Educational

June 3, 2021

Moving Averages Explained

Shubham GoyalProduct Specialist

Charles Dow, a prominent journalist and the founding figure of the Wall Street Journal, was one of the first people to point out that some market trends keep repeating themselves, and if monitored, they can give traders and investors an idea of what the future of a financial product or the overall market looks like. This was the origin of technical analysis: the method of using past market data (like market demands, market sentiment, trader experience and expectations etc.) to figure out the future of the market.

Technical analysis is based around the theory that in terms of market trends, history repeats itself. So technical analysis suggests that when you see the market following a particular trend, there’s a good chance it’s repeating a trend seen before. Technical analysis was initially used in the traditional financial markets, but in the past decade, crypto traders have started using the method to predict when they can enter the market for a profitable trade.

The tools traders use for technical analysis are called technical indicators. There are quite a few of these technical indicators out there, of which the moving average is one. In this post, we give you a detailed look at this particular technical indicator, and how it works.

What is a Moving Average?

Moving average is one of the less complex technical indicators used by a wide range of traders. The moving average does away with the impacts of random, short-term price shifts within a specified period of time. The moving averages entirely rely on historical data, and they are considered to be lagging or trend following indicators.

How Does Moving Average Work?

Moving averages are customizable trading indicators, so a crypto trader can adjust the time period when they’re calculating an average, reliant on their various trading objectives. It’s important to keep in mind that for short-term trading, relatively shorter moving averages are used, while for long-term trading, investors tend to use longer-term moving averages.

Some of the most used time periods while calculating moving averages are 15, 20, 30, 50, 100, and 200 days. The shorter a time frame you use to generate your moving average, the more sensitive it is to the shift in prices. On the contrary, the longer your time frame, the less sensitive the moving average is to price changes. However, there’s not really a set time span you must use in your moving averages. Over time, you can experiment with a number of time periods and find out for yourself what suits your objective best.

When the moving average is rising, it implies that the crypto you’re analyzing is in an uptrend. And as you can probably guess, a dropping moving average symbolizes the crypto asset is caught in a downtrend.

Types of Moving Average:

Traders and investors use quite a few different kinds of moving averages according to the nature of the trade they intend to make. However, there are two distinct types of moving averages generally in use for technical analysis. These categories are the SMA or simple moving average, and the EMA or exponential moving average. Below, we discuss the two types. In accordance with your trading goals, you can pick out which one is more likely to prove more advantageous for you.

The SMA or the simple moving average:

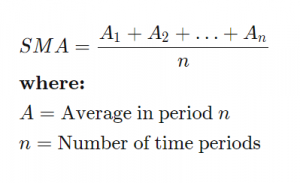

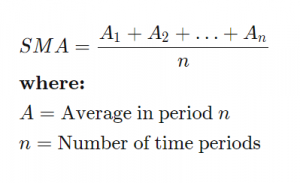

The SMA, as the name suggests, is literally the simplest of the various forms of moving averages. The simple moving average is deduced by calculating the average of any given set of values. So, it’s basically adding up a set of numbers- like the various prices of a crypto during a specific time period, and then dividing it by the number of the prices included in the data set.

What’s the difference between the SMA and just the average of the prices taken? Well, it’s just the fact that as soon as there’s a new data point, the oldest data point in the set is not taken into account anymore. So if you’ve set your moving average to calculate the average of the past 20 days’ worth of price info, it’s always being updated and discarding older data the moment new data is being inputted. This way, the moving averages always stay up to date.

In the image below, you can see the formula for a SMA:

(Image Source: Investopedia)

(Image Source: Investopedia)

The EMA or the exponential moving average:

The EMA is not much unlike the SMA; this technical indicator too uses past price shifts of a crypto to produce an average for the trader. However, the main difference between the SMA and the EMA is that an EMA puts more importance to the recent most prices, so the resulting average is way more responsive to newer data.

Both the SMA and exponential moving average are widely used by crypto traders both new and experienced; it’s undeniable though that the EMA is the technical indicator that is better for rooting out sudden price changes and reversals. And because of this particular quality of the EMAs, traders wanting to enter short-term trades prefer them.

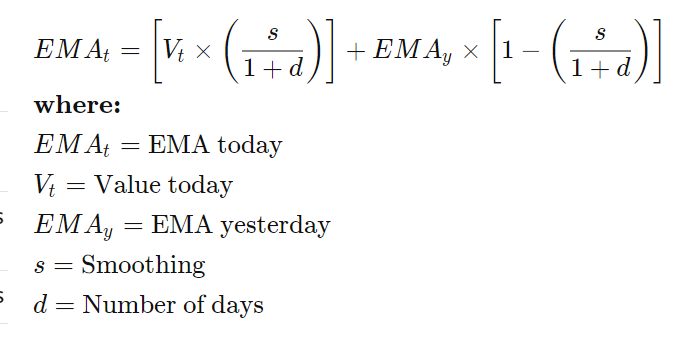

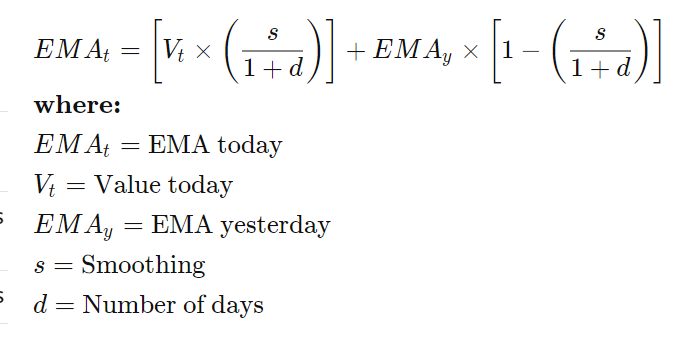

You can find the formula used for calculating EMAs in the picture below:

(Image Source: Investopedia)

(Image Source: Investopedia)

Again, as a crypto trader, you should choose the type of moving average more suitable for you based on your trading strategies and objectives.

To get the most accurate results out of your technical analysis, you can also use the moving averages in combination with other trading indicators, such as the moving average convergence divergence or the MACD. Moving averages, used in a combination, can help better spot bullish or bearish crossover signals.

A crossover signal, in case you weren’t aware, results when two different MAs crossover. For instance, when a short-term moving average crosses over a long-term MA, an upward trend is implied. Similarly, when a short-term MA crosses below a long-term one, a downtrend is signified.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter

(Image Source: Investopedia)

(Image Source: Investopedia)