Educational

July 3, 2021

What is Tokenomics?

Shubham GoyalProduct Specialist

2020 has been dubbed the year of the DeFi, and yet the crypto bull run has kept new, innovative crypto tokens and exciting DeFi projects coming to the limelight. DeFi, just in case you didn’t know, stands for decentralized finance, a movement within the crypto space that aims to combine the advantages of crypto with the various products and services of traditional finance and come up with an entire new range of financial offerings.

At the mid-point of 2021, as all these new DeFi platforms keep rolling out, we’re seeing updated or entirely new capabilities, improved tokenomics, and many other exhilarating developments within the crypto sector.

In this electrifying age of decentralized finance, there’s a horizon of opportunities for a crypto user within the DeFi and crypto world. If you’re someone who plans to enter this space and experiment with various DeFi tokens, you must firstly have at least the basics of DeFi down. The various aspects of a DeFi project you must be aware of include tokenomics. What is Tokenomics, you wonder? Well, as the title will tell you, it’s all about the economics of a crypto token.

In this article, we tell you about tokenomics and which particular factors it concerns. But first, let’s get into the absolute fundamentals: what exactly is a token?

What are Crypto Tokens?

In the real world, a token is essentially a tangible, usually small and easy to carry around representation or proof of some sort of qualification, any kind of fact, or even an asset like real estate or precious metals. For instance, your driver’s license is proof of the fact that you’re qualified to drive a car in your country, and again, it’s also a token that can vouch for your identity. Similarly, your membership card for any club can also be a token that states the fact that you have a paid subscription for that club.

Now, the token we’ll be discussing the economics for in this article is a crypto token. In the world of crypto, a token stands for one or several things on its particular blockchain, and it gives its holder different kinds of power according to the ecosystem it represents, such as voting rights, staking powers, etc. Of course, crypto tokens also stand as the common currency on their native blockchains.

What’s important to remember when thinking of crypto tokens is that none of these tokens are limited to one particular role, unlike fiat currency or most real world tokens. It usually plays a number of roles on top of the blockchain it’s native to. Most crypto tokens are distributed to investors through a public sale held by the projects they are a part of, and these investors usually assume various roles on the platforms as part of the respective communities, with various perks that come with the tokens.

Now, What is Crypto Tokenomics Exactly?

Tokenomics is the amalgamation of the words token and economics, as established before. The meaning of Tokenomics refers to the economics of a token or a crypto coin. Tokenomics for a particular cryptocurrency is usually discussed in detail in the whitepaper for the project.

You might still be wondering what crypto tokenomics means. Tokenomics for a token tells you all about the attributes and benefits of it that will convince you, the investor, to buy it and help build the ecosystem of the project the token is a part of. Simply put, any factor that concerns the value of a crypto token is included in its tokenomics. So as you can probably guess, crypto tokenomics actually covers a wide ground and there can be many, many components to it. These components would include the token’s utility, its supply, its structure, etc.

Components of Crypto Tokenomics:

Now that we have the definition out of the way, we’ll get into some of the components that are a part of a crypto coin’s tokenomics.

- The Team: If it’s a credible project offering up the crypto token, there should definitely be a team behind it, on whom you can conduct some research should you feel like it. In fact, the team behind a crypto project and their objective is one of the critical factors that can help you determine whether the token in question has any chance of succeeding and seeing broad adoption and usage in the future or not.

- The Supply of Tokens: One of the primary things to know while deciding the potential and implications of a crypto token is the supply of it – such as the circulating supply, the total supply, and the max supply. The circulating supply of a crypto token is the number of tokens that are already being circulated, and of course, this number keeps changing constantly. The total supply of a token is the number of tokens that exist at the present moment, not counting any of the tokens that might have been burned. Finally, the max supply of a token is the maximum number of tokens that will ever be minted, like the max supply of Bitcoin is capped at 21 million. In some cases, the max supply of a token is the same as its total supply, and sometimes there’s no limit to signify as a max supply.

All the information regarding the supply of a token should be provided in the tokenomics section of a project whitepaper. Most DeFi projects come out with about 10-20% of the tokens already in circulation, unlocking more of them with time. If the circulating supply of a crypto token is increased by the team steadily, there’s a good chance the value of the token will go up over time. However, you should keep in mind that a torrent in the circulating supply can have the opposite effect, and drown the token’s value.

- The Allocation and Distribution of Tokens: The first order of business, when it comes to the distribution of tokens, is to know whether the token is pre-minted or if it’s a fair launch. A fair launch is when a cryptocurrency is only mined by the community as a whole, like the OG crypto Bitcoin. On the other hand, pre-minted tokens are the result when a small collection of people mint out a few of the tokens before they are made available to the broader community or a public sale.

Now, most of the DeFi projects we see today have pre-minted tokens, as mentioned before, so it’s not that you have to mistrust every platform that comes with pre-minted tokens. All you have to do is make sure the distribution is fair before you join in. Indeed, one of the significant things the tokenomics of a coin should let you know is how exactly it will be distributed after the initial public sale. The details regarding the distribution of a token should be provided in the project whitepaper.

One more thing you should check is the lock-up period on the portion of tokens kept aside for the project’s team and advisors. This is because the project founders and the creative team behind it, who will remain interested in the project in the long run, usually have a longer lock-up period than an average investor.

You should be aware that if a project distributes their tokens to as many users as possible, there’s a good chance it’s legitimate. And if there are large accumulations by any particular addresses, know that you run the risk of these whales releasing their holdings and bringing down the price of the token. In fact, with fair launches too, you have to look into the token distribution across addresses, to see if there’s large accumulations recorded.

- Market Capitalization of a Token: This component of tokenomics shows the total amount of the funds that have been invested in the crypto project a particular token belongs to. Why should you be aware of a token’s market cap? Well, combined with the supply information of said token, it can tell you a lot about the future of the token.

For instance, the higher a token’s market cap and the lower its circulating supply, the more valuable the token will potentially be with time. A good example of this would be Yearn Finance, which has a pretty high market cap combined with a low supply, and this has resulted in a high price of the token.

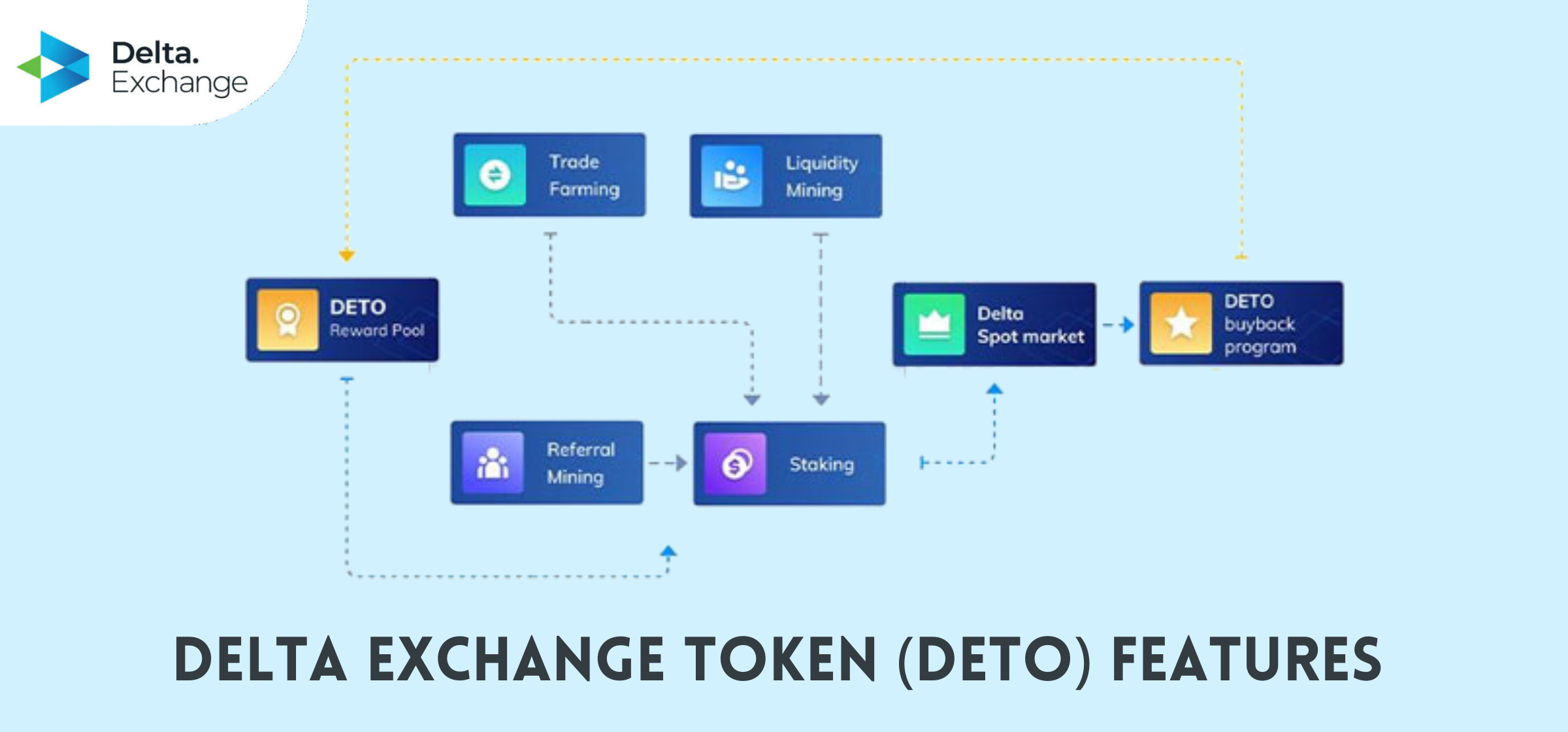

- The Utility of a Token: Now, this is probably the most critical information a project’s tokenomics should offer up. A token’s utility plays a major role in maintaining and driving up its price in the market. A crypto token, as we now know, can cover a broad area; it can go from being a store of value to serving as the medium for fees payments, distributing voting rights, giving holders staking powers and even acting as reward for liquidity providers and other deserving community members. The more the utility of a crypto token, the more established it could potentially be in the future.

A good example of this is Ethereum, the blockchain platform that’s at the core of DeFi at the moment. The price of ETH is driven largely by its utility. Plus, Ethereum is the preferred platform for dApp (decentralized application) developers. So, since ETH is primarily used for paying network fees, it has a high value, and holds the second position in the crypto markets as per market cap.

Some more things you should check while looking into a token’s utilities: does it have any real-world utility? And is the project entirely dependent on the token? If the answers are yes, then you should definitely consider investing in the project.

- The Token Structure and Token Flow: Last but not the least, do get information on the structure of the token and how it suits the objective and goals of the project it’s native to. To understand the structure of the token, you’d also need to find out about the token flow. Both of these, again, you should find in the tokenomics section of a project’s whitepaper.

In conclusion, while finding out about a crypto coin’s tokenomics, here are some questions you should absolutely be finding answers to:

- How does the project intend to develop a stable ecosystem?

- How exactly does the project intend to sustain said ecosystem in the long run?

- How many of the tokens currently exist?

- How many tokens will exist in the future?

- Is there some coin set aside for the team and advisors? If yes, how many?

- How are tokens being generated and coming into the ecosystem?

- How are tokens leaving the ecosystem?

- How are investors and participants being incentivized by the project to give the project the best of their abilities?

Why Should You Care About Tokenomics When Investing in Crypto?

The factors that make up the tokenomics for a cryptocurrency are extremely vital for you to know, since they will surely impact your investment and the kind of profits you are expecting. Tokenomics is important mostly because it will tell you what a crypto token’s worth might be in the future. Once you can determine that, it will be easier for you to decide which crypto coin out of the many within the DeFi space is most likely to remain reliable in the future, and which one you want to put your faith in.

And there was all you need to know about what is tokenomics! We do hope you found this post helpful!

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter