Educational

March 10, 2020

Insurance Funds in Derivatives Exchanges: Why they are needed and how do they work

Jitender TokasChief Business Officer

Cryptocurrency derivatives exchanges require insurance funds because they offer leverage trading. Leverage is the key characteristic that separates cryptocurrency margin trading and derivative exchanges from cryptocurrency spot exchanges. Through leverage, traders can take positions that are multiple times the size of their equity. But leverage is a double-edged sword; it amplifies both the profits and losses of a trader by the same magnitude. Consequently, in leveraged trading, there is a chance that losses in a trade exceed the trader’s equity. In such situations, exchanges require Insurance Funds.

Leverage trading exchanges look to close or liquidate a position before losses wipe out the equity put in the trade, i.e. the margin. Exchanges employ a suite of risk management strategies to liquidate loss-making positions. However, in extremely volatile market conditions, an exchange may not be able to close a position before it goes into negative equity. There are various mechanisms to handle negative equity situations. Among them, the most trader friendly solution is an Insurance Fund.

In this article, we will discuss leverage, liquidation mechanisms and strategies for handling negative equity situations. We will also explain in detail how in the Insurance Fund of Delta Exchange operates.

How Leverage and Liquidation work

In leveraged trading, a trader can take a position that is several times bigger than the capital he has available. The capital put up in trade is margin or equity. The ratio of position size and margin is the leverage.

When the market moves against the trader, his margin should be sufficient to offset his unrealised losses. When after factoring in losses only a small amount of margin remains available, his position goes into liquidation.

Bankruptcy Price – The price at which the margin drops to zero

Liquidation Price – Price at which the position goes into liquidation

A position will go into liquidation when the mark price reaches the liquidation price of the position. Exchanges will always try to liquidate the position at a price better than the bankruptcy price. A liquidation charge is levied on all positions that go into liquidation.

Strategies adopted by exchanges to handle liquidations.

Some of them are:

- Leverage proportional to volatility: The simple rule is: more volatile the contract, offer lower leverage for the same. As you can see on Delta Exchange, the maximum leverage offered on BTC is 100x while the maximum leverage offered on another altcoin such as Ravecoin is 20x or TOMO Chain is 10x. This is because altcoins tend to have higher volatility in general, giving rise to higher liquidation situations which exchanges would prefer to avoid.

- Partial Liquidation: On Delta Exchange, the margin requirement for a contract scales up linearly as the position size increases. Increasing the margin requirement for large positions helps in orderly liquidation and helps in avoiding instances of negative equity. Partial liquidation computes the minimum size that needs to be liquidated to ensure the remaining position has sufficient margin to remain open. It also has a lower impact on the market as the entire position is not liquidated at once. Click here to read more on margin scaling.

Occasions when traders fall into negative equity

Derivative trading is a zero-sum game; one party’s gain has to be the other party’s loss. At times, due to high market volatility, the exchange is unable to close a position before it’s bankruptcy price is breached. This situation leads to a trader having negative equity in a position. The shortfall caused by this negative equity will have to be provided for by either the exchange or other traders. We list the various risk management approaches adopted by exchanges to deal with negative equity situations.

Strategies to deal with negative equity

1. Auto-Deleveraging:

In ADL, the profitable position of the opposite trader is forcefully closed at the bankruptcy price of the initial liquidated order. Traders who get ADL’ed are selected on a certain ranking criterion. The ADL ranking is computed based on profit and leverage of their position. All open positions are ranked from the ADL ranking with the highest rank on top. the deleveraging occurs from the top position and continues downwards. Click here to know the ranking criteria.

The drawback to ADL is that the position of profitable traders is forcefully closed. Due to this, a trader may miss on the upside gains they would’ve otherwise recognised in case ADL didn’t occur. Traders who get ADL’ed can re-enter into the position but the same entry price might not be available.

2. Clawbacks:

Clawbacks is another technique where the exchange calls back on the realised profits of the traders to make up for the losses faced due to negative equity situations resulting from liquidations. Okex is one of the exchanges that have a clawback mechanism for its derivatives trading platform. The exchange once had to liquidate positions of over $400 million. This resulted in uncovered losses of $9 million. These liquidation losses were recovered via clawbacks. Read more on it here.

Clawbacks are a major disadvantage to profitable traders because although traders have realised their profits in their accounts, there can be a possibility of the profits being taken away by the exchange due to a single large liquidation event. This can create uncertainty amongst the traders.

3. Position Assignment:

In Position Assignment, the near bankruptcy trade is then assigned to liquidity providers to take over the trade. These liquidity providers (LP) are willing to take the risk of unfilled liquidations. The reason LP’s take over such positions is that they receive the maintenance margin which remains from the marked value of the position.

4. Insurance Fund:

Insurance fund bears the losses of an adverse trade and takes over the positions in liquidation. The purpose of an Insurance Fund is to cover the deficit faced by a trader due to negative equity. Insurance funds can also work in tandem with other risk management techniques such as ADL. In this case, the fund can bear part of the losses and remaining is handled through ADL or clawbacks.

Insurance Fund at Delta Exchange and how does it work?

When a position goes into liquidation, the Delta Exchange liquidation engine tries to liquidate the position automatically. The aim is to liquidate at prices better than the bankruptcy price. At this stage, the Insurance Fund ensures the profitable traders remain unaffected and cover up for any excess losses faced by the losing trader. The profitable trader is indifferent to the event of liquidation and the mechanisms of the insurance fund as they receive their profits entirely.

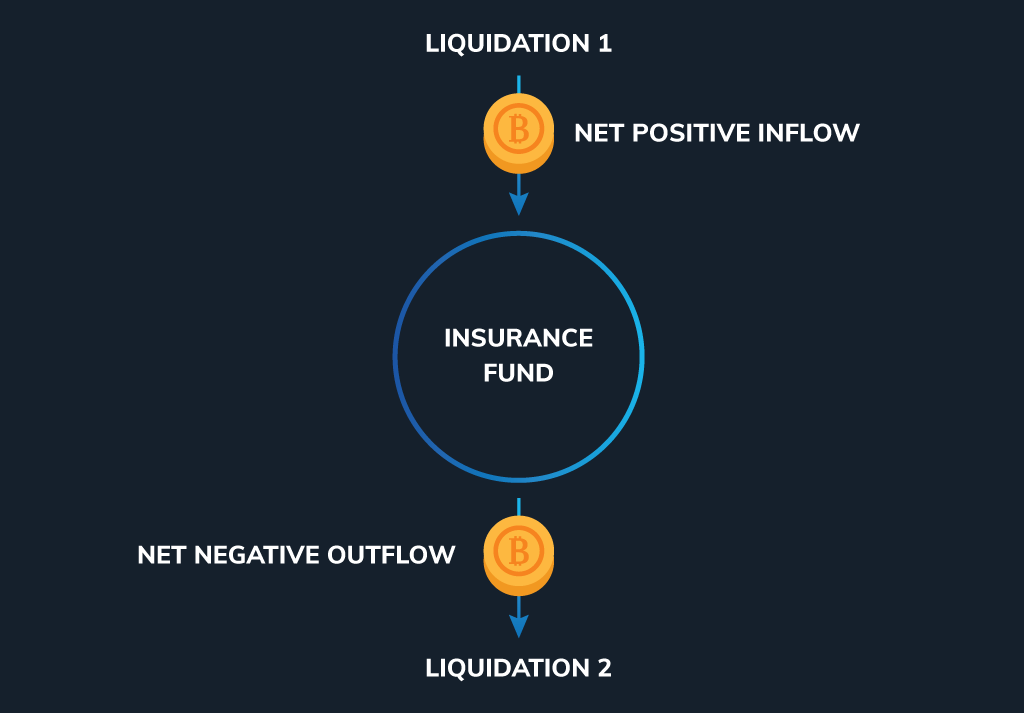

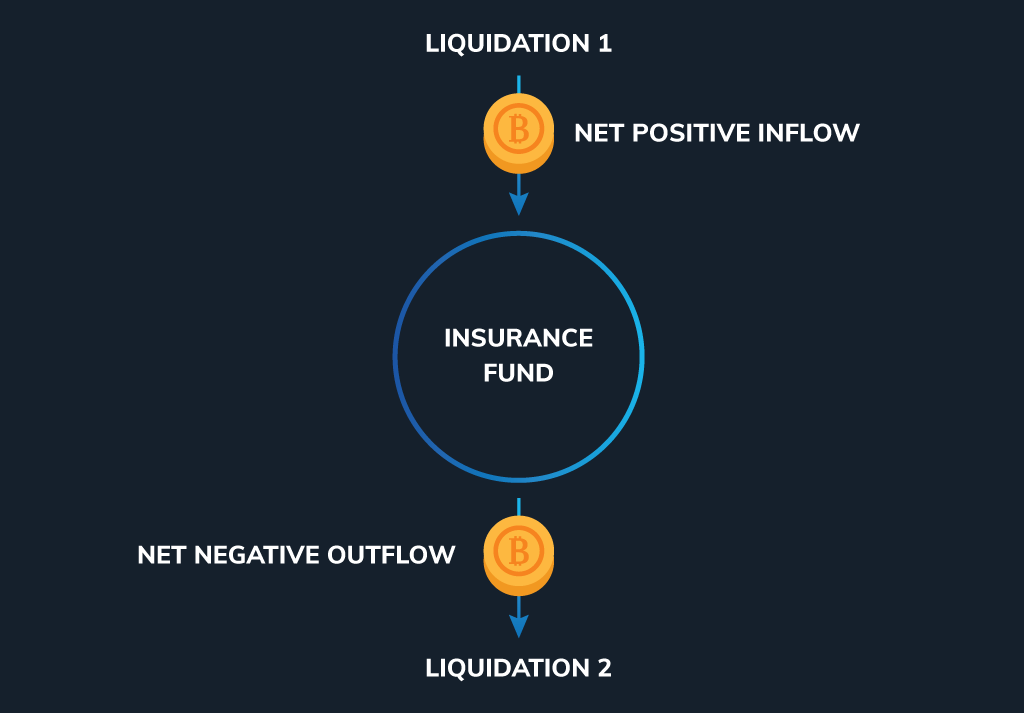

How does the Insurance Fund grow

The insurance fund grows from liquidations that were executed in the market at a price better than the bankruptcy price. The fund grows only through liquidations and is solely used to compensate the traders. The exchange does not make any money off it nor does it use the funds for any other purposes.

Liquidation Charge

When a position goes into liquidation, the trader faces a liquidation charge. The liquidation charge is based on the maintenance margin and liquidation penalty factor.

Liquidation charge = Min maintenance margin X liquidation penalty factor

This liquidation charge is added to the insurance fund. In case there is any excess margin-left post the liquidation charge, the margin is deposited back in the trader’s account.

Uses of the Insurance Fund

At Delta Exchange, in the event of liquidation, the liquidation engine will bear a maximum loss of 5% for BTC & ETH contracts and 2% for all other contracts. This loss will be borne by the insurance fund. ADL triggers when the liquidation loss is greater than the loss threshold that the Insurance Fund is willing to absorb. Delta Exchange has adopted this strategy because, in case of a large liquidation, it is not wise for the entire fund to be wiped out in a single trade. Click here to read more on Delta Exchange’s Insurance Fund.

Examples of Liquidations & Insurance Fund in Action

A trader enters into a long position at max leverage available for a contract.

Entry Price: 100

Liquidation Price: 95

Bankruptcy Price: 90

Minimum Maintenance Margin: 5

Liquidation Penalty Factor: 0.5

1. Current Mark Price: 94

Liquidation Charge = 5 x 0.5

= 2.5

Remaining Position Margin = 94 – 90 – 2.5

= 1.5

- An Immediate – or – Cancel (IOC) order is placed with the limit price set to the bankruptcy price. Since the order is filled at 94, there is position margin to pay the liquidation charge.

- Liquidation charge i.e. 2.5 adds to the Insurance Fund, and the remaining 1.5 goes back into the trader’s account.

2. Current Mark Price: 92

Liquidation Charge = 5 x 0.5

= 2.5

Remaining position margin = 92 – 90

= 2

- The liquidation engine fills the position at 92. The traders in profit are paid in full with the remaining margin.

- Since the mark price has fallen to 92, the minimum margin of the position is only 2. The liquidation charge in this instance will be the entire margin, i.e. 2.

3. Current Mark Price: 88

Liquidation Charge = 5 x 0.5

= 2.5

Remaining position margin = 0

- In this scenario, the mark price has fallen drastically, not giving the liquidation engine enough time to fill the order at the liquidation price or the bankruptcy price.

- The position is in negative equity. Due to no margin, there is no liquidation charge.

- The liquidation engine fills the position at 88 and uses capital from the insurance fund to pay the profitable trader.

- The spread between the mark price and the bankruptcy price is the loss the insurance fund will have to bear. 88-90 = -2 paid out from the insurance fund.

4. Current Mark Price: 78

Remaining position margin = 0

- In an extremely unlikely scenario, the mark price can significantly fall to 78.

- The liquidation engine will take over the position immediately and close it at 78.

- The insurance fund covers the losses. But since the insurance fund at Delta bears only 1% loss of the position, i.e. 90 x 1% = 9, insurance fund max loss will be at = 81.

- ADL triggers for the remaining spread of 81-78.

*The above numbers are just for representation purposes. Please refer to the Delta Exchange Calculator before entering in trades.

Can Insurance Funds become redundant?

As exchanges become efficient in executing trades at liquidation price or better, the capital drawn down from the fund might reduce largely. The inflows compared to the outflows will be significant, keeping cash idle. However, with the uncertainty in the price volatility, exchanges must keep aside a certain fund. It is on the exchange to then form the right balance between the inflows, outflows and usage of funds to ensure it does not become redundant over time.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter