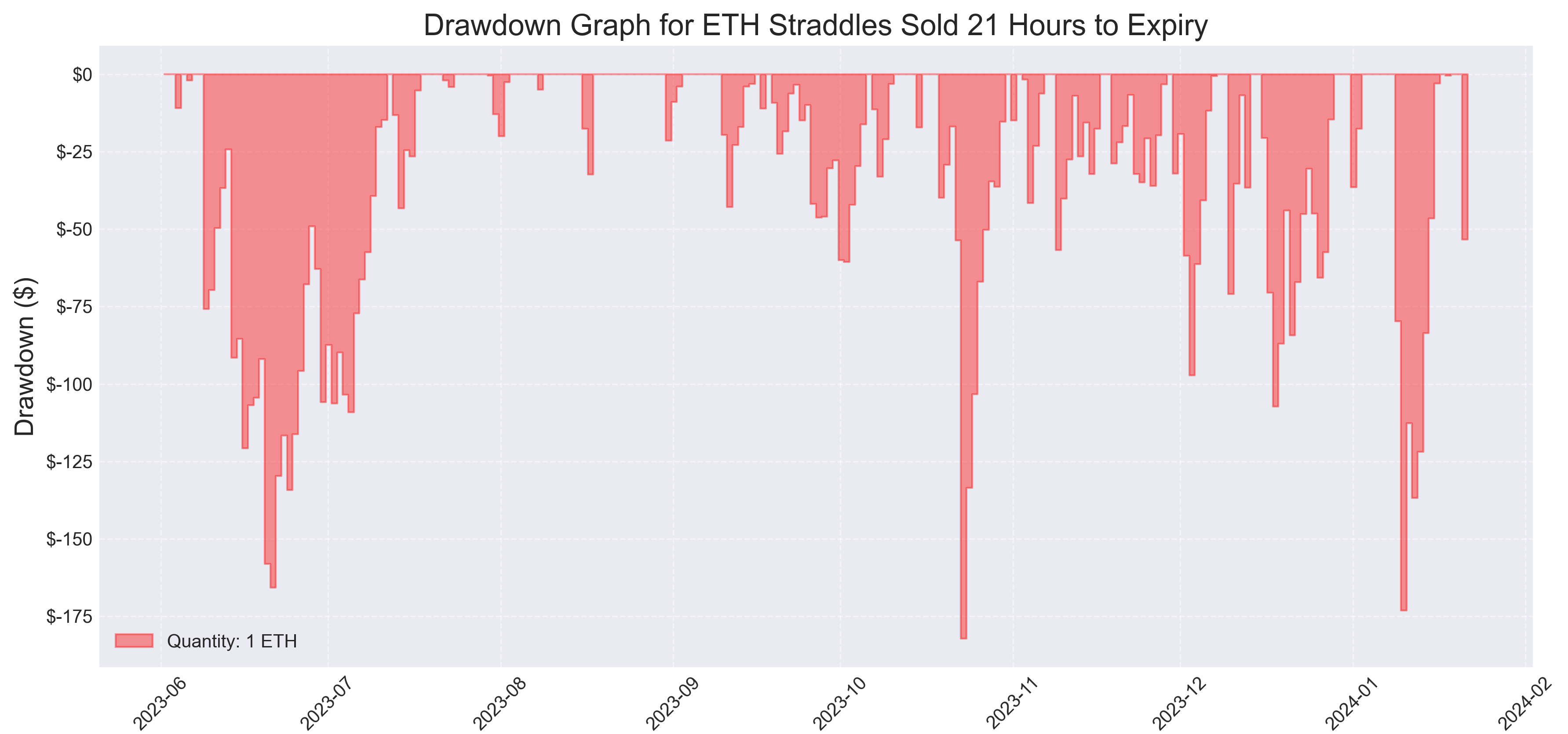

Drawdown Curve

The strategy experienced a maximum drawdown of approximately $182.26, which represents the most significant decline from a peak

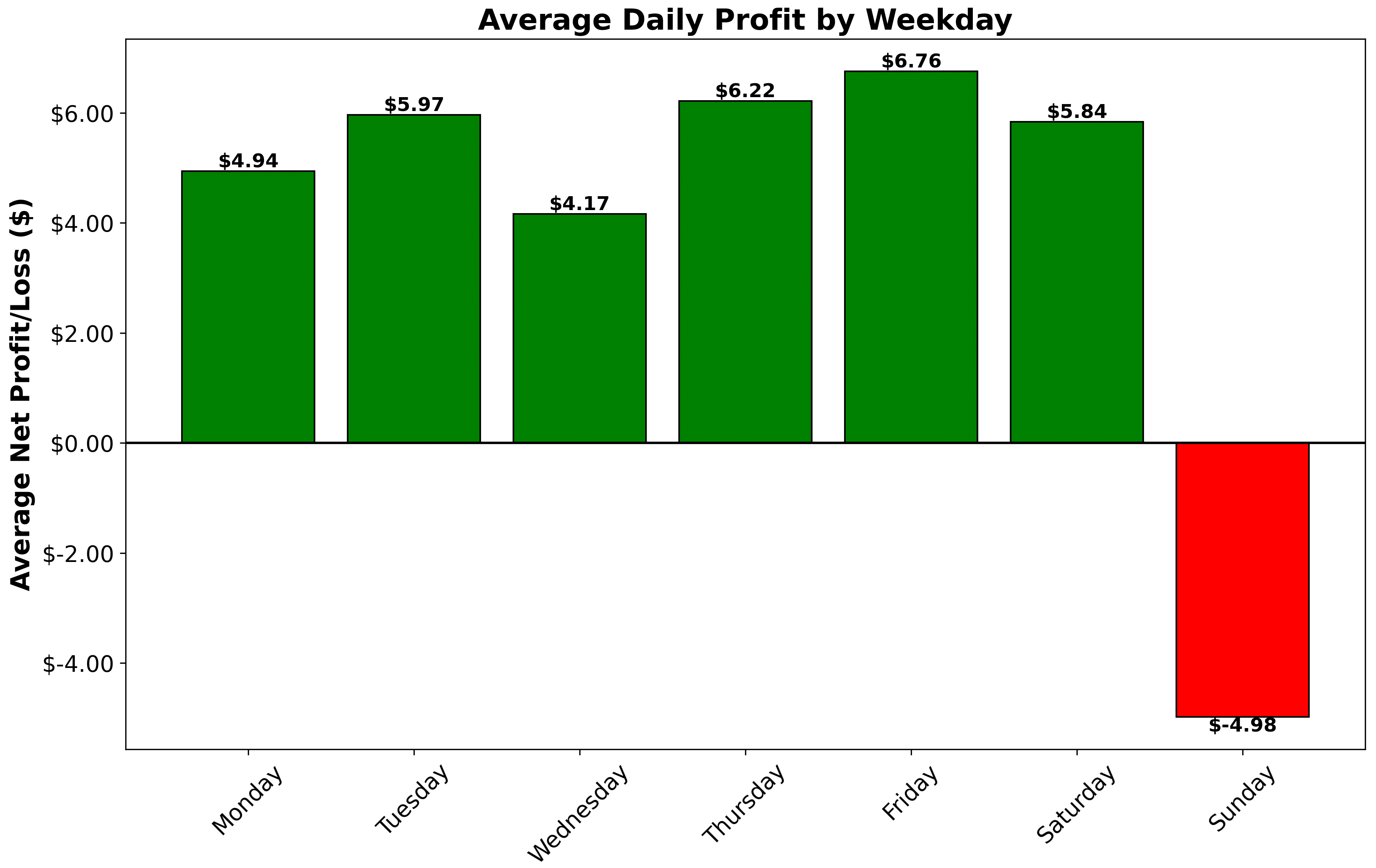

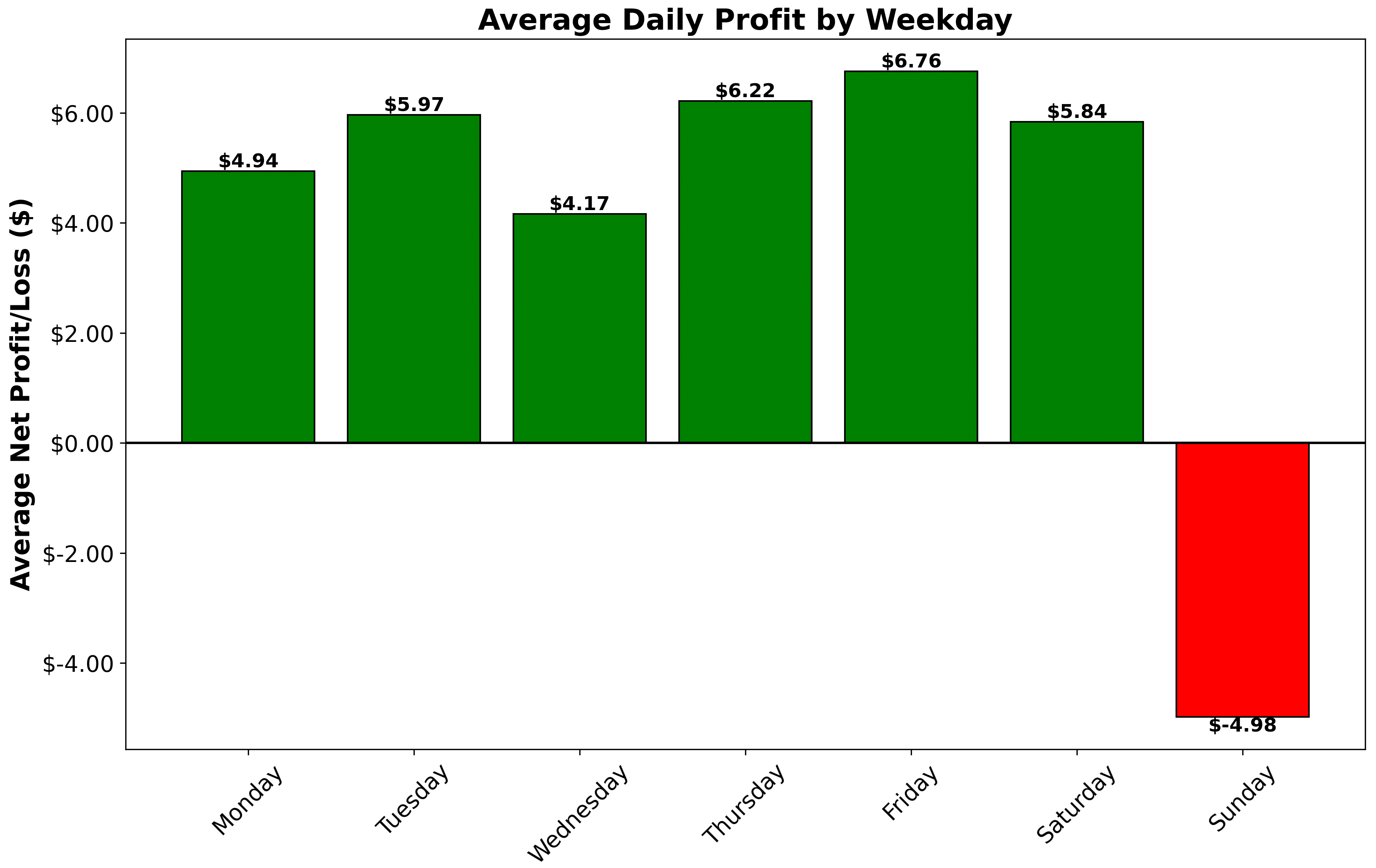

Average Profit by Weekday for ETH Straddle Selling

This graph displays the strategy’s performance across different weekdays, offering insights into which days might offer better trading opportunities based on historical data. Sundays are the outlier days when straddles are underpriced compared to ETH’s volatility. The best day of the week to sell straddles is Friday!

Disclaimer

This report is for informational purposes only and does not constitute financial, investment, or trading advice. The backtest results are based on historical data and do not guarantee future performance. Trading in options involves a high level of risk, including the total loss of investment. You should consult with a qualified professional for investment advice suited to your personal circumstances. The authors or distributors of this report bear no responsibility for any actions based on the information provided herein.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter