Educational

June 15, 2022

How To Trade Crypto Using Falling Wedge Pattern

Shubham GoyalProduct Specialist

A crypto trader is more likely to succeed if they buy an asset from a logical position than randomly buying an asset without proper thought and analysis. Technical analysis can be a great way to analyze and assess the markets before making your next buying decision. A falling wedge pattern is an important technical analysis tool that traders should keep on their checklist.

In a falling wedge pattern, a bullish price pattern depicts the trend or story about the market in which the bulls prepare for another push. Keeping a falling wedge pattern as our trading pattern is a beneficial method to make money in the crypto market.

Bullish Nature of the Falling Wedge Pattern

The falling wedge pattern is bullish in nature and appears after a bearish trend. The pattern indicates that the bulls have lost their momentum, and bears have taken over the price temporarily. As such, the price hits lower lows but at a corrective speed.

Like all other assets, crypto prices tend to move in a zigzag pattern, with swings between highs and lows. They rarely move in a straight line. Thus, traders experience a temporary bearish correction within bullish trends, which gives rise to patterns like the wedge, triangle, flag or channel.

These are signs that purchasing pressures have been reduced to profit-taking. The falling wedge pattern can produce a higher trade accuracy than a conventional descending channel.

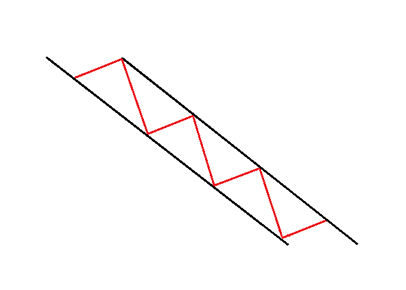

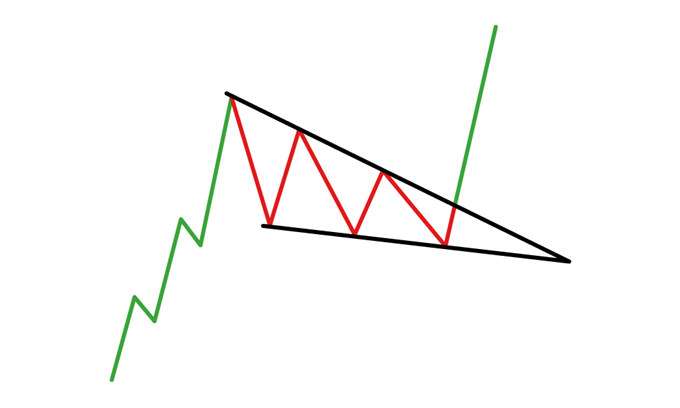

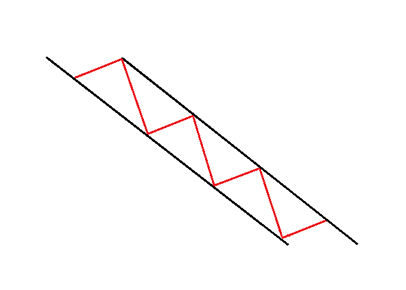

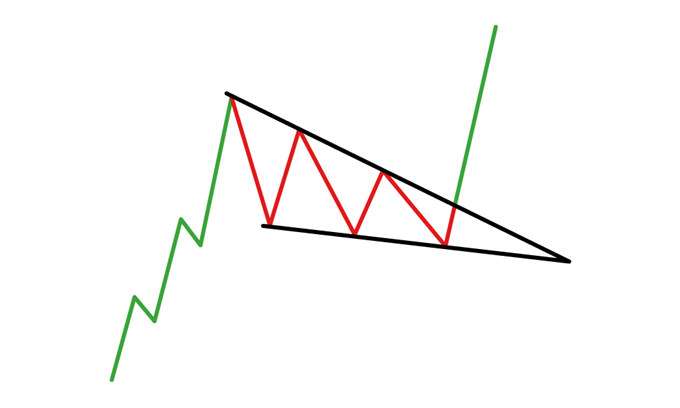

Source: Daily FX

The depicted patterns, descending channel and falling wedge, are bullish reversal patterns. The falling wedge has better accuracy than descending channels. The price of descending channels corrects by keeping an equal distance between swing highs and lows. However, the swing levels squeeze towards one another on the falling wedge, depicting deeper correction.

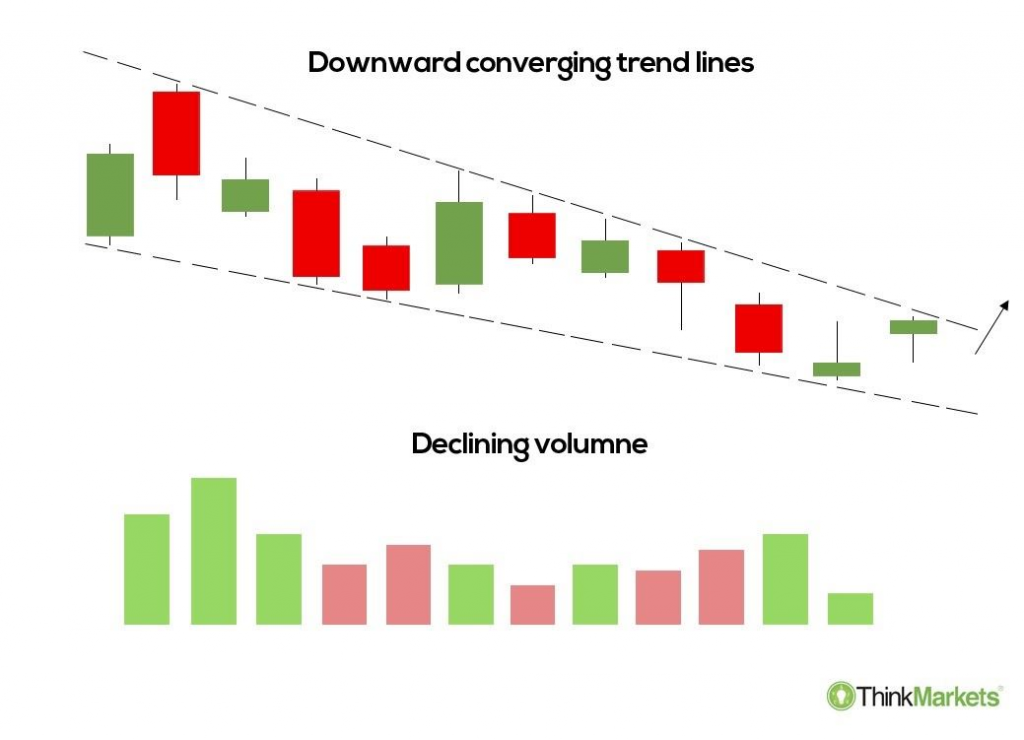

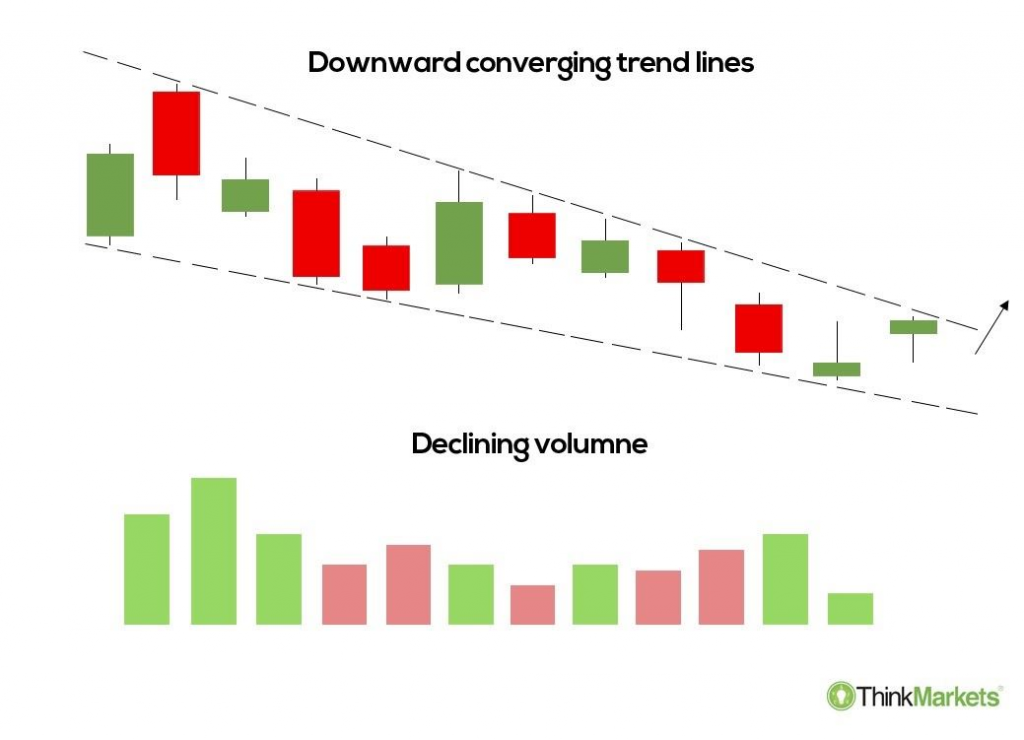

Before making a trading decision, investors should consider the present trends and the performance of volumes.

Source: Think Markets

Pros & Cons of Falling Wedge Patterns in Crypto

The falling wedge pattern offers a lucrative methodology to investors to earn profits. However, there are some downsides to it too.

Pros

The advantages of the falling wedge pattern are:

- It is a frequent occurrence in financial markets.

- This pattern works as both a trend reversal and trend continuation pattern.

- It is easy to find stop-loss and take-profit levels.

- It offers a good risk-to-reward ratio.

Cons

The disadvantages of the falling-wedge pattern are:

- While using this pattern to initiate a trade, additional confirmation is required when opening a trade.

- In lower time frames, falling wedge patterns have lower accuracy.

- New traders may face confusion in distinguishing between the falling wedge and other price patterns.

How to Identify a Falling Wedge Pattern in Crypto

Price patterns aren’t random formations; they represent a story about the buyers’ and sellers’ activity in the market. The falling wedge pattern appears after a bearish trend. They indicate a narrative about the behaviour of the bulls and bears and what their next possible move would be.

A falling wedge formation occurs when two downward sloping trendlines appear to converge on the price chart representing the price squeeze, followed by a possible breakout. The trendline pair can be formed by joining lower highs and lower lows occurring during the given time period.

Underlying dynamics of falling wedge pattern: A bullish trend is formed after an event that encourages buyers to purchase a cryptocurrency with hopes of price appreciation. After getting a benefit, they usually book a profit, which often adds more positions when the prices are discounted. The bearish wedge pattern that appears after the bullish one results from buyers’ taking the profit. Once this process of profit-taking ends and the price drops, investors and traders start buying again.

The approach is to find when corrections are over and the bullish trend is likely to resume. Traders in the global finance market need liquidity. There have to be enough sellers to buy and enough buyers to sell. The falling wedge pattern indicates that institutional traders who created the bullish trend might open another position for buying, resuming the trend after a discount.

Source: CoinMarketCap

Besides swing levels, investors must monitor the changes in volumes as well. The volume will reduce due to less activity in trading as the price will move to a consolidation phase. A higher volume should support it once the breakout occurs.

How to Trade Crypto Using a Falling Wedge Pattern

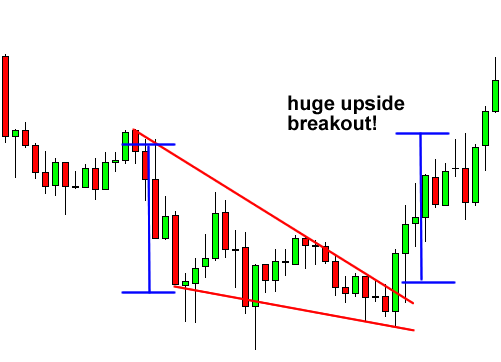

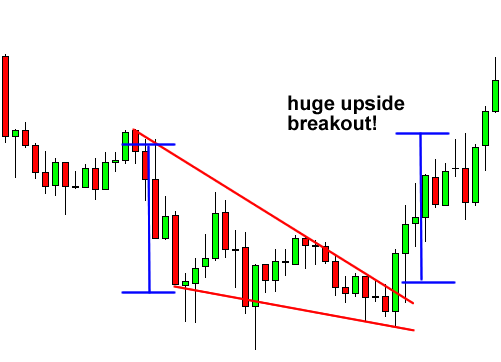

Source: CoinMarketCap

Determining a trading strategy is a quotient of how the price performs following a breakout and the degree of risk a trader wishes to bear. However, a general strategy for trading a falling wedge pattern could be as follows:

- The first and crucial step is to identify the wedge on the chart by drawing trendlines along lower highs and lower lows to highlight the pattern.

- Watch when the price moves out of the wedge and confirm the breakout by checking that the price has actually moved outside the scope of trendlines.

- If the price moves above the upper trendline, consider that as a buy position. Sometimes the price comes back to retest the wedge after a breakout. Consider this as an entry point.

- Set a stop-loss for the trade on the opposite side of the point of the wedge from where the price breaks out. The chart shows a few possible locations for setting the stop-loss target.

- Next, you need to select a profit target for your trade. Usually, the estimated profit target is the thickest part of the wedge. The rectangle at the beginning of the wedge represents the estimated target profit margin.

- This rectangle is then added to the breakout point on the wedge to have an idea of the price target (See chart).

What is the Falling Wedge Reversal Pattern?

A falling wedge reversal pattern from a significant price level provides more profits in cryptocurrency trading than in traditional markets. It is important to find the right patterns from ideal locations for this to happen.

These patterns indicate bears losing momentum as they appear in a swing low. If you find a falling wedge reversal pattern after a considerable price downturn, consider it more profitable. It is difficult to predict whether the bearish trends will reverse or continue. Therefore, finding the falling wedge reversal pattern at the bottom increases the probability of trend reversal.

Source: Babypips

To trade the falling wedge pattern as a market reversal strategy, we need to ensure:

- The falling wedge pattern appears at the downtrend’s bottom.

- Before the formation of the wedge pattern, the downtrend becomes weak.

- There are a minimum of three touches at trend line levels of the falling wedge.

- Bulls mostly open their orders from a price which has reached an important demand zone.

Conclusion

Though it might be difficult to find an ideal falling wedge pattern in the perfect market conditions, the investors can apply the concepts stated in the article to find beneficial trading options. The falling wedge patterns – both continuation and reversal – are a great way to identify the reversal of trends in the market and figure out strategies before making any trades in the market or before new trends emerge.

FAQs

What is a falling wedge pattern?

It is a bullish reversal pattern which appears in the swing low of downtrends.

How to confirm a falling wedge pattern?

To confirm a falling wedge pattern, there must be at least three touches at the levels of trend lines.

When does the falling wedge pattern become tradable?

The falling wedge pattern becomes tradable once the price breaks out above the resistance trendline in the pattern with a bullish candle.

When is the trading entry confirmed?

After a valid breakout and bearish correction, the trading entry is confirmed. However, the price may move higher without any retracement in some cases.

What is the ideal stop-loss approach?

The ideal stop-loss approach is to set the limit below the near-term swing low with some buffer.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter