Educational

February 25, 2024

What is Long Short Ratio and How to Use it for Crypto Futures Trading?

Shubham GoyalProduct Specialist

Over 420 million people own crypto in the world right now, and crypto is, without a doubt, the talk of the hour for investors. The best part of the asset class is that while you can do some straightforward spot trading, you can also get up on platforms like Delta Exchange to trade in crypto derivatives- the likes of crypto futures and options. And if crypto futures is your cup of tea, for instance, you would need the knowledge of the long short ratio to cash in on the instrument just right.

What is the long to short ratio? The understanding begins at knowing the answer to ‘what is long position and short position?’

What is Long Position and Short Position?

You may have heard terms like ‘shorting Bitcoin’ used by traders before. Crypto long and short positions are essentially opened based on the direction you expect the market to go in when you buy a futures contract. Hopes for price increase lead to a long position and short position is opened when you expect the price to go down.

For a better understanding, you can think of crypto long and short positions as respectively buying and selling a crypto. You may see more long positions when most traders hope for a bullish market, while more in favor of short positions can mean the majority expects prices to go down.

Here’s a quick look at long position vs short position against each other:

| Long Position |

Short Position |

| In the crypto futures market, getting into a long position is equivalent to buying a crypto in the spot market in hopes of its prices going up in the future. |

On the other hand, out of long and shorts, a short position is akin to selling a crypto because you think its prices will go down. |

| Out of long position vs short position, the potential profit in a long position is unlimited, as the price of the crypto can theoretically increase indefinitely. On the other hand, the potential loss is only limited to the initial investment. |

Out of crypto long and short positions, the potential profit in a short position is limited to the initial value of the cryptocurrency, but the potential loss is theoretically unlimited. This means if the price rises significantly, short sellers would face substantial losses. |

What is the Long Short Ratio in Crypto Futures?

You may have an idea already, but the long to short ratio basically shows the strength of bullish or bearish feelings in the market. It is one of the sentiment analysis indicators regularly checked by both rookie and pro traders to gauge how the broader market feels about a certain crypto.

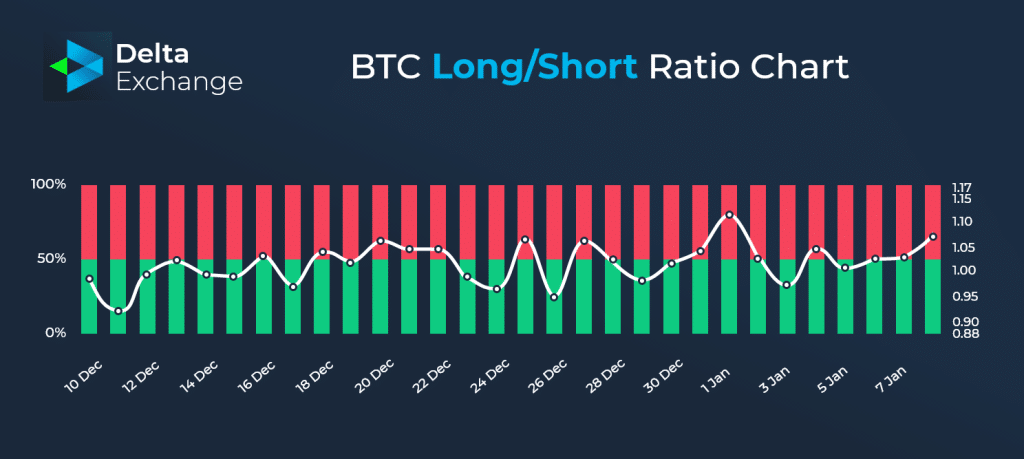

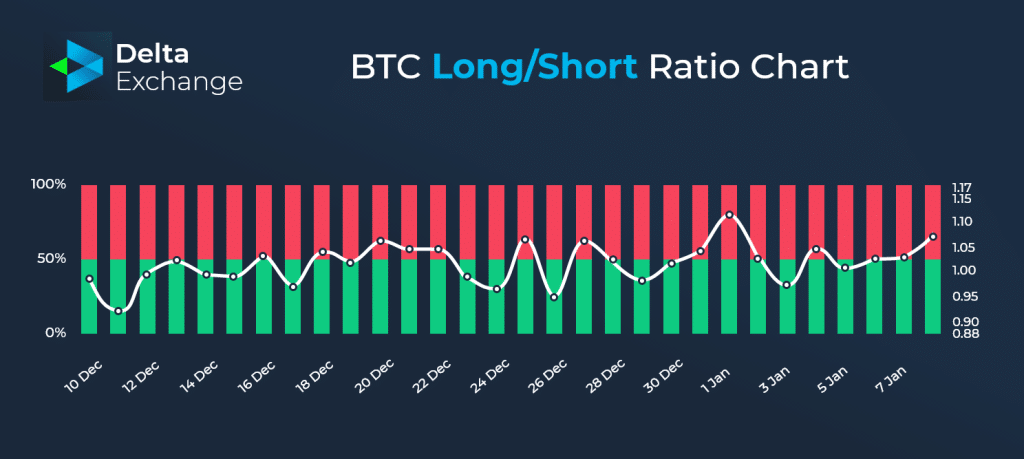

If you take a look at the figure above, this is what a typical long to short ratio chart looks like. If you look carefully, in terms of shorts vs longs, there are some 24 hour candles with more green, while some are more red. The more red candles show a day with bearish sentiments as per long to short ratio reading, while the more green candles show a bullish day as per long short ratio.

As you can see, due to various macroeconomic factors, the broader market sentiment shifts everyday, resulting in shifting long short ratios as well.

The significance of the long short ratio is high for crypto future traders:

- A long to short ratio above 1 stands for bullish sentiments, while a long short ratio below 1 shows dominance of the bears.

- You may argue that a majority vote does not automatically imply they are correct, and you’d be right, because in many cases wrong opinions spread massively because of FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt). However, even when you use other technical indicators to more precisely gauge the future of the market, you must take the long short ratio into account for the short term. This is because public sentiment is in large part responsible for affecting a crypto’s prices as the value of digital currencies depends on their perceived value by the users in the absence of a centralized backing.

How is the Long to Short Ratio Calculated?

Shorts vs longs are compared to arrive at an accurate long short ratio; the number of long positions is divided by the number of short positions. So if there are 30 long positions compared to 15 short positions, the long to short ratio will be 2.

Evaluating the number of long position vs short position, a long short ratio above 1 signifies more long positions in the market, while a ratio below 1 means there are more short positions. The first event shows positive sentiment, with the latter showing negative emotions.

To conclude, the long to short ratio can help a crypto futures trader gauge the percentage of crypto long and shorts for a certain historic period, and evaluate the history of a crypto accordingly. Knowing public sentiments can give you a good insight into market trends.

However, as always, do not rely on this single indicator to tell you about the crypto market, and expand your research across several technical and fundamental indicators to understand the potential of a crypto before you make a futures trade.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter