Educational

September 7, 2021

What is MACD?

Shubham GoyalProduct Specialist

MACD, fully known as Moving Average Convergence Divergence, is a common and technical tool among traders used to identify price trends and movements in financial markets. The technical analysis indicator was first developed in 1981 by Gerald Appel, and is still in use, even 40 years later. Traders employ the use of the MACD due to its relevance in trading – it helps them identify opportunities in the market.

How to Use the MACD Indicator

The MACD is a trend-following momentum indicator. As such, it is a handy tool for traders who want to capitalize on it to interpret the direction, strength, momentum and duration of a trend on the price of a crypto asset.

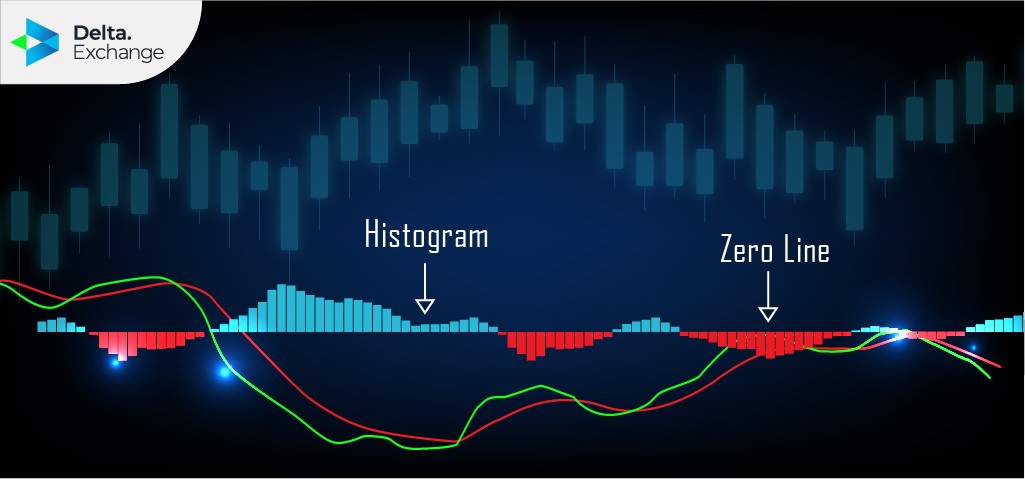

Using three components- two moving averages and a histogram, the MACD identifies trend direction and duration. There are two lines within the indicator which both have the appearance of simple moving averages (SMA) but are actually exponential moving averages (EMA).

What the MACD does is it creates a histogram which indicates the difference between the two moving averages (MACD Line) and the exponential moving average of these two moving averages (represented by the Signal Line). It is the histogram that moves downward or upward- depending on the momentum- across what is known as the Zero line.

Where the two moving averages are separated from each other, they are ‘diverging.’ However, if they close in on the gap between them, they are making a ‘converging’ move. Hence the term ‘Convergence and Divergence.’

The histogram confirms the trend momentum of any crypto asset. For instance, a crypto asset like Bitcoin, the histogram’s move above the Zero Line indicates an uptrend while a move below the line points to a downtrend on Bitcoin.

Traders will likely long Bitcoin when an uptrend has been confirmed such that higher highs and higher lows are being reached and resistance levels have been breached. Lower highs and lower lows and breached support levels indicate otherwise.

Calculating MACD

A MACD chart is usually set according to three numbers. These numbers have different connotations.

- The value of the fast moving average (MACD Line) is normally the first number. This represents the moving average of the previous bars before the line.

- Slow moving average (Signal Line) is given the second number, which still signifies the moving average of the previous bars before The Signal Line.

- The last number is usually the value of the difference between the two moving averages.

There is a mathematical representation for MACD;

macd = ma(source, fast_length) – ma(source, slow_length)

signal = ma( macd , signal_length)

histogram = macd – signal

where exponential moving average ( ema ) is in common use as a moving average (ma)

fast_length = 12

slow_length = 26

signal_length = 9

Advantages of MACD

The crypto market is studied by expert traders, and the MACD is one of the tools that aids them in understanding the nuances of the market. In view of this, the MACD has some advantages, some of which include;

- It is a useful technical analysis tool with which traders can identify trading signals and opportunities

- The MACD can be used to verify the reversal of a trend which is a major advantage over other technical analysis indicators.

- Traders can stay updated with the MACD as regards the direction and duration of a trend.

- Since MACD is a short-term indicator (at most 26 days), short-term traders will find it very handy.

Disadvantages of MACD

- Long-term traders should avoid the MACD tool. As already stated, the MACD is a short-term technical indicator such that the longest period for an EMA is 26 days.

- Traders might always have to search for a suitable MACD indicator for each crypto asset.

- The MACD is a slow indicator. Any signal a trader identifies on it may be late because he would have missed out on the early profits before entering the position at a later time.

- It is guilty of giving traders false alarms. Sometimes, when the MACD predicts a shift in the momentum of an asset’s price, the price of the asset itself may not observe such a shift as well.

Conclusion

Despite being a useful tool, the MACD can be misleading on certain occasions. In such instances, it is advisable to consult the MACD for trend momentum and duration alongside other technical indicators like stochastic oscillator, Bollinger bands and the Relative Strength Index (RSI). Moving Average Convergence Divergence is used for identifying three kinds of primary signals- Signal Line Crossover, Divergence and Zero Line Crossover.

FuturesTrade Futures & Perpetual Swaps on 25+ crypto assets, with up to 100x leverage

OptionsTrade call, put or MOVE options on BTC, ETH, BNB and LINK

Interest Rate SwapsInterest rate derivatives that enable swap of fixed-floating rates

Mock Trading PlatformLearn Crypto Derivatives trading without risking real capital

Research & AnalyticsExclusive data, charts and analytics to help you trade smarter