Educational

March 2, 2022

Long Straddle: Understanding One of the Most Popular Options Trading Strategies

Shubham GoyalProduct Specialist

Options trading strategies consider buying and selling multiple option trading contracts simultaneously for an optimized investment position. Such strategies offer a cost-effective route to hedge against risk and profit from price speculations and future market movements.

Now, crypto options are arguably a superior derivatives avenue over futures contracts given their non-linear nature. This means that options’ payoffs aren’t just the function of the underlying crypto asset. Options depend on several factors, including time left for expiration, implied volatility, general volatility, and the subsequent relation of the current price to the options’ strike price impact the overall health of the options trading contract.

Options have become one of the most popular and fastest-growing derivatives trading contracts backed by increasing institutional interest. Given the wide selection of products on offer, retail traders and investors are taking a keen interest in options trading strategies with a proven track record in conventional financial markets.

Long Straddle, one of the most sought-after and effective options trading strategies is particularly considered effective for volatile crypto assets. Let’s understand the basics and potential of the straddle strategy in options trading and its profit efficacy in relation to the risk involved.

What is a Long Straddle Strategy in Crypto Options Trading?

Straddles can be understood as a strategy when a trader acquires two offsetting positions on the same asset under two separate transactions or options contracts. This means that the trader buys two options contracts with the same strike price on the same underlying asset but with opposite positions that offset each other.

A long straddle option strategy involves buying a call option and a put option for the same underlying asset with the same strike price and expiration date. The long straddle option strategy strategy is highly effective when traders anticipate sharp price movements or higher IV but are unsure of the direction of price movements.

Short straddles are considered when the prices are relatively stable. A short straddle strategy involves selling a call option and a put option with the same expiration date and strike price.

How does a Long Straddle Strategy work?

Let’s understand how the long straddle strategy works with the help of an actual example from BTC options on Delta Exchange. We have already discussed that this strategy works best in a volatile market such as cryptocurrencies. So a trader named Mr. O believes that BTC prices will undergo volatility soon but isn’t sure what direction the prices will move. So, Mr. O opts for a straddle strategy and buys a call and a put MV BTC option with the same strike price and expiry at Delta Exchange.

For our discussion, let’s assume he buys a call option (MV-BTC-35300-300122-C) and a put option (MV-BTC-35300-300122-P). The Delta Exchange Move options that we have taken as examples to simulate the working a straddle strategy has a strike price of $35,300 each and will expire on the 30th of January 2022.

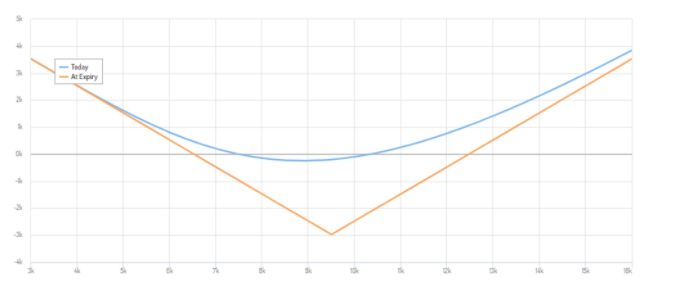

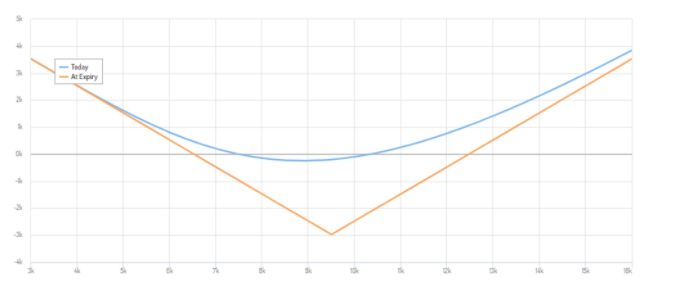

The strike price is the price at which the BTC can be bought or sold at expiry as per the contract written by Mr. O. The premium, i.e., the cost of the contract, is, say, $4,000 each. The profit and loss profile of such a strategy would look something like the graph below.

BTC Long Straddle Strategy

BTC Long Straddle Strategy

Source: FX Street

A long straddle strategy reaches the break-even point, which is equivalent to the premium paid, either above or below the strike price, even before the expiry of the contract. For a strategy to break even, regardless of the direction, the intrinsic value of one option must be equal to the premium paid for both options. The other option becomes worthless by the time of its expiration.

Upside Break-even = Strike Price + The Two Premiums Paid

And

Downside Break-even = Strike Price – The Two Premiums Paid

The two break-even case scenarios – upside and downside – for the trade example above will be $43,300 and $27,300, respectively.

Break-even Case Scenario I: When BTC is trading at $43,300

Total premium paid = $4000+$4000 = $8000

Using the equations mentioned above;

Upside Break-even = Strike Price + The Two Premiums Paid

= $35,300 + $8000

= $43,300

Break-even Case Scenario II: When BTC is trading at $27,300

Total premium paid = $4000+$4000 = $8000

Using the equations mentioned above;

Downside Break-even = Strike Price – The Two Premiums Paid

= $35,300 – $8000

= $27,300

Any deviations beyond these points will result in a profit for this trading strategy. Taking the example further, if at the time of expiry Bitcoin’s current price is $46,000, the call option will have a total net profit of $2,700.

$2,700 = $46,000 – ($35,300 + $8000)

In another case, if Bitcoin’s current price at the time of expiry of the option is $24,000, the put option will have a total net profit of $3,300.

$3,300 = $35,300 – ($24,000 + $8,000)

But if Bitcoin’s current price remains within the breakeven points, i.e., $43,300 and $27,300, the trader will incur a loss. For example, If BTC’s price is $37,300 at the time of expiry, the call option is $2,000 in the green, but when the cost of both the options is deducted ($8,000), Mr. O is losing $6,000.

If BTC is priced at $30,300 at the time of expiry, the put option is $3,000 in the green. But when we deduct $8000 as the cost of options, Mr. O is left with a loss of $5,000.

How does a Long Straddle Strategy Benefit a Trader?

The maximum gain that a trader can achieve on the upside is potentially infinite in hypothetical terms as Bitcoin can continue rising the charts without meeting any friction or ceiling. At the same time, the downside profit that can be attained is also significant but not infinite as BTC will never fall below the zero level.

For a trader to achieve the maximum profit out of their long straddle strategy, the BTC prices need to surge or plunge significantly beyond the break-even points as the profit will always be the difference between the current price and the strike price minus the two premiums paid for the call and put options.

Long Straddle Strategy doesn’t hold much relevance in a market with a steady mood, i.e., if BTC’s prices remain stable and expire at the strike price, the call and put options under the strategy would become ‘at-the-money,’ and their intrinsic value will be zero. The trader will lose both the premiums in their entirety.

What Should a Trader Keep in Mind While Opting for the Long Straddle Strategy?

Implied Volatility and time decay are significant factors that impact a long straddle strategy at play. Increased implied volatility will add intrinsic value to the call and put options within the strategy, and will allow investors to close the straddle at a profit even before the options expire.

When a trader first enters the trade using this strategy, any one of the two options they buy – one call and one put – will be ‘at-the-money.’ In case BTC’s price remains stagnant for a long time, the total value of the position attained=ed within the strategy will decline significantly. As the time of expiry approaches, the rate of time decay will also increase.

Long straddle strategy is a proven options trading strategy that traders can optimize their positions and hedge risk. As for beginners, it is best first to understand the dynamics and risks involved in derivatives trading before they take their first actual shot at options trading.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter