Educational

January 2, 2023

What is an option chain?

Shubham GoyalProduct Specialist

If you are new to crypto derivatives trading, you might have heard of the term ‘option chain’. If you’re a trading veteran, you almost certainly know what it means. In any case – whether you’re not yet aware of what this specific jargon means, or if you want to refresh your memory – in this post, we bring you the beginner’s guide to crypto option chains!

What is an option chain?

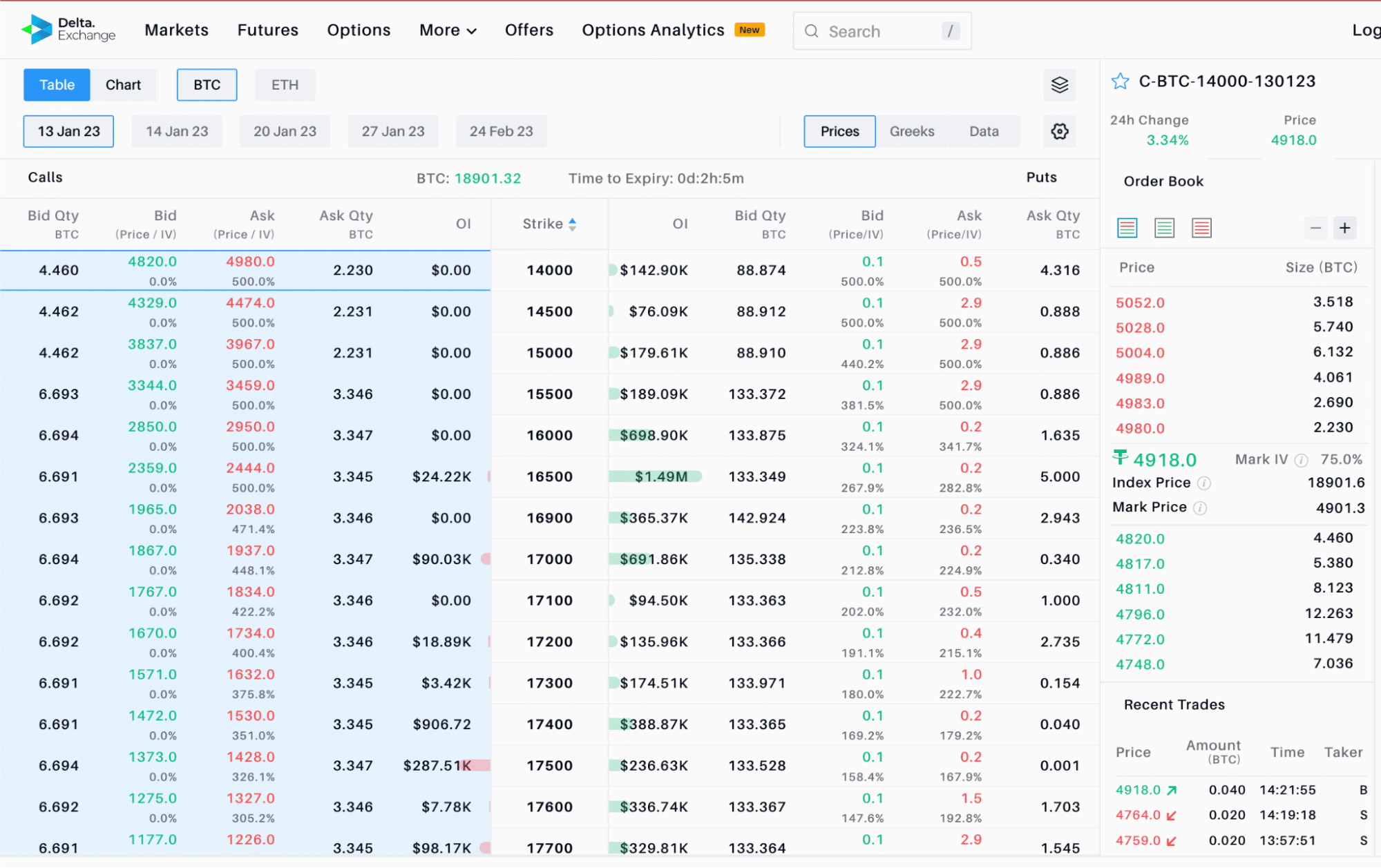

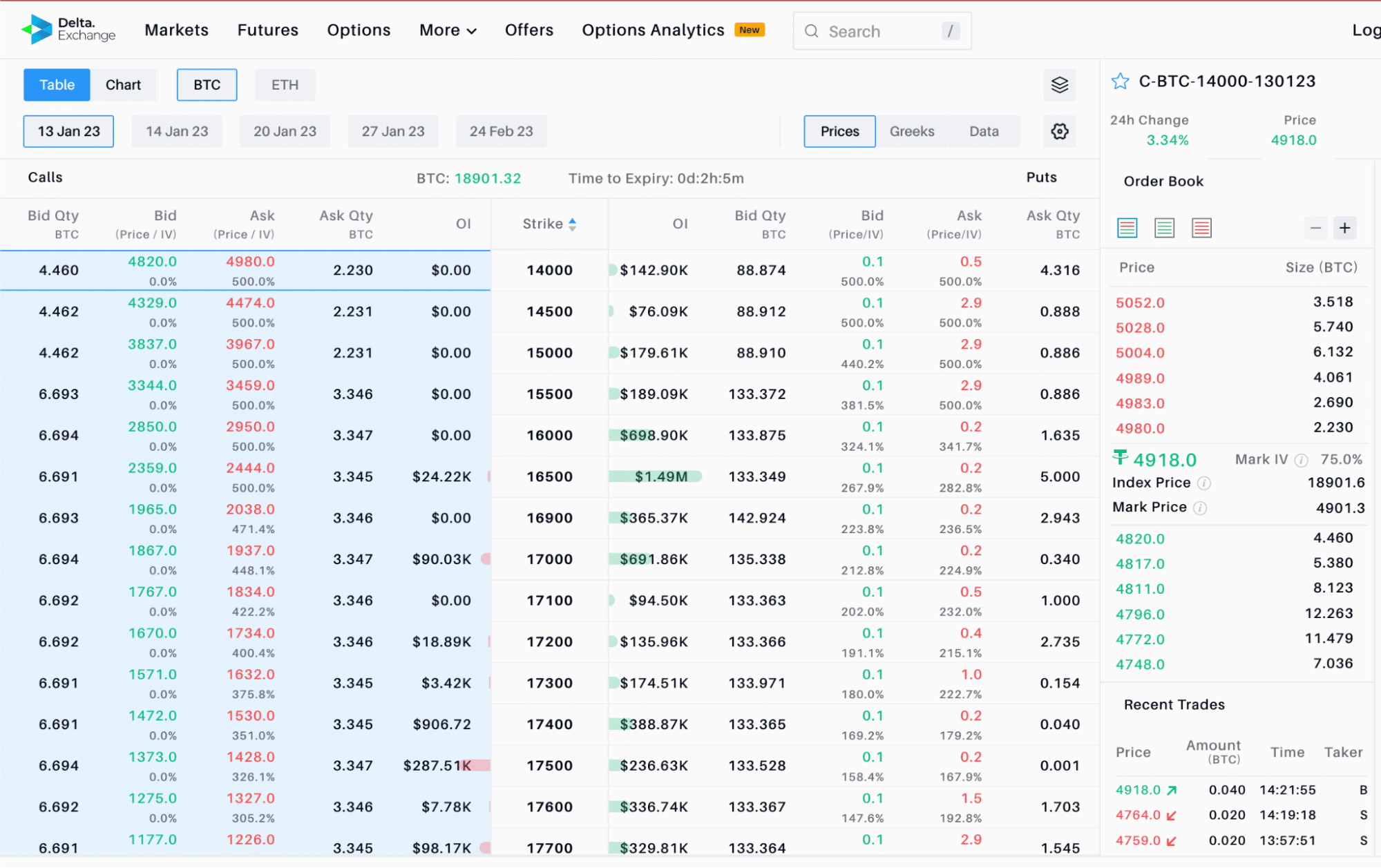

An option chain on a platform is essentially a comprehensive list of all options for a certain asset (such as a chain of Bitcoin options) – both call and put options. An option chain can be a useful tool to determine which direction a crypto’s price might move into next. An option chain can further help to root out any particular points where higher or lower levels of liquidity appear.

What are the components of an option chain?

On an option chain, there are usually four columns – net change, bid, ask, and the last price. Here are some metrics an option chain can give you an idea of:

- Executed price

- Current bid price

- Bid quantity

- Ask price

- Ask quantity

First, a quick refresher of the basics:

There are, of course, two prevalent types of crypto options, which are the call and put options. The call option allows you to buy the underlying asset at a certain point of time in the future at a predetermined price. Meanwhile, the put option allows you to sell the underlying asset at a future date and time at a specified value.

Notably, while both call and put options give you the right to buy or sell a certain amount of the underlying assets, you’re not obligated to carry out the trades.

The ‘strike price’ of an options contract is the value at which the counterparties agree to exercise a call or put option. The strike price is also called the exercise price.

A call option is considered in-the-money if the current market value of the underlying asset is over the strike price, and in the complete opposite case, it is considered out-of-the-money. Similarly, a put option is in-the-money if its current market price is below the strike price, and it is out-of-the-money if the strike price is below the current market price.

Now – how to read an option chain?

Here are some things you need to know to read an option chain:

- Usually the order of columns in an option chain goes like this: strike, symbol, last, change, bid, ask, volume, and open interest.

- The strike price is the predetermined price at which an option contract would be settled.

- Each option comes with its own symbol; these symbols vary depending on underlying assets and expiry dates.

- The last price shown on an option chain is the most recently posted trade, and the change column shows the difference between the last trade and the closing price seen on the previous day.

- The bid and ask columns show the prices at which respectively the buyers and the sellers are ready to trade at a certain point of time. Negotiations happen between both parties until the bid and ask prices get closer.

- Some options might have a big difference between their bid and ask prices, we can assume these are the ones that do not trade a lot. These options carry higher risks than those with closer bid and ask prices.

- The volume column shows how many options are traded on a certain day.

- The open interest column shows how many of the options listed are outstanding; open interest is the number of options existing for an asset. The higher this number, the more interest investors are showing in an asset. Open interest is an especially important column, as it shows higher liquidity.

The significance of an option chain

An option chain is very important for the following reasons:

- They allow you to take a look at the in-the-money and out-of-the-money options at any given moment.

- It allows you to evaluate the depth and liquidity of certain strikes.

- An option chain is a good tool to warn you against any sharp moves.

- An option chain brings a good view of the economic Straddles and Strangulations at different strike prices.

What are some uses of option chains?

What are option chains used for? They are useful for a number of reasons, namely:

- Option chains give a precise overview of the options market for a particular crypto at any given moment.

- They can help you formulate a solid option trading strategy at different strike prices.

- They can help predict a particular crypto asset’s future price directions.

- They can provide warnings ahead of sharp price movements.

- They can help you determine the level of liquidity for an options contract.

Conclusion

We do hope this post has helped you grasp the notion of an option chain better! If you are interested in crypto options trading in India, do give our website a visit today!

FAQs

Q. What is an expiry date for a crypto options contract?

A. The date of expiry is when the two counterparties in an options contract agree to settle said crypto option. The closer an option is to expiry, the more value it loses.

Q. What are call and put options?

A. A call option is a crypto options contract that gives you the right to buy the underlying asset, and a put option is a crypto option that gives you the right to sell the underlying asset.

Q. How can you read an option chain?

A. Usually the order of columns in an option chain goes like this: strike, symbol, last, change, bid, ask, volume, and open interest. With the information these columns provide, you can learn about premium (the upfront fee you a buyer has to pay for an options contract), volume, open interest, and various other factors in relation to an options contract.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter