Educational

June 10, 2021

Golden Cross and Death Cross Explained

Shubham GoyalProduct Specialist

Technical analysis, brought into the traditional financial markets largely by journalist Charles Dow, is the method of using past market data to predict the future of a particular asset or the market as a whole. The basic theory of technical analysis is that when it comes to market trends, history repeats itself. So when an asset is following a trend, there’s a good chance it’s only repeating a trend it has followed in the past. Traders using technical analysis utilize special tools called technical indicators to perform the analysis on an asset of their choice.

It’s only recently that traders and investors have started using technical analysis in the crypto market, to figure out when to enter the markets for a profitable trade. Golden cross and death cross are both terms associated with the technical indicator known as the moving average (MA). So before we get to the part where we explain the golden cross and the death cross, let’s see a little about the moving average.

What is the Moving Average?

This technical indicator is essentially a line on a price chart that works to calculate the average price of a crypto asset during a specified timeframe. The usual time periods traders put in while calculating moving averages are 15, 20, 30, 50, 100, and 200 days; but you can choose a timeframe for your moving average chart according to your trading strategy and objectives.

Now, the golden cross and the death cross. They’re both crossover signals, and they occur when two different moving averages crossover in specific ways. What is meant by the terms, and how do you use them when trading crypto? Read on to find out.

What is the Golden Cross in Crypto Trading?

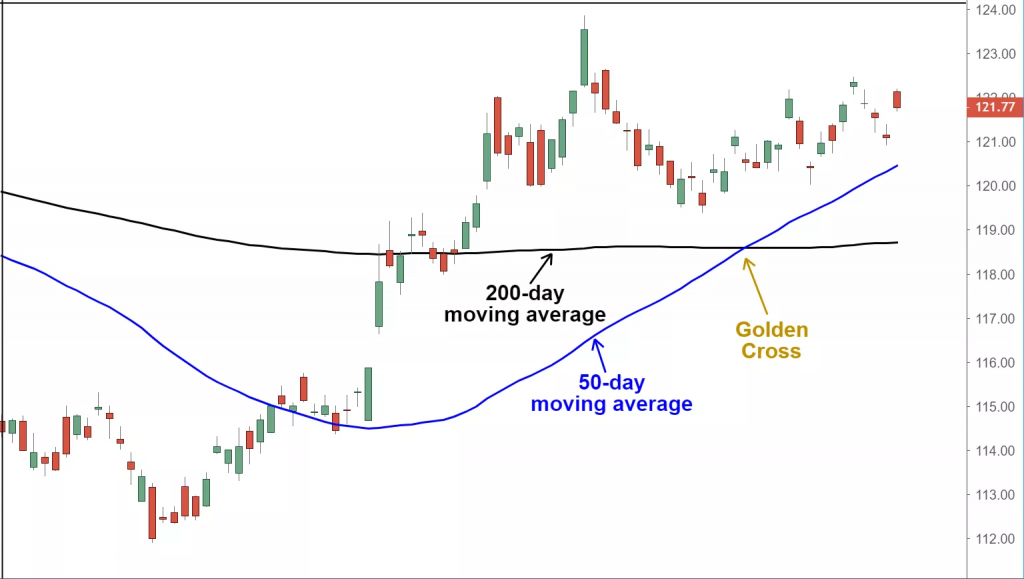

The golden cross is a chart pattern that happens when a shorter-term moving average crosses above a longer-term moving average. Traders take a golden cross as the signal for an uptrend in the market.

Usually, this golden cross occurs in three distinct stages:

- The shorter-term moving average is below the longer-term moving average during a downtrend.

- Once the trend reverses, the shorter-term moving average now crosses over the longer-term moving average.

- An uptrend begins when the shorter-term moving average is above the longer-term moving average.

Conventionally, a golden cross has the 50-day moving average as the shorter-term average, and the 200-day moving average as the longer-term one. However, golden crosses can still happen with any other time frames; as long as the basic concept of a shorter-term average crossing over a longer-term average is maintained. However, it’s important to keep in mind that higher time frame signals are usually more accurate than lower time frame signals.

Golden Cross

(Image source: investopedia)

What is the Death Cross in Crypto Trading?

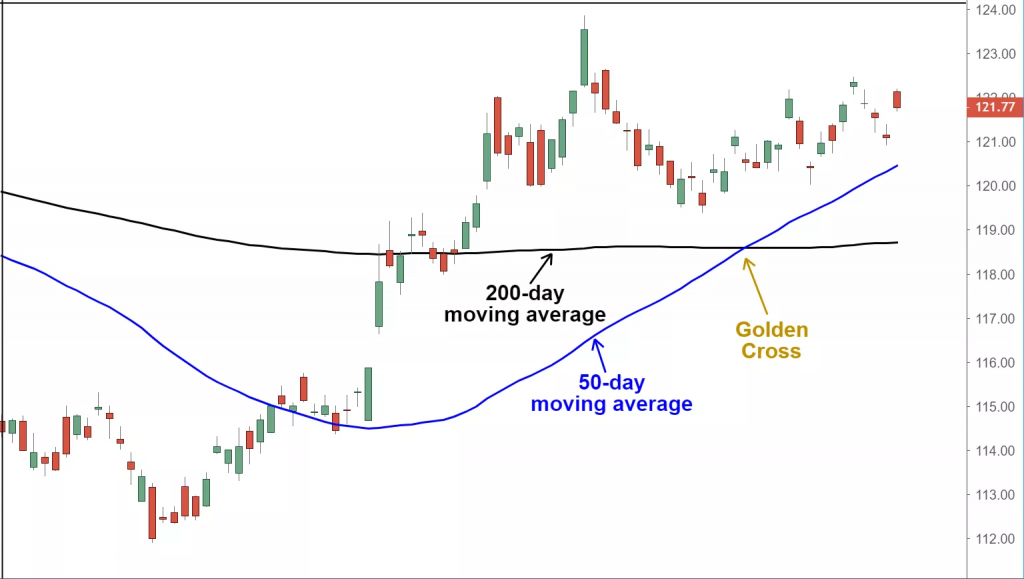

The death cross is the exact opposite of the golden cross in that it signifies a definitive downtrend in the market. Contrary to the golden cross, a death cross is a chart pattern that is symbolized when a shorter-term average goes down and crosses under the longer-term average. Again, it’s commonplace to use the 50-day and 200-day moving averages as respectively the shorter and longer-term moving averages for a death cross.

And again, a death cross takes place in three stages:

- The shorter-term moving average is over the longer-term moving average while an uptrend is going.

- Once the trend reverses, the shorter-term moving average crosses under the longer-term moving average.

- Then a downtrend begins when the shorter-term moving average strays below the longer-term moving average.

In the past, the death cross has rightly forecasted a bearish signal before notable economic downturns in history, like those of 1929, 1938, 1974, and 2008. On the contrary, though, the death cross has also been known to give out false signals, like it did in 2016.

Death Cross

(Image source: investopedia)

Golden Cross vs. Death Cross: What’s the Difference?

As you must have figured out by now, a golden cross and a death cross are the exact opposites of each other. While a golden cross signifies a long-term bull market to come, a death cross stands as an indication of a long-term bear market going forward.

However, both a golden cross and a death cross is considered way more momentous when it is followed by a high trading volume. Once the crossover has taken place, if it’s a golden cross, the longer-term moving average is considered to be a major support level for the market in the coming times. Similarly, if it’s a death cross, the longer-term moving average is taken to be a resistance level.

There’s been considerable interest in the death cross and golden cross for Bitcoin in 2021, in the wake of it’s 2021 crash. As a crypto trader you must keep in mind that moving averages are lagging indicators and therefore don’t actually possess any predictive power. So whether it’s a golden cross or a death cross, they are only a robust confirmation of a trend reversal that has occurred already, and not one that’s still going on.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter