Educational

August 15, 2020

All You Need To Know About Trading Crypto Options

Shubham GoyalProduct Specialist

The financial world can be full of jargon that may overwhelm a novice at first glance. The complicated terms and unheard words might induce fear and keep you at bay. But there is absolutely no need to worry. The underlying concepts are much easier to understand and partake. One such popular jargon is ‘options trading.’ In this post, we hope to offer you satisfactory answers to questions like What is a cryptocurrency option? And what is options trading?

Let’s get started.

Understanding Options Trading

Options are a type of derivatives contract. Now, what are derivative contracts? Derivative contracts derive their value from an underlying asset like equity, real estate, or other. Since here we are considering cryptocurrency options, the underlying asset in consideration is a cryptocurrency.

Cryptocurrency options give the holder ‘the right but not an obligation’ to either sell or buy a cryptocurrency at a pre-agreed price on or before a set date. Now there are two types of options, call option and put option:

- A call option will give the holder a right to buy a cryptocurrency at the strike price.

- On the flip side, a put option will give the holder a right to sell a cryptocurrency at the strike price.

The strike price is nothing but the predefined price of the cryptocurrency set while formulating the options contract. The day when the holder decides to execute the option is called the trade date. Also, the day at which the option is finalized is the delivery/settlement date.

Let’s check out the meanings of other terms associated with options trading.

Premium: This is the price you pay to own an option. In other words, it’s the price of the contract. The premium is influenced by all the factors associated with the options contract – the underlying asset, its future potential, etc.

Maturity: It is the last date by which an option needs to be exercised (call or put) before it expires.

Now, how can trading options be an advantageous sport for the discerning crypto trader?

Advantages of Cryptocurrency Options Trading

- Traders can make a lucrative profit on a highly volatile entity like cryptocurrency. Let’s check out how:

Say you purchase a put option at a certain price. Now, suppose the price of the underlying cryptocurrency falls. Now a put option will give a right to you – the holder – to sell the cryptocurrency at the already predetermined price, dodging any losses.

Similarly, suppose the price of the underlying cryptocurrency shoots up. Now a call option would have given the right to the holder to buy the cryptocurrency at an already predetermined price, which would be lower than the existing price in this case. The holder will make a remunerative profit on the trade.

- Trading cryptocurrency options aids holders in hedging financial risks from any ungauged future event.

- In their own ways, trading crypto options can be far more advantageous than trading crypto futures. They are one of the most flexible financial instruments where you can implement sophisticated strategies. With the right strategy in your hand, you can milk exciting profits out of crypto options trading.

Where Can You Buy Crypto Options?

Cryptocurrency options can be bought from a cryptocurrency derivatives exchange. These exchanges will charge you a certain fee on the trade made. Also, you will be subjected to certain limits applied by the exchanges.

Another medium from where you can buy crypto options is through a publicly regulated exchange. These exchanges, unlike cryptocurrencies, work under the regulation of an overseeing body.

Popular Crypto Options Strategies

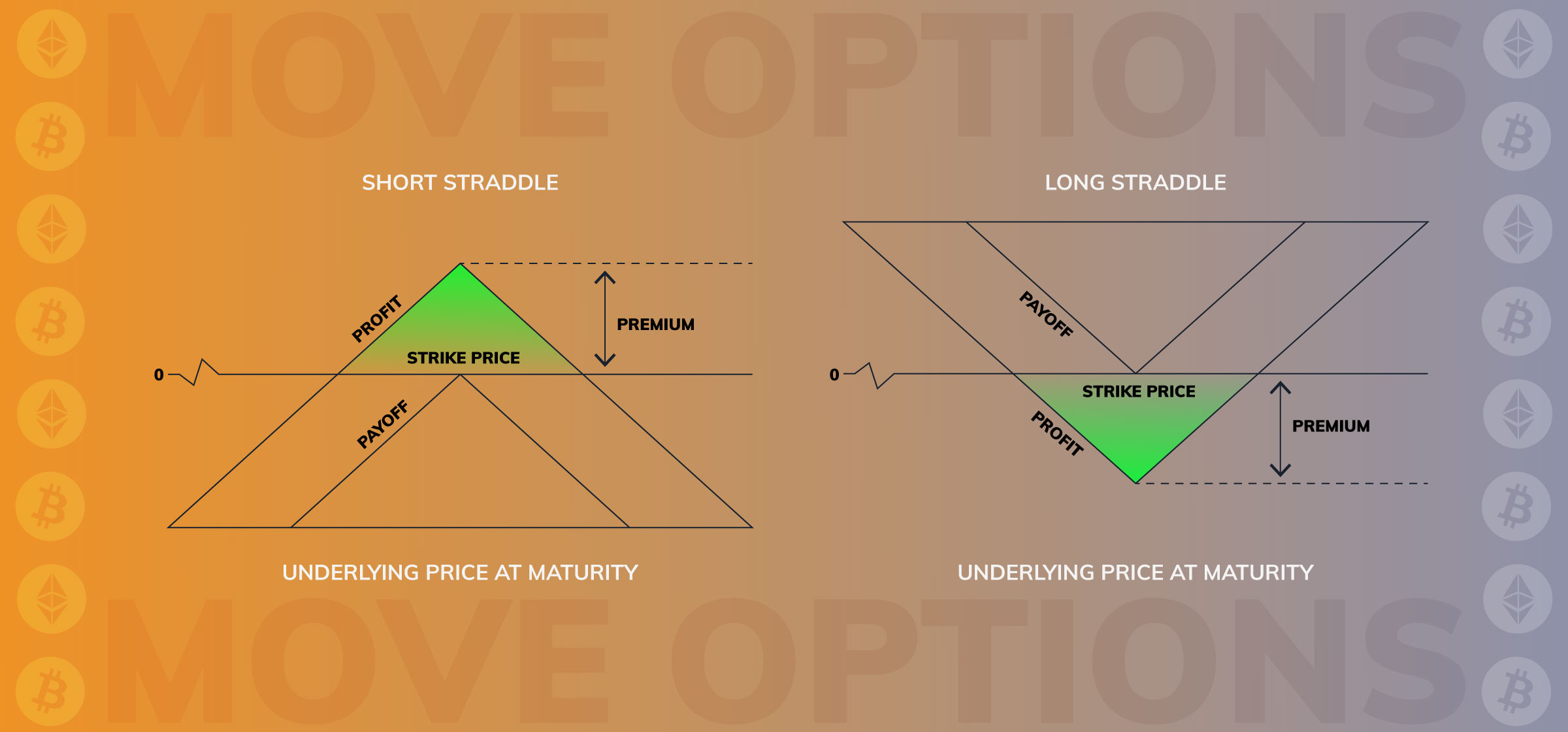

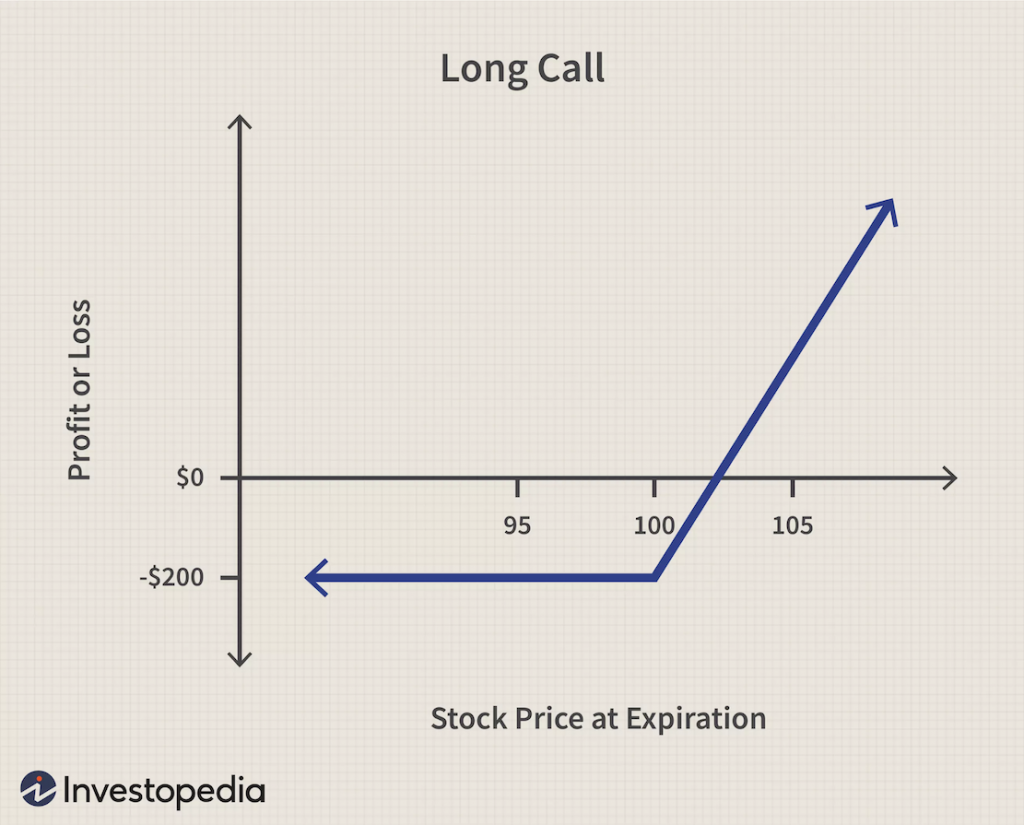

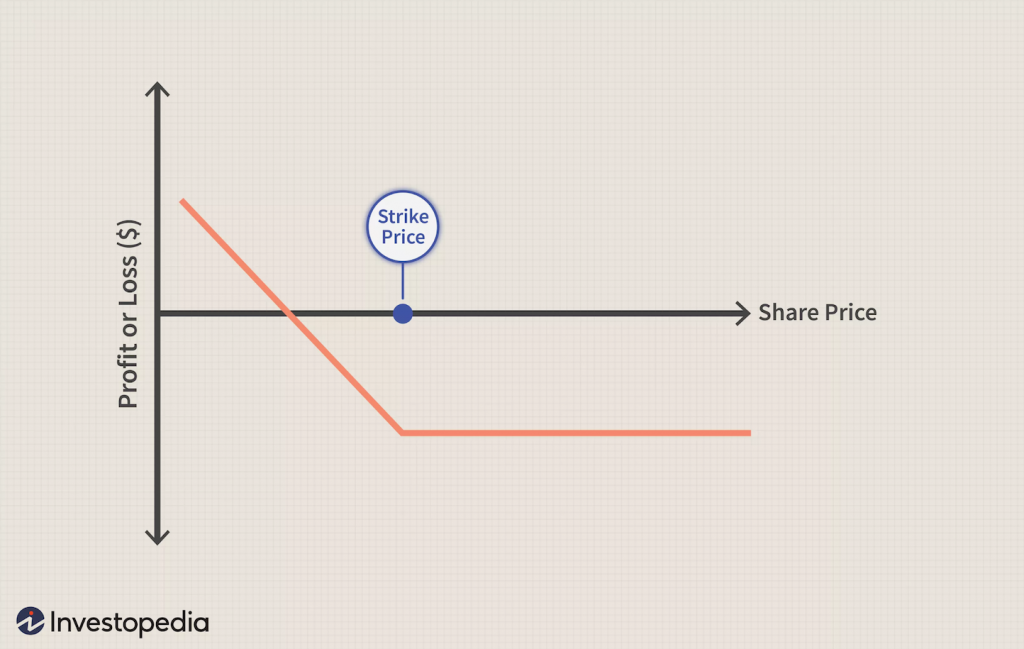

Options strategies are designed in such a way that an investor either makes a profit on the volatility of the underlying asset or hedges this risk. Let’s check out a few popular options strategies, with images courtesy of the very reliable and high-quality Investopedia.

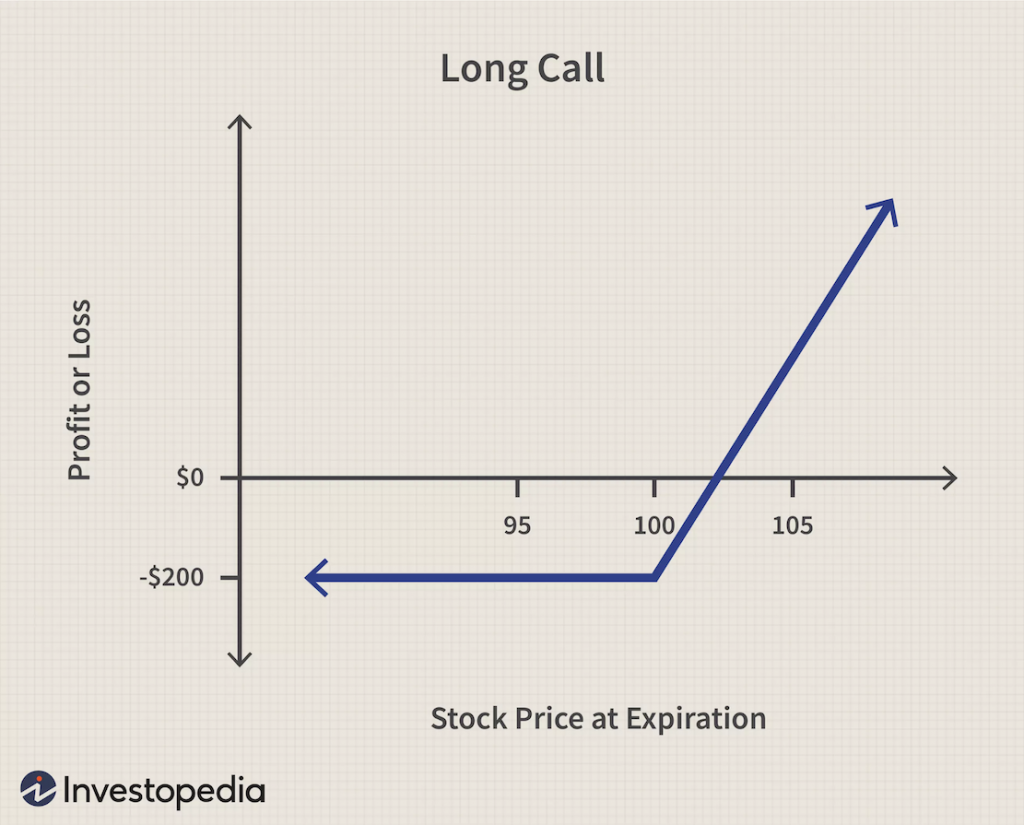

- A long call is an investment strategy when an individual takes a bullish stance and purchases one or more call options. Here the potential of profit is theoretically unlimited if the prices go up.

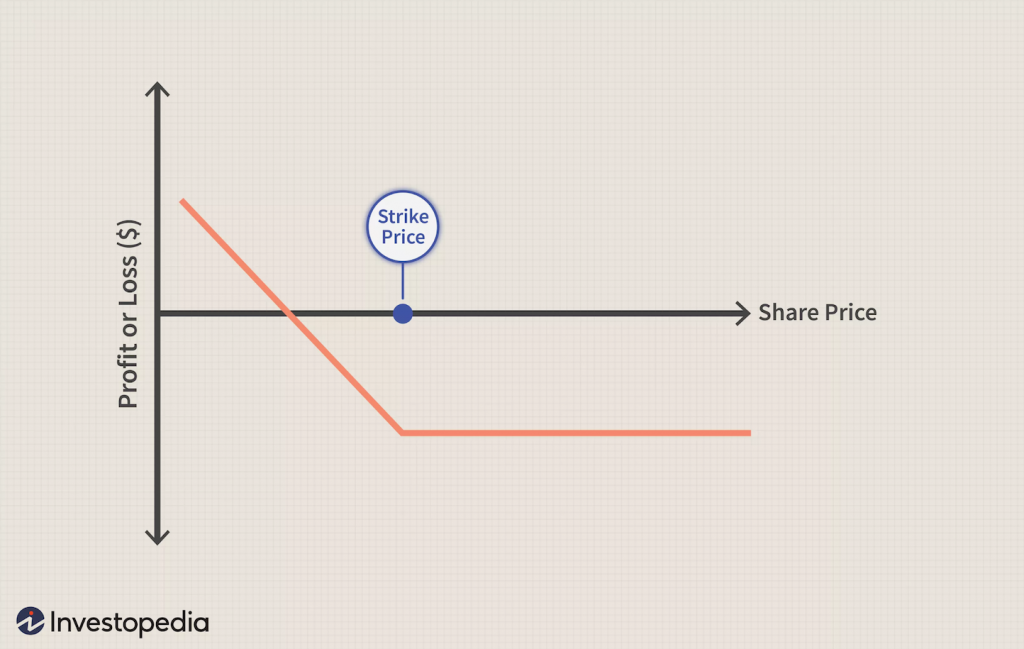

- A long put strategy is when an individual takes a bearish stance and purchases one or more put options. Here also, the profit margin is unlimited, depending upon the degree to which the price of the asset falls.

- A collar strategy is a protection strategy where an individual takes a neutral stance and sells one call option and simultaneously buys a put option. If the strategy pays off, the profit made lies between the call strike price and the asset’s current price.

- A long call/short put spread is a vertical strategy where an investor makes a profit based on probabilities. In a long call spread, an investor purchases one call and sells another call at a higher strike price with the same expiration. In case of a short put spread, the investor sells a put and purchases a put at the next lower strike price of the same expiration. If all goes as per the speculation, then the premium received is the profit of the investor.

What to Keep in Mind While Trading Crypto Options

- Since there are few mainstream crypto exchanges that support options, it is paramount to first list together with all the exchanges that offer options trading opportunities. Now weigh them on critical parameters like types of the options provided, their credibility, transaction fees, customer support, and other such key attributes associated with the exchange and trading.

- The maturity, strike price, and premium of the option are critical. Your defined period till which you can exercise an option should not be very lengthy or too short. This can make you lose money on the premium paid, or via the lack of liquidity. Choose a crypto option after carefully examining the strike price and the market.

- While you can’t accurately predict volatile assets like cryptocurrencies, the time you spend researching is sure to offer you an advantage. Research the underlying cryptocurrency thoroughly before indulging in trading crypto options.

Crypto options trading remains an unexplored segment owing to its often mistaken complexity. But now you know how simple trading crypto options are, when are you getting started?

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter