Educational

July 12, 2021

Guide to Swing Trading in Cryptocurrency

Shubham GoyalProduct Specialist

Trading cryptocurrencies require knowledge of basic trading strategies and methods. Any trader should have the understanding that the crypto market, just like other trending financial industries is quite volatile, and therefore one must be cautious when interacting with them.

There are a handful of trading strategies in the cryptocurrency world. Some of them are popular while others are too complex for a newbie trader. Day trading, swing trading, and trend trading are some of the most known trading strategies. The difference between these strategies varies but the most observed difference is the time factor.

In this article, we are going to explore the strategy of swing trading and how it applies to the crypto sphere. Probably, you’d be able to determine if it would be a useful strategy to you or not.

What is Swing Trading?

Swing trading is a strategy that involves traders holding a position within a medium time frame. This position is dictated by the conclusions made from fundamental analysis over the Moving Average Convergence Divergence (MACD). A swing trade might go above 24 hours or even a few weeks for a trade to attain the expected point a trader has in mind. In essence, swing trading contrasts with day trading as it takes quite a much longer time before a trade is completed.

This strategy is not so different from day trading as both are focused on clinching a chunk of the price movements of a digital asset. Just as mentioned earlier, the major difference is the time frame. If a trader successfully predicts the price pattern of a cryptocurrency over a specified period, they profit from that trade and move onto the next one. Unlike day traders, swing traders achieve their expected points by leaving their positions open for days, weeks, but not longer than a month.

Swing traders depend on both technical and fundamental analysis to make their predictions. The ratio of swing trades is dependent on the risk or reward that a trader would expect to see. After careful analysis and the examination of the trading pattern of a crypto asset, traders place their swing trades at the most appropriate time and place their stop limits.

How to Earn Using Swing Trading

The approach to swing trading is an attempt by traders to capture momentum swing in the trend of a cryptocurrency. Swing traders should be able to detect when they’d be an upswing momentum on a medium scale, then enter the market at the right time, exit after the trade is completed, or when the cryptocurrency takes an adverse turn.

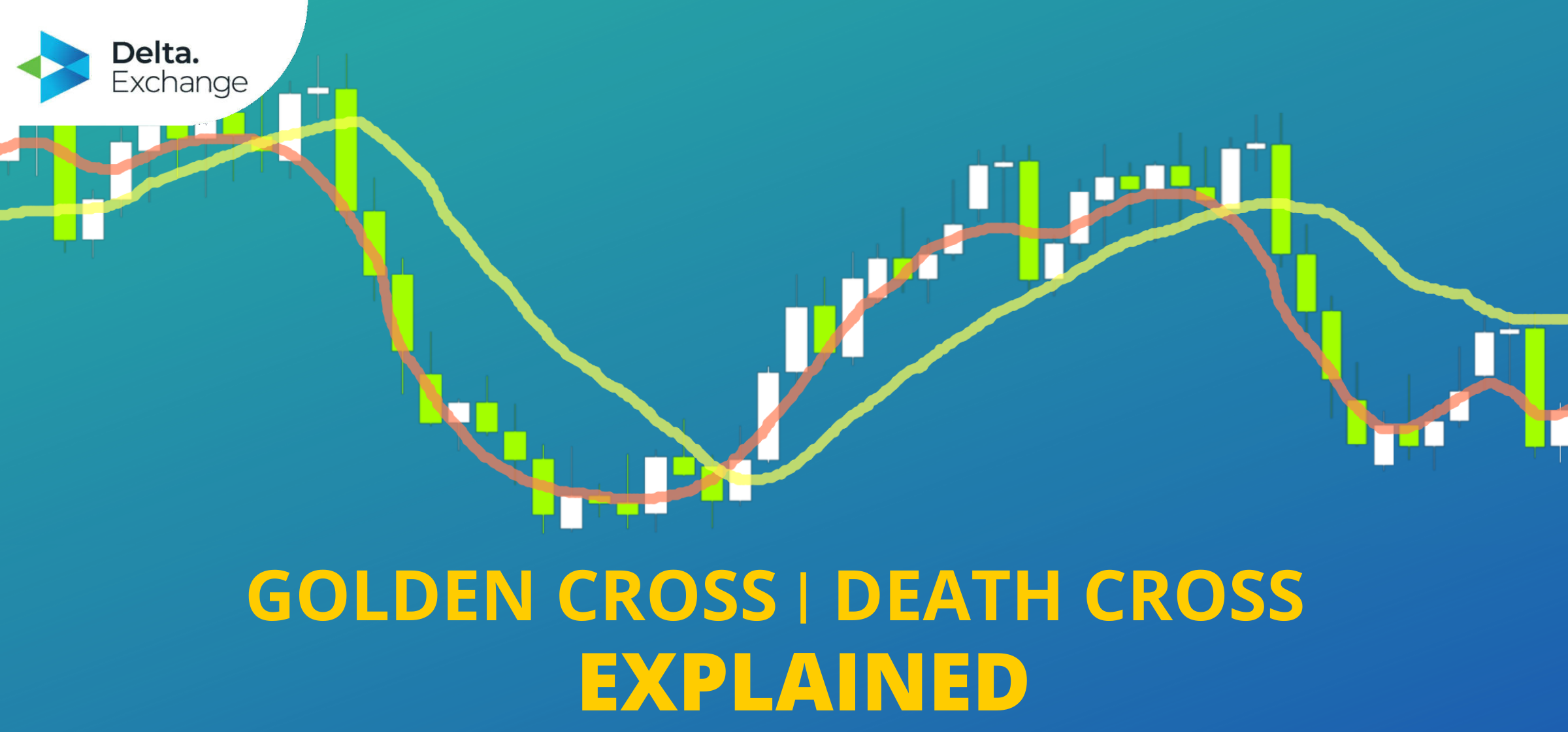

Simply put, swing traders maximize the market and make profits by buying and holding a crypto asset for a long or short period. A professional swing trader uses a wide variety of tools to come up with a swing trading setup to earn from the volatility of the crypto. Technical and fundamental analysis are the basic framework for traders. However, they can also draw trade conclusions by judging the price action of an asset, as well as the candlestick chart patterns in a one-hour, four-hour, or twelve-hour time frame. Tools like moving averages, the relative strength index, the Fibonacci retracement tool, and a host of others function as the major indicators for swing traders.

Using the swing trading strategy, there are simple approaches that swing traders fondly use. A swing trader can implement the ‘catch the wave’ approach which entails entering a trade after a pullback or the ‘stuck in the box’ approach which is simply trading above the resistance/support level of crypto.

Advantages/Disadvantages

Similar to other trading strategies in connection with the financial market, there are pros and cons involved in swing trading which a trader ought to be aware of before diving in.

Advantages

- More Convenient Time Frame: Unlike day traders, swing traders hold their positions for longer periods and are therefore more flexible to engage in other activities while expecting their trades to hit the desired targets. This is because the trader has done sufficient research and analysis which when implemented accurately does not require them to watch intraday trading patterns.

- Riding the Volatility: Swing traders are better beneficiaries of the volatility of a crypto asset. This gives them a better edge to make short-term profits and even gain from the start of a short bullish break which most day traders might miss.

- Focus on Fewer Assets: A swing trader is only bullish on a few assets and does not have to switch focus hastily to other cryptocurrencies like day traders. They can switch after completing a trade(s) but with greater caution and the benefit of more time to observe the asset in question

Disadvantages

- Higher Risk Probability: Swing traders are more at the mercy of the market as a cryptocurrency can take on a different trend overnight. Since swing traders rarely trade intraday, their trades are prone to higher risk, unlike day traders who stoutly monitor their trades.

- Overlooking Longer Potentials: Swing traders are mostly concerned with making profits on a medium scale. Once their trade is completed, they tend to exit the market and might miss out on longer bullish breaks likely to occur after, thereby limiting their profits.

- Experience and Timing: To successfully swing trade, a trader is required to make conclusions based on expertise and knowledge of potential trends as well as understanding when to enter and exit a trade. A trade might be liquidated if a trader lacks experience or enters at the wrong time.

Conclusion

Trading cryptocurrencies is quite an adventure and there are many approaches to maximize this sector of the financial market. Swing trading is a popular trading strategy that enables users to profit from the crypto market while spending only a limited amount of time.

However, traders are expected to be knowledgeable and must grasp the concept of potential volatility in the market. This would aid them to take on a creative approach that suits the factors that affect them like timing, experience, and capital. Whichever way, trading is a speculative venture, one can also use a demo account to try out diverse strategies.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter