Educational

December 3, 2019

Crypto Traders’ Guide: Know When to Take Profit. Know When to Cut Losses.

Jitender TokasChief Business Officer

“Every trader knows

That the secret to survivin’

Is knowin’ what to throw away

And knowin’ what to keep”

Trading discipline is what set great traders apart from good ones. You may spend hundreds of hours learning the charting, technical and fundamental analysis, but you would not be able to make money on all your trades. Losing trades are part and parcel of the game. In this backdrop, it is trading discipline and prior planning that will determine the overall profitability of your trading endeavours.

As easy as it sounds, being a disciplined trader is actually quite hard. All humans, including traders, have a propensity towards making bad decisions due to psychological biases. These biases are a result of fundamental human emotions like fear and greed. For e.g. ‘cut losses short and let winners run’ is a well-known adage in trading circuits. Intuitively it makes sense to everyone, but most traders struggle to implement this rule in practice. This is due to the loss aversion bias. Traders are averse to closing a losing trade because that will result in crystallisation of the loss. Instead, traders hold on to the losing trades in the hope of recovery. Similarly, traders book profit on their winning trades too early lest the market turns and their profit vanishes. You can read about various psychological biases that can impact your trading in this blog post.

Managing Risks of your trading

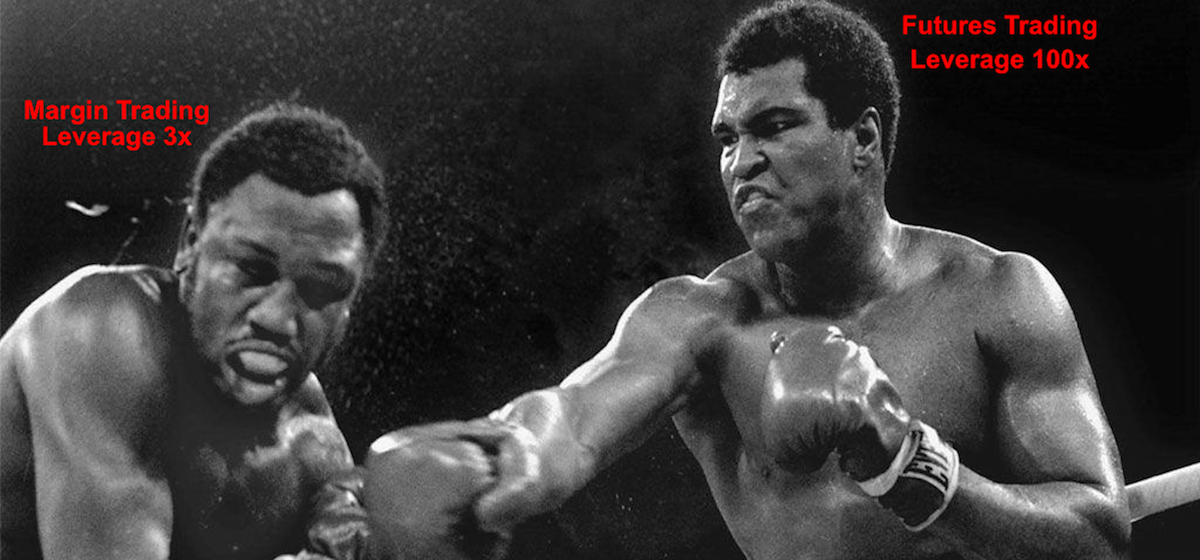

Risk management techniques are a set of tools and ideas that can help you trade with discipline. And, when you trade with discipline, you might still lose some battles, but you will likely win the war. Below are some of the key ideas in risk management that you must understand and practice:

- Allocate only part of your capital for a single trade: Betting the farm on a single trade might result in a home run or end your trading career. In the long-run, such risks usually lead to unfavourable outcomes.

- Size positions based on risk-reward assessment: Before getting into a trade, think about your conviction levels and your odds of making the right trade. And, then size the trades according to your assessment of the odds.

- Always set take Profit (TP) and Stop loss (SL) levels: Setting TP and SL levels not only help you plan ahead but also keep you disciplined and not give in to fear or greed.

In this article, we will only focus on setting take profit and stop loss levels and cover other risk management techniques in subsequent articles.

How to set up stop-loss levels

A trader should place a stop-loss at a logical level, where the trader would know that his trade thesis did not play out and he was wrong about the market’s direction. Stop-loss setting can be informed by key support levels too. Simultaneously, the stop-loss level should not be set so tight that it gets triggered due to normal market fluctuations.

Stop-loss levels also impact position sizing decisions. Let’s say a trader with a $100,000 trading capital (i.e. $1 million max position size at 10x leverage) doesn’t want to lose more than 1% (i.e. $1000) of this portfolio in a single trade. This means that for trades where potential loss can be high, the position size needs to be small. So, if the stop-loss level is 5% away from entry-level, the max trade size can be $20,000. Conversely, for trades where the potential loss is small, position size can be increased. So, if the stop-loss level is 2%, the max position size can be $50,000.

How to set up take profit levels

Once a trader has decided the entry point and stop-loss level, the next step is to decide when to take profit. A common strategy followed across several markets is to use the risk-reward ratio to determine the take profit levels. This is how it works:

(a) the stop-loss level is 2% away from entry price,

(b) the trader likes to have a risk-reward ratio of 1:3,

(c) so, he sets the take profit level 6% away from his entry price. This is a rather arbitrary way of selecting a take profit level.

Instead, a trader should determine to take profit level independently by looking at important levels from technical analysis or chart patterns and/ or insights about the general market, overall traders’ sentiment and positions. The levels that can be used to set take profit include key resistance levels, important moving average numbers (e.g. 100-day moving average), pivot points or Bollinger bands.

Once a trader has independently determined take profit and stop-loss levels for a trade, he can compute the risk-reward ratio. He can then take the decision to enter into the trade on the basis of this computed risk-reward ratio.

How to use trailing stop-loss to enhance your profits

Unlike a stop-loss which is static, a trailing stop-loss is dynamic. A trailing stop-loss moves in tandem with the price when price moves in the direction of the trade. And, when price moves against the trade, the trailing stop-loss doesn’t move.

The result of this behaviour is that stop-loss level is always relative to the price at which a trader’s profit was highest, instead of his entry price. This dynamic adjustment of stop-loss level allows a trader to capture/ keep upside from a trade while keeping the downside same. Due to this reason, a trailing stop-loss is also known as profit protecting stop.

Let’s take an example here. A trader goes long BTC at $10000 and set a trailing stop-loss at -1000. The table below shows how the trailing stop-loss for this position will move as BTC price moves.

A trailing stop-order can be used without a take profit order. This would work quite well in strongly trending markets as the trailing stop will continue to move with the market and will close the trade when the trend reverses.

Using Bracket Orders for setting take profit and stop loss levels

In a typical setting, a trader places take profit and stop-loss orders after he has entered into a position. Moreover, there is no linkage between these two orders, which means if the take profit order is hit, the trader needs to manually cancel the stop-loss order. Bracket orders address these issues.

A bracket order is a pair of two orders: a take profit order and a stop-loss or trailing stop-loss order. Both these orders are linked to either an open position or an open order. This means that a trader is able to specify his take-profit and stop-loss levels at the time of order placement. Moreover, if one of the orders in a bracket order gets executed, the other one is automatically cancelled. Due to this feature, bracket orders are also known as one-cancels-the-other. Given these properties of bracket orders, they are the ideal order types for setting take profit and stop-loss orders. Delta Exchange is one of the few crypto exchanges to offer bracket orders. You can read on how bracket orders at Delta Exchange work here.

Final Thoughts: Stick to the process

Trading is the business of taking a risk. And, if you are to succeed in this business, you have to know how to assess, analyse and manage risk. The strong is a trader’s risk management, the longer he is likely to survive in trading and the more profitable his trading likely to be. Defining and setting take profit and stop-loss levels are the fundamental part of any trader’s risk management strategies. All traders must cultivate the discipline to enter trades with a plan and then have a process for managing the open position according to the plan. Trading success comes to those who are deliberate, meticulous and disciplined.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter